Decoding Berkshire Hathaway's Q3 2024 Earnings: What Investors Need to Know

📡 Daily Signal Telegram Alerts Update.

Hi fellow investors and welcome back for some Quant data driven Insights!

[Update] Reduced to 16,000 to remove low volume and young stocks. My Alert Quant is scanning 20,000 US Stocks to only filter the top signals. I'm thrilled to introduce Alert Quant, a tool that scans thousands of stocks to filter out the top signals so you don’t have to. I'm committed to continuously fine-tuning and improving it over time. With over 20,000 16,000 US stocks out there, finding the best opportunities is as good as searching for a needle in a haystack. That's where Alert Quant comes in.

Here's what you can expect:

Phase 1 [UPDTATE]: Live testing and launch of Daily Signal Alerts. Live Daily Signal Alerts is now outputting 20 top daily top alerts and is being refined.

With simplified details to cater for beginners who wants straightforward guidance without the complexity.

Phase 2 [UPDTATE]: Daily Intraday Alerts - High risk for high reward - Live testing and launch of Intraday Signal Alerts Started based on 4hours TF.

Phase 3: Weekly Buy-and-Hold and Short Swings Alerts - Conservative

Aimed at steady mid and long term portfolio growth

Phase 4: Bitcoin only daily alerts - High risk for high reward

These come with higher risk but the potential for significant rewards.

Phase 5: FinTech / Blockchain TBA - Very High risk

These are very high risk but could offer groundbreaking potential for rapid capital growth.

[Update] I increased the configuration configuration is base on a $100,000 capital account and 2% position allocation to simplify decision making and risk management.

Now without further ado.

ICYMI:

Berkshire Hathaway, the conglomerate led by legendary investor Warren Buffett, has just released its Q3 2024 earnings report. The numbers reveal a robust performance that sheds light on the company's strategic direction and offers valuable insights for investors. Let's break down the key takeaways and explore what they mean for both short-term and long-term investment strategies.

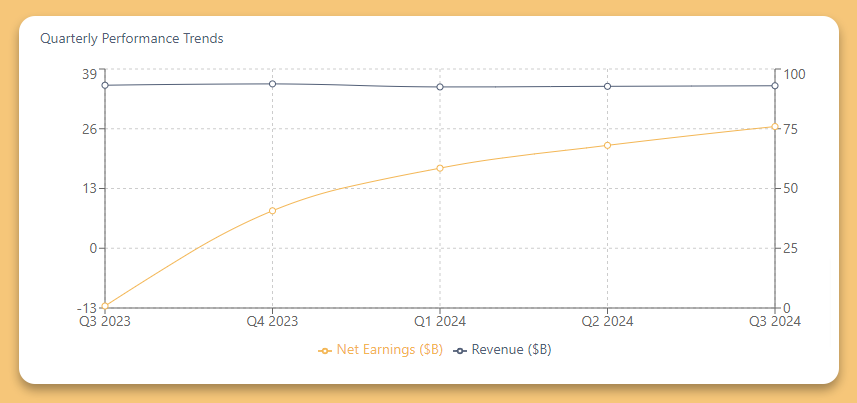

A Snapshot of the Quarter

Despite market volatility and global economic uncertainties, Berkshire Hathaway reported net earnings of $26.48 billion for the third quarter. This marks a significant turnaround from the $12.57 billion loss reported in the same period last year.

Highlights:

Total Revenues: Remained stable at $92.99 billion, compared to $93.21 billion in Q3 2023.

Operating Earnings: Increased across several key sectors, showcasing the strength of Berkshire's diversified portfolio.

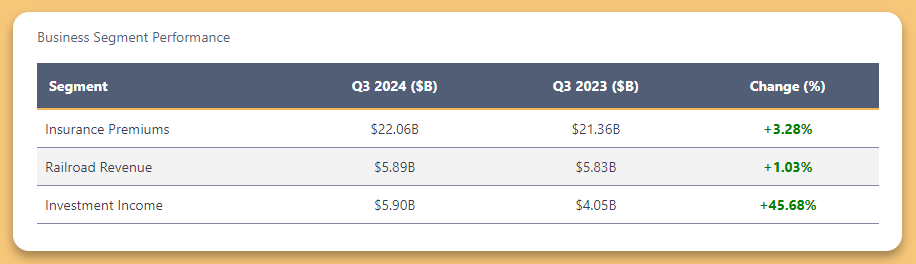

Investment Income: Interest, dividend, and other investment income surged to $5.90 billion from $4.05 billion.

Breaking Down the Business Segments

Berkshire Hathaway's conglomerate structure spans various industries, each contributing to its overall performance.

Insurance Operations

The insurance segment continues to be a cornerstone:

Insurance Premiums Earned: Rose to $22.06 billion, up from $21.36 billion.

Underwriting Results: Mixed performance with increased losses and loss adjustment expenses at $15.16 billion, up from $13.72 billion.

Railroads, Utilities, and Energy

Railroad Revenues: Slight uptick to $5.89 billion from $5.83 billion.

Utilities and Energy: Stable performance, signaling consistent demand in these essential services.

Manufacturing, Service, and Retail

Steady revenues reflecting the resilience of consumer spending and industrial demand.

Investment Portfolio Movements

Berkshire's investment decisions often provide insight into market trends and Buffett's strategic thinking.

Equity Investments

Total Equity Securities: Valued at $271.65 billion.

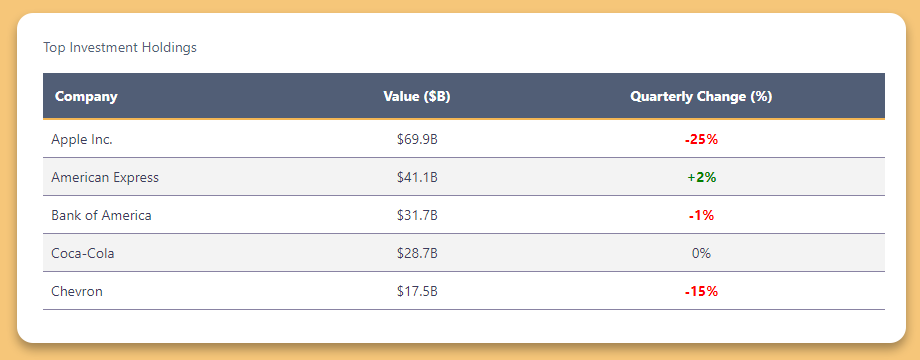

Top Holdings:

Apple Inc.: $69.9 billion

American Express: $41.1 billion

Bank of America: $31.7 billion

Coca-Cola: $28.7 billion

Chevron: $17.5 billion

Treasury and Fixed Income

U.S. Treasury Bills: Short-term investments more than doubled to $288.03 billion from $129.62 billion at the end of 2023.

Indicates a conservative approach, possibly preparing for future investment opportunities or shielding against market turbulence.

Strategic Moves and Acquisitions

Pilot Travel Centers

Completed acquisition of remaining non-controlling interests for $2.6 billion.

Berkshire now owns 100% of Pilot Travel Centers.

This move strengthens Berkshire's position in the retail and energy distribution sectors.

Berkshire Hathaway Energy ( BHE 0.00%↑ )

BHE repurchased 5.85% of its outstanding common stock.

Became a wholly-owned subsidiary, simplifying corporate structure and potentially improving operational efficiency.

Recent Performance and Market Position

Apple's Q3 2024 earnings revealed concerning metrics:

EPS significantly missed expectations at $0.97 versus the expected $1.60

Revenue slightly exceeded expectations at $94.9 billion, up 6% year over year

Stock price has shown weakness, dropping below $220, a level last seen in early September

Buffett's Strategic Selloff

Warren Buffett's recent moves provide significant market signals:

Berkshire Hathaway sold approximately 100 million Apple shares in Q3 2024

This represents about 25% of Berkshire's stake in Apple

Despite the selloff, Apple remains Berkshire's largest holding at $69.9 billion

Technical Analysis Concerns

Several technical indicators suggest potential downside:

Stock traded within an ascending triangle before breaking down below the pattern's lower trendline

Key support levels to watch:

$218 (near June peak)

$198 (historical support level)

$181 (potential buy zone)

Fundamental Challenges

Market Headwinds

Weak iPhone 16 upgrade cycle expectations

Delayed rollout of Apple Intelligence features

Increasing competition in key markets

Valuation Concerns

PE ratio stands at 35.14, suggesting potential overvaluation

Forward PE of 32.02 indicates limited earnings growth expectations

Market cap at $3.51 trillion may limit further upside potential

Investment Implications

Risk Factors

Technical breakdown on increasing volume suggests growing selling pressure

Berkshire's significant reduction signals potential overvaluation concerns

Earnings miss could indicate broader operational challenges

Strategic Considerations

Consider taking partial profits while maintaining core position

Watch key technical levels for potential entry points

Monitor insider trading activity for additional signals

Short-Term Investing Analysis

Market Conditions

Economic Indicators: Inflation rates and interest rate changes are influencing market dynamics.

Berkshire’s Liquidity: With substantial cash reserves, Berkshire is well-positioned to capitalize on immediate opportunities.

Opportunities

Defensive Holdings: Investments in essential sectors like utilities and consumer goods offer stability.

Potential for Buybacks: Increased treasury stock suggests ongoing share repurchase programs, potentially boosting shareholder value.

Risks

Market Volatility: Short-term fluctuations could impact stock prices.

Regulatory Changes: New policies could affect financial and energy sectors.

Long-Term Investing Analysis

Diversification Strategy

Broad Portfolio: Exposure to multiple industries mitigates risk.

Value Investing Philosophy: Focus on fundamentally strong companies with long-term growth potential.

Growth Drivers

Technology Investments: Significant holding in Apple positions Berkshire to benefit from tech sector growth.

Energy Transition: Full ownership of BHE may enable Berkshire to lead in renewable energy initiatives.

Challenges

Succession Planning: As Buffett ages, leadership transition is a consideration for long-term investors.

Market Saturation: Mature industries may offer slower growth, requiring strategic innovation.

What This Means for Investors

For Short-Term Investors:

Potential Upside: Stable performance may lead to modest stock appreciation.

Caution Advised: Given market uncertainties, monitoring economic indicators is crucial.

For Long-Term Investors:

Strong Fundamentals: Berkshire’s solid financials and strategic acquisitions bode well for future growth.

Dividend Potential: While Berkshire traditionally doesn't pay dividends, reinvested earnings contribute to compounding value.

Final Thoughts

Q3 2024 earnings report shows the company's resilience and strategic acumen. The combination of strong operating earnings, strategic acquisitions like Pilot Travel Centers and BHE, and a prudent investment approach positions Berkshire favorably in both the short and long term.

Berkshire Hathaway continues to demonstrate that fundamental principles of value investing remain effective. By focusing on solid businesses, prudent capital allocation, and strategic flexibility, the company not only withstands market challenges but often emerges stronger.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always do your own research and consider your financial situation before making investment decisions.

Remember what goes up must come down (eventually)

Stay safe and invest wisely and this is in no mean financial advice. [Full Disclaimer]Thank you for supporting this newsletter. It will keep improving.

Harry