#44 Weekly Report - Signal Alerts Samples BUY/SELL - Looking Really Good!

Samples inside! Daily Trading Signal Telegram Alerts 💸 - The Week Ahead 💥 - Today's newsletter is brought to you by ATAS 📈

Hi fellow investors and welcome back for a Quant data driven analysis for the week ahead. [Full Disclaimer]

Updates:

I'm thrilled to announce that my Automated Trading Signal Alerts Bot is ready and stronger than ever!

Over the past few months, I've been developing a tool that provides real-time trading signals directly to you via Telegram alerts. After extensive testing, the bot is delivering highly reliable signals that can help you make informed trading decisions.

I've fine-tuned the algorithms to not just find good signals but the best possible ones. By analyzing market trends, volatility, and key indicators, the bot identifies opportunities that might otherwise be missed.

And these are just test samples!

Popular

The Week ahead (for paid members only)

Remember to check out US Stocks Picks release, if you haven’t already.

Let's dive in and make some smart moves! 💰🚀

Short Term Update - Newest Additions

Market Movements: Navigating the Shifts

Recent updates reveal notable changes across various sectors:

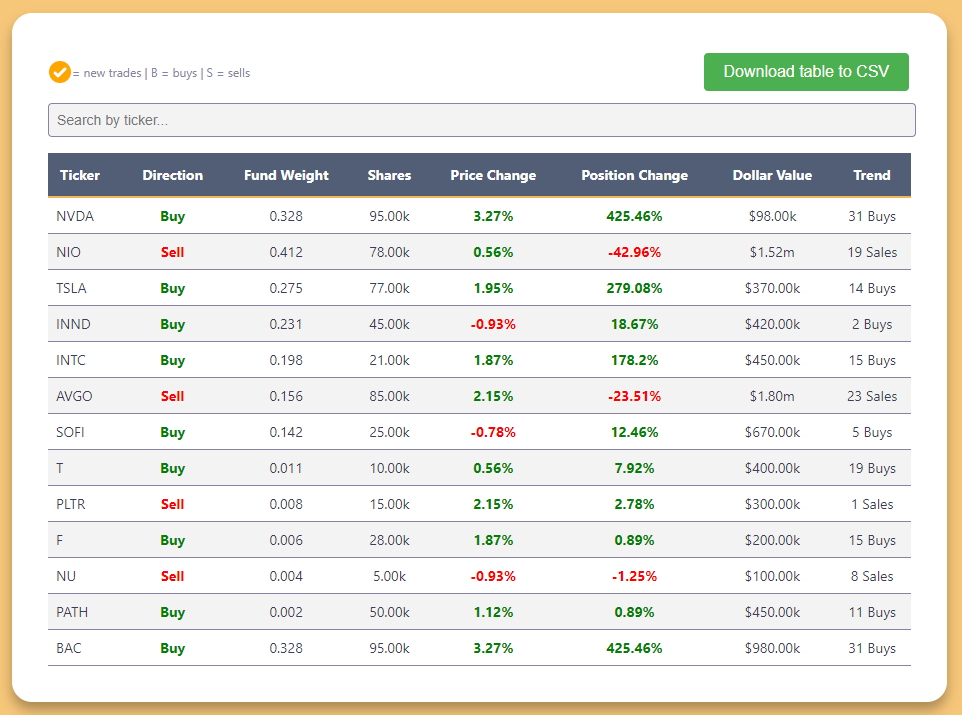

NVIDIA ( NVDA 0.00%↑) continues to shine in the semiconductor space. Matching VALE's impressive 31 new buys and 425.46% position increase, NVIDIA is drawing significant institutional attention. The $98,000 invested in 95,000 shares reflects a strong belief in NVIDIA's market trajectory.

Tesla ( TSLA 0.00%↑ ) maintains its innovative edge in the EV industry. With 14 new buys and a 279.08% position change, investor enthusiasm for Tesla remains high. The $370,000 investment and 77,000 shares held show sustained confidence in Tesla's future.

Intel ( INTC 0.00%↑ ) is showing renewed vigor in semiconductors. Recording 15 new buys and a 178.20% position change, Intel has attracted $450,000 in investments. Investors are backing Intel's strategic initiatives and potential for growth.

Early week updates highlight these intriguing movements.

Strategic Shifts in Focus

Mid-week updates reveal ongoing strategic adjustments in key sectors:

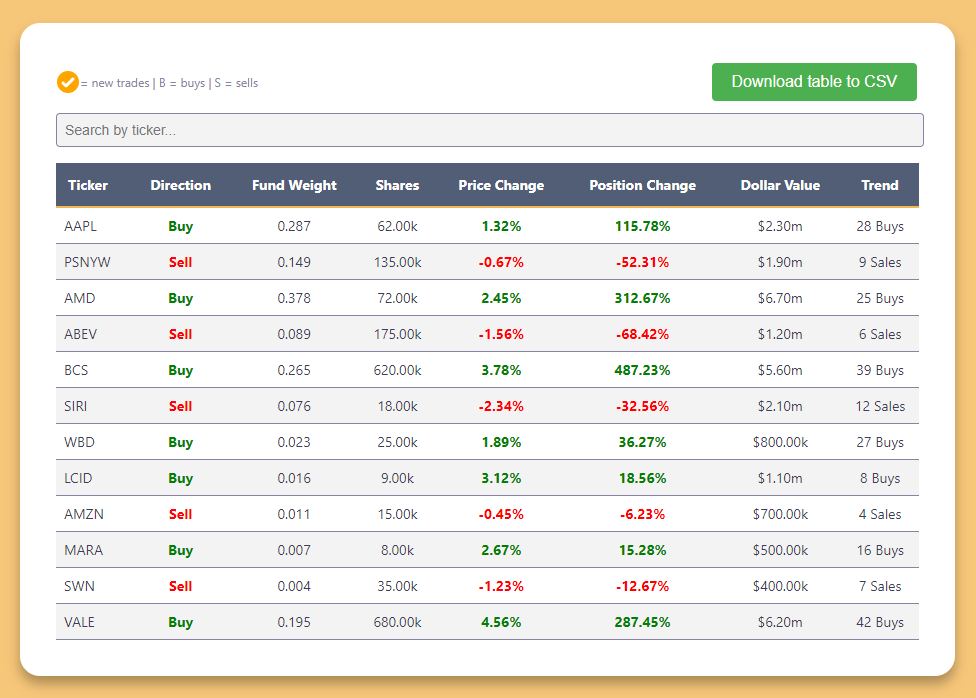

VALE ( VALE 0.00%↑ ) maintains its innovative edge in the mining industry. With 42 new buys and a 287.45% position change, investor enthusiasm for VALE remains high. The $6,200,000 investment and 680,000 shares held show sustained confidence in VALE's future.

Polestar ( PSNYW 0.00%↑ ) continues to face challenges in the automotive industry. With 9 new sales and a 52.31% position decrease, investor sentiment towards Polestar appears to be waning. The $1,900,000 investment and 135,000 shares held suggest a cautious outlook for Polestar's market trajectory.

Ambev ( ABEV 0.00%↑ ) Ambev (ABEV) a heavyweight in the beverage industry, is facing headwinds. With 6 new sales and a 68.42% position decrease, the company has seen a decline in investor interest. The $1,200,000 invested in 175,000 shares reflects a more conservative stance towards Ambev's strategic direction and growth prospects.

Mid-week updates highlight these strategic shifts.