Weekly Report - Tesla & Amazon - 4 Titans Analysis Update - Portfolio Update

Game-Changer Shaping the Future Not to miss 💥 - Incoming Earning 💸 - Today's newsletter is brought to you by ATAS 📈

Hi fellow investors and welcome back for a Quant data driven analysis for the week ahead. [Full Disclaimer]

After 4 years of testing I’m proud to announce Partnership with ATAS Trading Platform. ← check it out here. [Free] for C-rypto.

Updates:

Popular

The Week ahead (for paid members only)

NVDA, AMD, TSLA, AAPL Update coming Wednesday (for paid members only)

Remember to check out US Stocks Picks release, if you haven’t already.

Not a Premium Member?

Let's dive in and make some smart moves! 💰🚀

Short Term Update - Newest Additions

Market Movements: Navigating the Shifts

Recent updates reveal notable changes across various sectors:

ASML Holding ( ASML 0.00%↑ ) continues its upward trajectory in the semiconductor equipment sector. With 11 buys and a 0.89% position change increase, ASML's critical role in chip manufacturing appears to be driving investor interest. The substantial dollar value of $497.00k per share underscores its importance. Is ASML poised to benefit from the global push for semiconductor independence?

IBM ( IBM 0.00%↑ ) shows resilience despite a slight price dip. With 5 buys and a significant 12.46% increase in position change, investors seem to be betting on IBM's transformation and AI initiatives. Is this a sign of confidence in IBM's strategic pivot, or are investors seeking stability in an uncertain market?

Marvell Technology ( MRVL 0.00%↑ ) presents an intriguing case with the highest price change but a substantial -18.93% position change. This divergence, coupled with 2 sales, suggests some investors may be taking profits or reassessing the company's prospects in the competitive chip market.

Early week updates highlight these intriguing movements.

Strategic Shifts in Focus

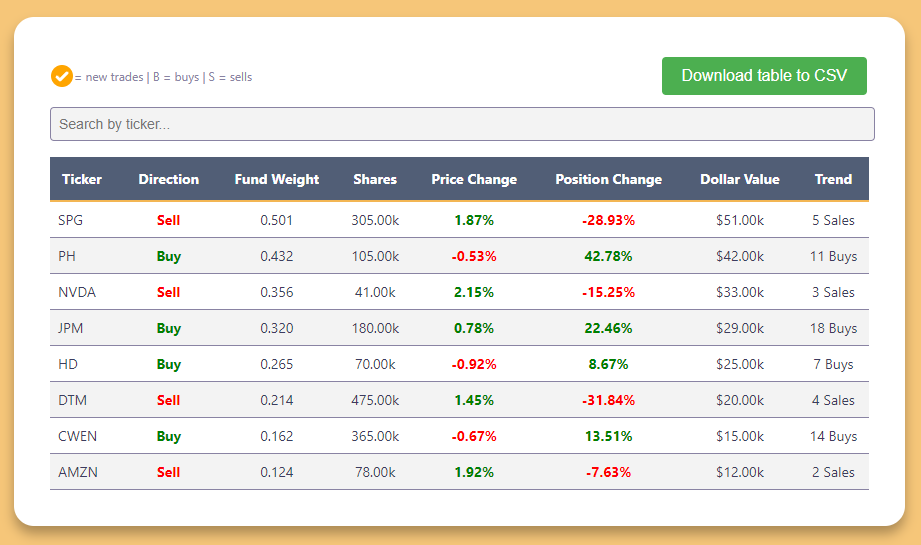

Mid-week updates reveal ongoing strategic adjustments in key sectors:

Simon Property Group ( SPG 0.00%↑ ) faces a complex narrative in the real estate sector. Despite a positive price change, there's a significant -28.93% decrease in position changes and 5 sales. With the highest fund weight of 0.501, this suggests major investors may be reassessing their exposure to commercial real estate. Is this a sign of broader concerns about the retail landscape, or just a portfolio rebalancing?

Parker-Hannifin ( PH 0.00%↑ ) shows resilience in the industrial sector. Despite a slight price dip, there's a substantial 42.78% increase in position changes and 11 buys. This could indicate growing confidence in the company's long-term prospects. Are investors betting on a rebound in industrial activity?

Simon Property Group ( SPG 0.00%↑ ) faces a complex narrative in the real estate sector. Despite a positive price change, there's a significant -28.93% decrease in position changes and 5 sales. With the highest fund weight of 0.501, this suggests major investors may be reassessing their exposure to commercial real estate. Is this a sign of broader concerns about the retail landscape, or just a portfolio rebalancing?

Mid-week updates highlight these strategic shifts.

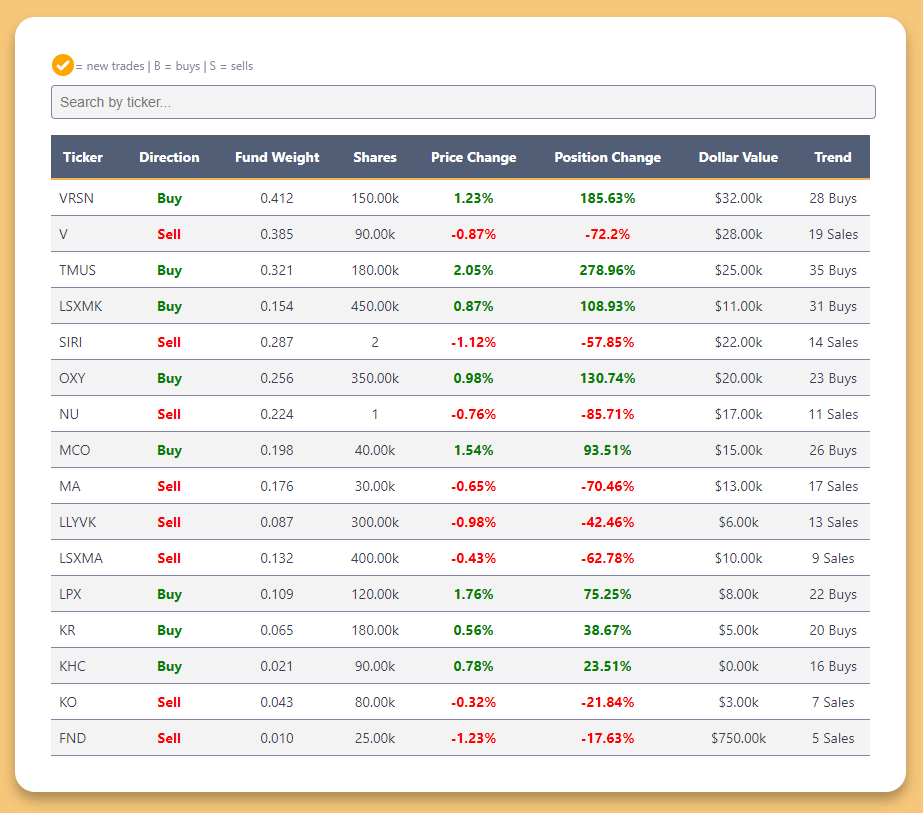

Ending week updates showcase further market dynamics:

Verison ( VRSN 0.00%↑ ) secures a strong position. With a 1.23% price increase, 28 buys, and a substantial 185.63% increase in position changes, the internet infrastructure company seems to be processing significant gains. Is this surge driven by increased demand for domain names and web security services?

T-Mobile US ( TMUS 0.00%↑ ) dials up investor interest. A 2.05% price increase, 35 buys, and a remarkable 278.96% increase in position changes suggest growing confidence in the telecom giant's 5G strategy. Are investors betting on T-Mobile's network expansion and market share gains?

Advanced Micro Devices ( AMD 0.00%↑ ) chips away at investor confidence. With a 2.15% price increase but a -5.63% decrease in position changes and 1 sale, the semiconductor giant presents a mixed picture. As the stock with the highest fund weight (0.485), this divergence is particularly noteworthy. Is this reflecting concerns about intensifying competition in the chip market?

These end-of-week updates highlight the complex interplay of sector-specific trends and broader market forces, showcasing the nuanced decision-making of institutional investors across various industries.

ICYMI:

Last week Report:

Insider Activity - Annalists Upgrades, Downgrades, Price Targets Changes

Analyst Ratings Price Target Changes [Download]

Keep reading with a 7-day free trial

Subscribe to Eltoro Market Insights to keep reading this post and get 7 days of free access to the full post archives.