#17 Weekly Update - Odyssey +259% ! Gulf of America Impact or Fluff?

A look at Odyssey Marine Exploration recent rally and deep-sea exploration

Hi and welcome back for a Quant data driven analysis. [Full Disclaimer]

Why the sudden rally of Odyssey Marine Exploration? I previously covered deep-sea exploration at length and why the next 4 years might be game changer.

ICYMI:

Catalysts, Technical Signals, and Risk Assessment

So I've been down a rabbit hole with Odyssey Marine Exploration for the past few weeks. This thing fascinates me – it's like watching several market forces collide in real-time. The stock went absolutely bonkers in early April, shooting up over 250%, and there's a ton to unpack here.

The Rally: What the Hell Just Happened?

First, let's talk price action, because. Odyssey spent months languishing below fifty cents, looking pretty much dead. Then suddenly – BOOM – it explodes to over $2. I've seen enough pump-and-dumps to be skeptical of these moves, but this one has actual substance behind it.

The volume tells the real story here. We saw multiple days with 5-10x normal volume, which suggests this isn't just Reddit traders playing hot potato. There's institutional money moving in. The stock broke through its 200-day moving average for the first time since September, which is kind of a big deal technically. More on this below.

Let's dive in and make some smart moves! 💰🚀

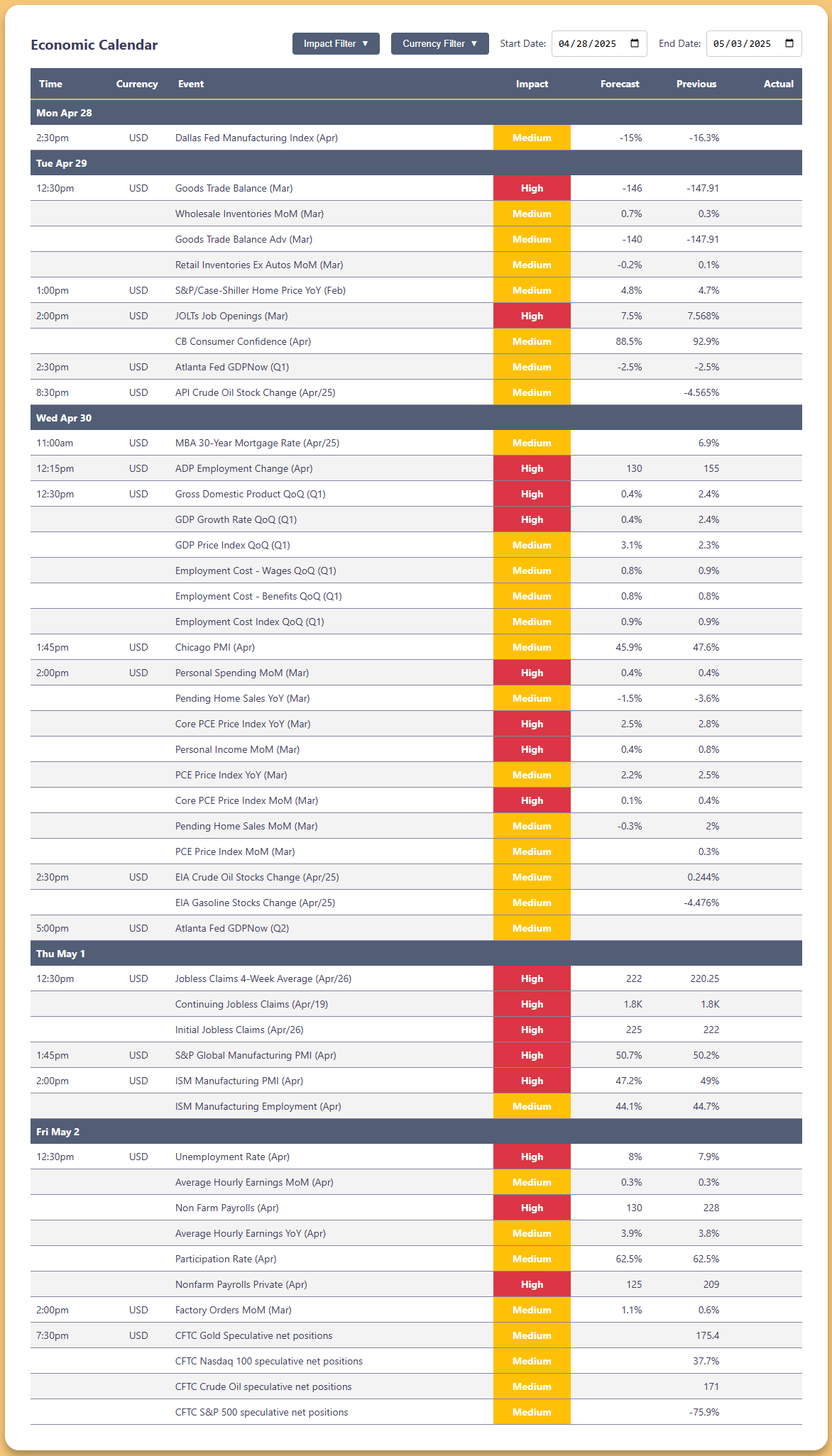

📅Week's Calendar April 28-03, 2025

High Impact Events

Tuesday Apr 29

Goods Trade Balance (Mar): Forecast -146, Prior -147.91

JOLTs Job Openings (Mar): Forecast 7.5%, Prior 7.568%

Wednesday Apr 30

ADP Employment Change (Apr): Forecast 130K, Prior 155K

GDP Growth Rate QoQ (Q1): Forecast 0.4%, Prior 2.4%

Core PCE Price Index YoY (Mar): Forecast 2.5%, Prior 2.8%

Personal Income MoM (Mar): Forecast 0.4%, Prior 0.6%

Thursday May 1

Initial Jobless Claims (Apr/26): Forecast 225K, Prior 222K

S&P Global Manufacturing PMI (Apr): Forecast 50.7%, Prior 50.2%

ISM Manufacturing PMI (Apr): Forecast 47.2%, Prior 49%

Friday May 2

Unemployment Rate (Apr): Forecast 8%, Prior 7.9%

Non Farm Payrolls (Apr): Forecast 130K, Prior 228K

Key Economic Data

Monday Apr 28

Dallas Fed Manufacturing Index (Apr): Forecast -15%, Prior -16.3%

Tuesday Apr 29

CB Consumer Confidence (Apr): Forecast 88.5%, Prior 92.9%

Atlanta Fed GDPNow (Q1): Forecast -2.5%, Prior -2.5%

Wednesday Apr 30

Chicago PMI (Apr): Forecast 45.9%, Prior 47.6%

EIA Crude Oil Stocks Change: Prior 0.244%

EIA Gasoline Stocks Change: Prior -4.476%

Market Positioning (Friday)

CFTC Gold Speculative net positions: Prior 175.4

CFTC Nasdaq 100 speculative positions: Prior 37.7%

CFTC Crude Oil speculative positions: Prior 171

CFTC S&P 500 speculative positions: Prior -75.9%

This week features critical economic indicators including GDP, employment data, and manufacturing indices that could significantly impact market sentiment.

Last Week Recap:

In-Short

Global Economic Outlook

Global GDP growth is projected at 3.3% for both 2025 and 2026, below the historical average of 3.7% (2000-2019) according to the IMF's January 2025 World Economic Outlook. The economic landscape shows diverging paths across regions, with advanced economies expected to see modest improvement while emerging markets face a slight slowdown.

US Market Projections

S&P Global forecasts US real GDP growth will cool to 1.9% in 2025 and 2026, down from 2.9% in 2023 and 2.8% in 2024 as economic momentum loses steam amid shifting policies. For the S&P 500, major Wall Street firms are projecting continued but more moderate gains, with most forecasts clustering around 6,500 by year-end 2025 representing roughly an 8-10% gain from late 2024 levels.

International Markets

Emerging markets are expected to grow at a slower 3.4% in 2025, down from 4.1% in 2024 according to J.P. Morgan Research. China's growth is projected to moderate to 4.5% as structural challenges in the property sector and demographics constrain activity despite policy support. India remains a bright spot with expected 6.4% growth, driven by public investment and strong domestic demand.

Market Catalysts & Risks

Several factors could influence 2025 performance:

Earnings Growth: S&P 500 earnings per share are forecast to grow 11% in 2025 according to Goldman Sachs projections, potentially supporting market valuations

Interest Rates: Central banks will likely maintain a cautious approach to rate cuts as inflation remains sticky

Sector Rotation: Small-cap stocks may finally outperform after a decade of underperformance relative to large caps

Geopolitical Tensions: Trade policy uncertainty and tariffs may drive increased market volatility

Insider Activity - Annalists Upgrades, Downgrades, Price Targets Change.

🔐Premium Member only.🔐

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always do your own research and consider your financial situation before making investment decisions.