Weekly Report - BUY/SELL Signal Alerts Launch Date! 7 Stock Pick - Up to +250% Top Performer - Announcement

Price will double after Signal Alert Launch 💸 - The Week Ahead 💥 - Today's newsletter is brought to you by ATAS 📈

Hi fellow investors and welcome back for a Quant data driven analysis for the week ahead. [Full Disclaimer]

Updates:

I'm excited to announce that my Automated Trading Signal Alerts Bot is ready and more powerful than ever! I'll be launching in the last week of this month, and I'll be sharing the exact date with you this coming week.

Over the past few months, I've poured my years of experience into developing a tool that delivers real-time trading signals directly to you via Telegram alerts. After rigorous testing, the bot is providing highly reliable signals that can help you make more informed trading decisions.

I've fine-tuned the algorithms to not just find good signals but to pinpoint the best possible ones. By analyzing market trends, volatility, and key indicators, the bot identifies opportunities that might otherwise be missed.

Popular

The Week ahead (for paid members only)

Remember to check out US Stocks Picks release, if you haven’t already.

Let's dive in and make some smart moves! 💰🚀

Stock Pick:

Short Term Update - Newest Additions

Market Movements: Navigating the Shifts

Recent updates reveal notable changes across various sectors:

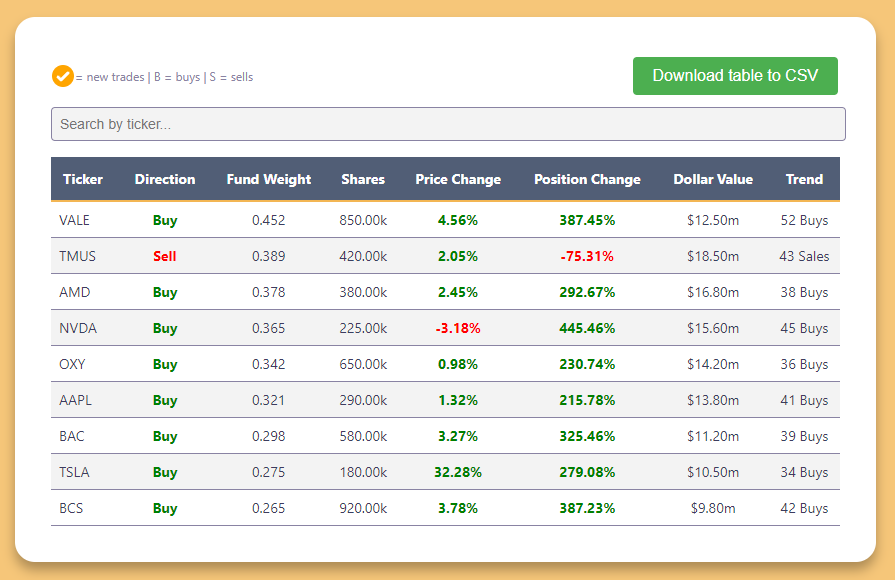

AMD ( AMD 0.00%↑ ) continues to gain momentum in the semiconductor space. With 38 new buys and a 292.67% position increase, AMD is attracting significant institutional interest. The $16.8M invested in 380,000 shares reflects strong confidence in AMD's growth trajectory.

Bank of America ( BAC 0.00%↑ ) shows robust performance in the financial sector. Recording 39 new buys and a 325.46% position change, BAC has drawn $11.2M in investments across 580,000 shares, indicating strong institutional backing for its strategic direction.

Apple ( AAPL 0.00%↑ ) maintains its dominance in the tech sector. With 41 new buys and a 215.78% position change, investor confidence in Apple remains strong. The $13.8M investment and 290,000 shares demonstrate continued faith in Apple's market leadership.

Early week updates highlight these intriguing movements.

Strategic Shifts in Focus

Mid-week updates reveal ongoing strategic adjustments in key sectors:

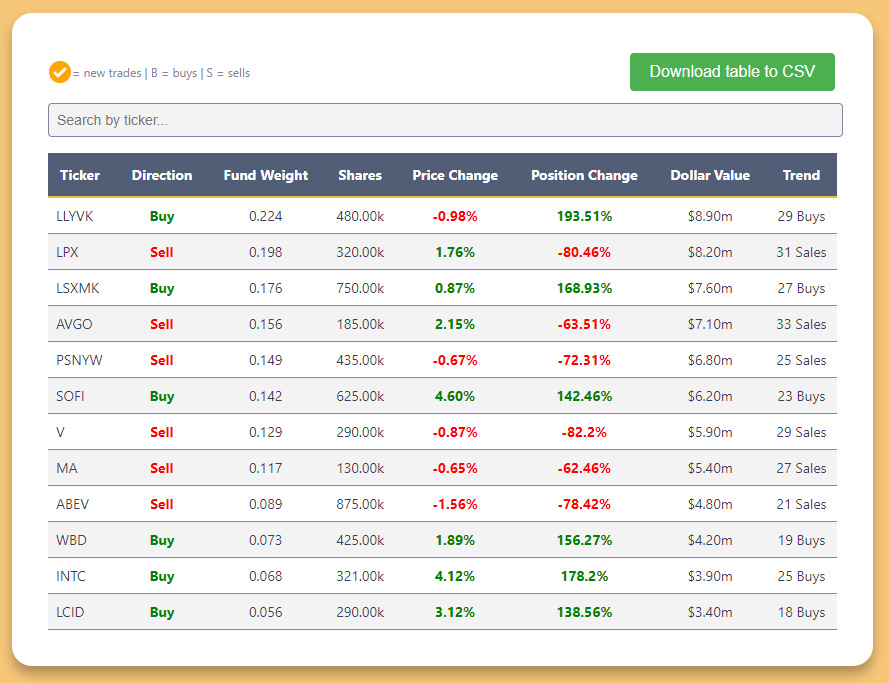

SoFi Technologies ( SOFI 0.00%↑ ) is gaining traction in the fintech space. With 23 new buys and a 142.46% position increase, SoFi has attracted $6.2M in investments across 625,000 shares, showing growing institutional interest in its digital banking platform.

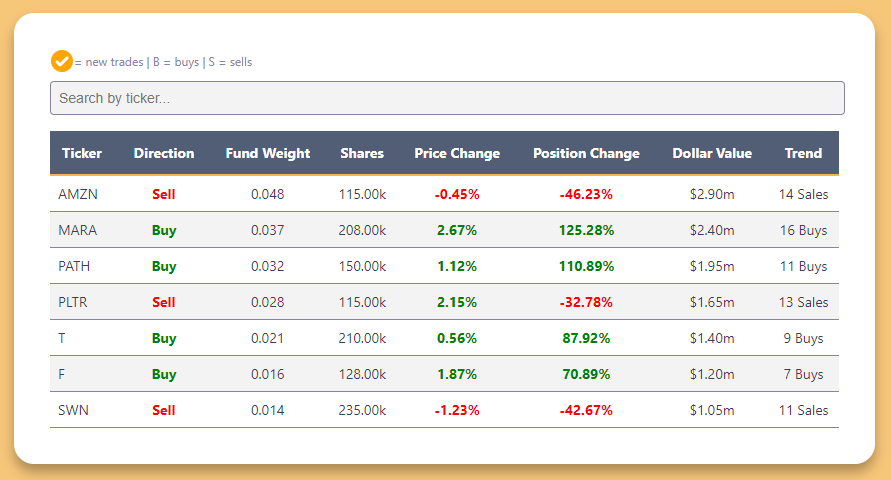

Marathon Digital ( MARA 0.00%↑ ) is making waves in the cryptocurrency mining sector. Recording 16 new buys and a 125.28% position change, Marathon has secured $2.4M in investments through 208,000 shares, reflecting optimism in the crypto mining industry.

Occidental Petroleum ( OXY 0.00%↑ ) demonstrates strength in the energy sector. With 36 new buys and a 230.74% position increase, OXY has secured $14.2M in investments across 650,000 shares, showing robust institutional confidence in its energy market position.

Mid-week updates highlight these strategic shifts.

Barclays ( BCS 0.00%↑ ) is showing impressive momentum in banking. With 42 new buys and a 387.23% position change, the company has attracted $9.8M in investments through 920,000 shares, indicating strong institutional backing for its global banking operations.

Lucid Group ( LCID 0.00%↑ ) is making strides in the electric vehicle market. With 18 new buys and a 138.56% position increase, Lucid has drawn $3.4M in investments across 290,000 shares, reflecting growing confidence in its luxury EV strategy.

ICYMI:

Last week Report:

Insider Activity - Annalists Upgrades, Downgrades, Price Targets Changes

Analyst Ratings Price Target Changes [Download]

Most Upgraded [Download]

Keep reading with a 7-day free trial

Subscribe to Eltoro Market Insights to keep reading this post and get 7 days of free access to the full post archives.