Weekly Report - Last Chance - Game Changer Sectors - ETF MOAT Portfolio Upgrade - Announcement

Not to miss 9 Game-Changing Technologies Shaping the Future 💥 - Market Movements 💸 - Today's newsletter is brought to you by ATAS 📈

Hi fellow investors and welcome back for a Quant data driven analysis for the week ahead. [Full Disclaimer]

After 4 years of testing I’m proud to announce Partnership with ATAS Trading Platform. ← check it out here. [Free] for C-rypto.

Updates:

Popular

The Week ahead (for paid members only)

The ETF MOAT Portfolio delayed. Being upgraded for bear market (for paid members only)

Full ATAS review coming and why I chose it.

Remember to check out US Stocks Picks release, if you haven’t already.

Let's dive in and make some smart moves! 💰🚀

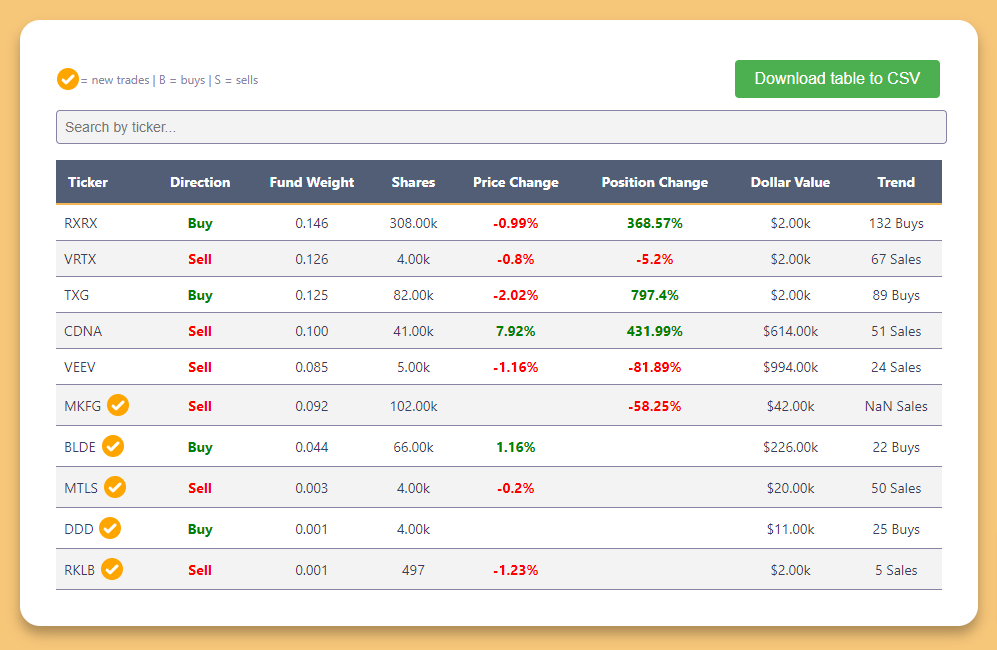

Short Term Update - Newest Additions

Market Movements: Navigating the Shifts

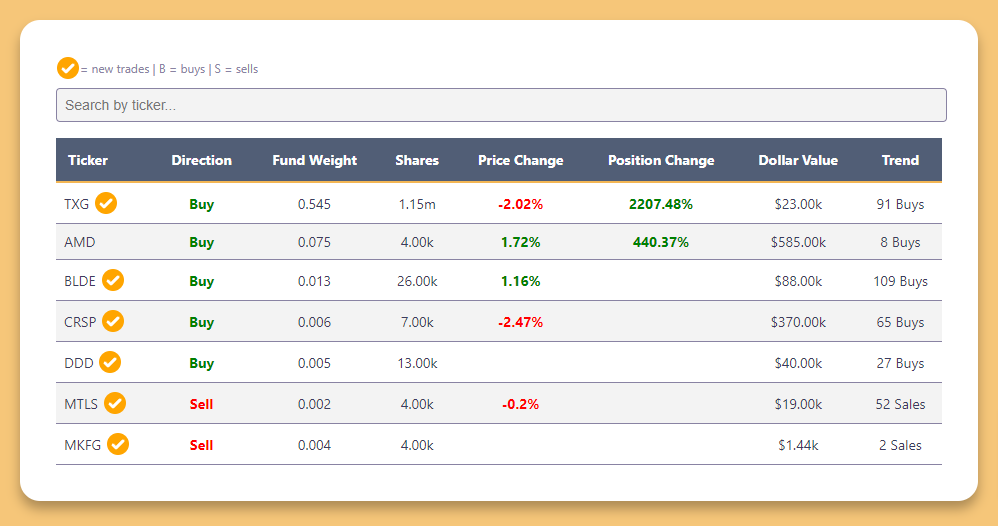

Recent updates reveal notable changes across various sectors:

10X Genomics ( TXG 0.00%↑ ) is sequencing a new narrative in biotechnology. With 91 buys and a significant 2207.48% increase in position changes despite a -2.02% price change, investors seem to perceive new dimensions of potential in single-cell analysis. Is this the beginning of a genomic revolution or just a well-amplified speculation?

CRISPR Therapeutics ( CRSP 0.00%↑ ) experiences some gene-editing turbulence. A -2.47% price dip, coupled with 66 buys, suggests the gene-editing pioneer might be facing regulatory headwinds. Is this a temporary setback in the quest to rewrite human DNA or a sign of broader market skepticism towards biotech?

Materialise ( MTLS 0.00%↑ ) continues its 3D printing reality check with a -0.2% price change and 52 sales. The additive manufacturing dream seems to be facing a stark reality. Is this a chance to build a position at a discount, or are investors deconstructing their additive manufacturing thesis?

Early week updates highlight these intriguing movements.

Strategic Shifts in Focus

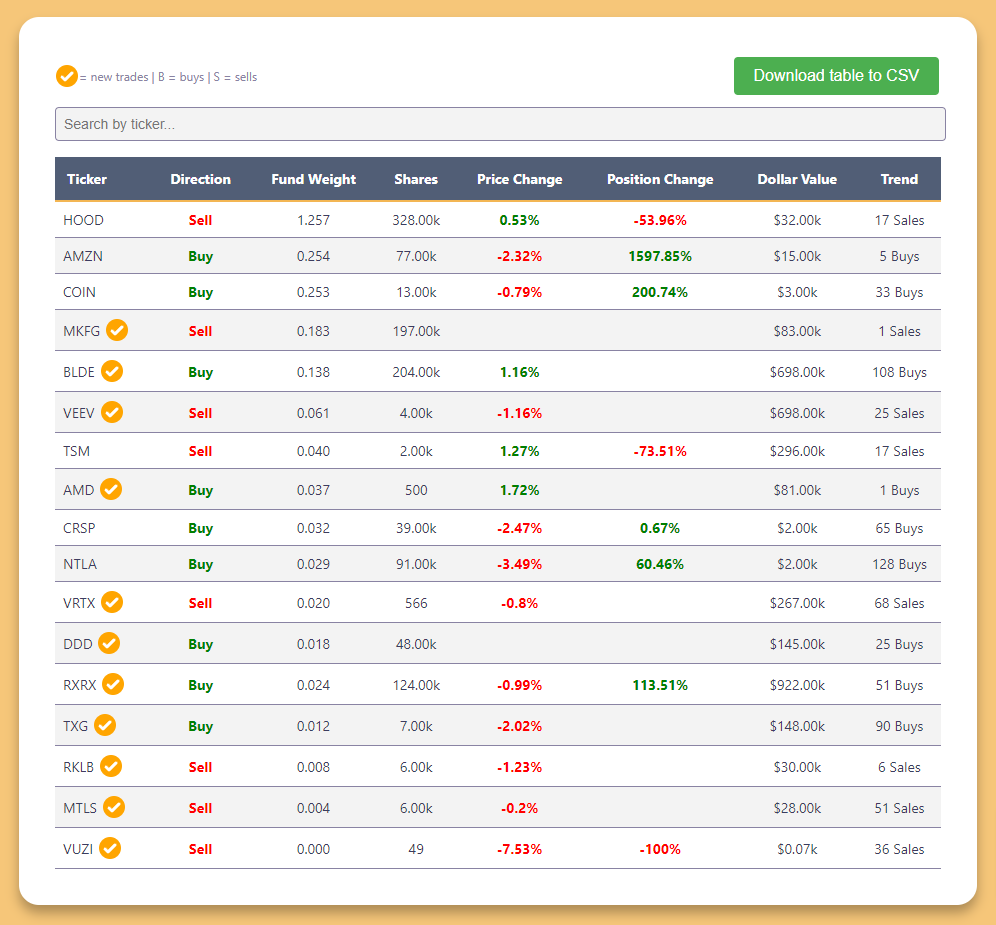

Mid-week updates reveal ongoing strategic adjustments in key sectors:

Coinbase ( COIN 0.00%↑ ) continues to make waves in the cryptocurrency exchange space. With a -0.79% price change and 33 buys, the digital asset platform's narrative is becoming more complex. Notably, there's a significant 200.74% increase in position changes. Are investors bullish on crypto or just hedging their bets?

Recursion Pharmaceuticals ( RXRX 0.00%↑ ) is pioneering new frontiers in AI-driven drug discovery. A -0.99% price change, coupled with 51 buys and a substantial 113.51% increase in position changes, suggests this biotech innovator is gaining momentum. Is the future of medicine being rewritten by algorithms?

Intuit ( INTU 0.00%↑ ) navigates through market volatility. With a 0.89% price uptick but 17 sales and a -14.54% decrease in position changes, this financial software giant appears to be on a complex trajectory. Are investors recalculating their portfolios or just troubleshooting their strategy?

Mid-week updates highlight these strategic shifts.

Ending week updates showcase further market dynamics:

Advanced Micro Devices ( AMD 0.00%↑ ) chips away at market share. With a 1.72% price increase, 8 buys, and a substantial 440.37% increase in position changes, the semiconductor giant seems to be processing gains. Is this the start of a new compute cycle or just a temporary overclock?

Blade Air Mobility ( BLDE 0.00%↑ ) takes flight with urban air transportation. A 1.16% price increase, 109 buys, and new positions opened across different fund categories (Q and X) suggest investors are boarding this futuristic transit concept. Will urban skies soon be filled with electric vertical takeoff and landing (eVTOL) aircraft?

Markforged Holding ( MKFG 0.00%↑ ) faces headwinds in the 3D printing space. With 2 sales across different fund categories (X and Q) and no reported price change, the industrial 3D printing company seems to be recalibrating its market position. Is this a temporary pause in the additive manufacturing narrative or a sign of sector-wide challenges?

Ending week updates highlight these strategic shifts, painting a picture of a market in constant flux, where innovation and disruption continue to shape investment landscapes across multiple sectors.

ICYMI:

Last week Report:

Insider Activity - Annalists Upgrades, Downgrades, Price Targets Changes

Analyst Ratings Price Target Changes [Download]

Keep reading with a 7-day free trial

Subscribe to Eltoro Market Insights to keep reading this post and get 7 days of free access to the full post archives.