Weekly Report - BUY/SELL Signal Alerts Ready For Launch!

Daily Trading Signal Telegram Alerts Are Ready 💸 - The Week Ahead 💥 - Today's newsletter is brought to you by ATAS 📈

Hi fellow investors and welcome back for a Quant data driven analysis for the week ahead. [Full Disclaimer]

Updates:

After strong request I’ve decided to prioritize completion of my Automated Signal Bot. Daily Trading Signal Telegram Alerts are in last testing phase and will be available to premium members only very soon. I am finalizing triggers to filter the best signals only.

Popular

The Week ahead (for paid members only)

Remember to check out US Stocks Picks release, if you haven’t already.

Let's dive in and make some smart moves! 💰🚀

Short Term Update - Newest Additions

There was a mistake in the sent version with outdated table which is now corrected.

Market Movements: Navigating the Shifts

Recent updates reveal notable changes across various sectors:

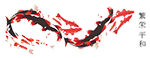

MRVL ( MRVL 0.00%↑ ) leads with remarkable momentum in the semiconductor sector. With 31 buys and a substantial 425.46% position change increase, MRVL's strong performance appears to be attracting significant institutional interest. The dollar value of $98.00k and 950,000 shares position indicates growing confidence in its market trajectory.

ADBE ( ADBE 0.00%↑ ) shows steady growth despite market volatility. With 19 buys and a 7.92% increase in position change, investors seem optimistic about Adobe's future prospects. The substantial dollar value of $156.00k suggests strong institutional backing.

META (META 0.00%↑ ) demonstrates positive momentum with 15 buys and a 0.89% position change. The company's share price increase, coupled with 238,000 shares position, suggests investors are confident in META's strategic direction and growth potential in the social media and metaverse spaces.

Early week updates highlight these intriguing movements.

Strategic Shifts in Focus

Mid-week updates reveal ongoing strategic adjustments in key sectors:

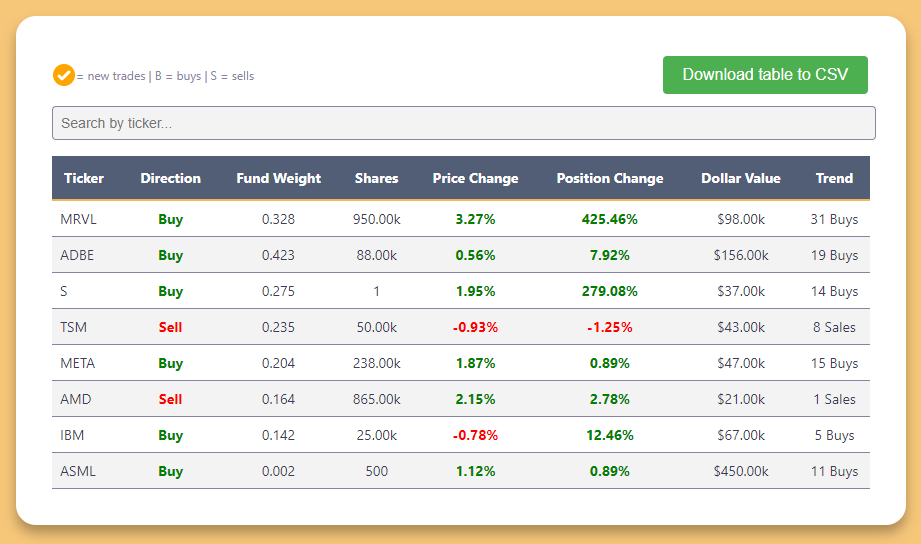

CWEN ( CWEN 0.00%↑ ) shows significant pressure in the renewable energy sector. With 9 sales and a substantial -28.93% position change decrease, despite holding a high fund weight of 0.501 and 365,000 shares, investors appear to be reducing their exposure. The dollar value of $51.00k suggests cautious sentiment in the clean energy space.

NVDA ( NVDA 0.00%↑ ) demonstrates remarkable strength in the semiconductor sector. With 31 buys and an impressive 378.96% increase in position change, coupled with a positive price movement, investors are showing strong confidence in NVIDIA's AI leadership. The $30.00k dollar value position indicates continued institutional interest.

DTM ( DTM 0.00%↑ ) presents mixed signals with 4 buys despite a -31.84% position change. With 75,000 shares and a $28.00k dollar value, the contrasting indicators suggest a period of repositioning. The positive price movement but negative position change might indicate selective accumulation amid broader portfolio adjustments.

Mid-week updates highlight these strategic shifts.

Ending week updates showcase further market dynamics:

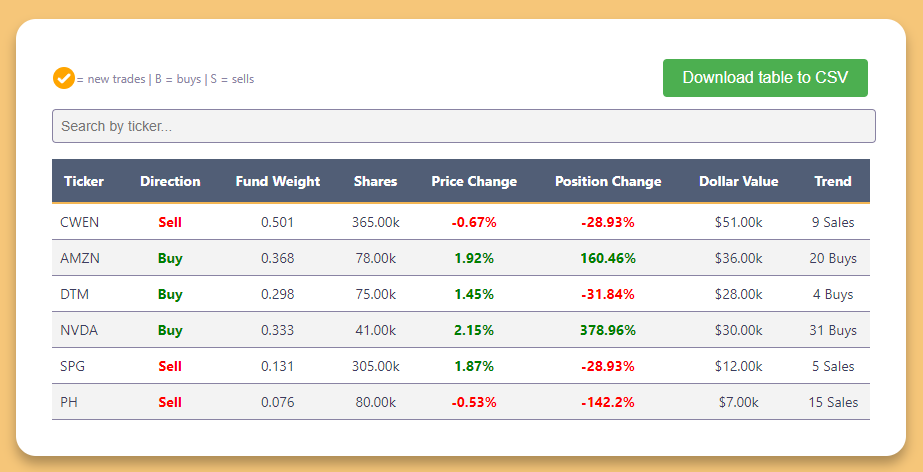

OXY ( OXY 0.00%↑ ) shows strong momentum in the energy sector. With 23 buys and a substantial 130.74% position change increase, coupled with 350,000 shares position, Occidental Petroleum demonstrates growing investor confidence. The $22.00k dollar value suggests strategic accumulation in the oil and gas space.

TMUS ( TMUS 0.00%↑ ) presents a complex picture in the telecommunications sector. Despite a positive price movement, there's a significant -85.71% decrease in position change with 35 sales. The 180,000 shares position and $20.00k dollar value indicate major portfolio adjustments by institutional investors.

LLYVK ( LLYVK 0.00%↑ ) demonstrates resilience despite price pressure. With 13 buys and a significant 93.51% position change increase, along with a substantial 300,000 shares position, investors appear confident in its prospects. The $17.00k dollar value suggests steady institutional support despite market volatility.

These end-of-week updates highlight the complex interplay of sector-specific trends and broader market forces, showcasing the nuanced decision-making of institutional investors across various industries.

ICYMI:

Last week Report:

Insider Activity - Annalists Upgrades, Downgrades, Price Targets Changes

Analyst Ratings Price Target Changes [Download]

Keep reading with a 7-day free trial

Subscribe to Eltoro Market Insights to keep reading this post and get 7 days of free access to the full post archives.