5 Biotech Caught My Eye - Benefiting From the Strangest Market in Decades

When (Not If) Trump Changes His Mind Again on Tariffs – How to Position

Hi and welcome back for a Quant data driven analysis. [Full Disclaimer]

When chaos becomes the strategy, discipline becomes your edge.

The market rhetoric around Trump's tariffs keeps shifting wildly, and it's a question of when (not if) it'll turn again. We're now a few weeks into this tariff saga, and some patterns are becoming clear. The biggest issue isn't even the tariffs themselves - it's the complete lack of policy consistency and coherence.

Trump finally decided to tone down his flagrant approach with China. He said the U.S. is "going to be very nice to China" and claimed that tariffs "will come down substantially" from their current 145% level. Markets bounced, but only modestly - because nobody really trusts the message anymore.

I mean, in the same breath he said "ultimately, they will have to make a deal" and that "they'll want to be a part of the US." Then he added that if no deal happens, he'll just "set a deal" and "set a number" on tariffs. And don't forget the jab where he claimed "we just destroyed China." Not exactly diplomatic language.

The problem is the flip-flopping and back-and-forth that makes this situation nearly impossible to read. It's a credibility issue at its core. With every about-face, investors become more skeptical about the next announcement. I’d rather see +400% tariff. At least direction would be clearer.

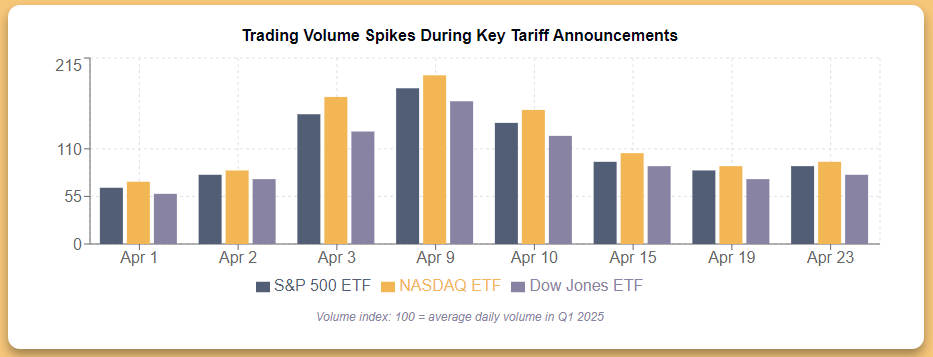

The Market Chaos by the Numbers

The S&P 500 dropped nearly 5% on April 3 after the initial tariff announcement, then surged 9.5% on April 9 after Trump paused many of the tariffs. Now we're at 5,398 - still whipsawing around based on the latest tweet or comment.

What's truly staggering is that $10 trillion in global equity value was wiped out in just three days after the tariff announcement. This isn't small potatoes.

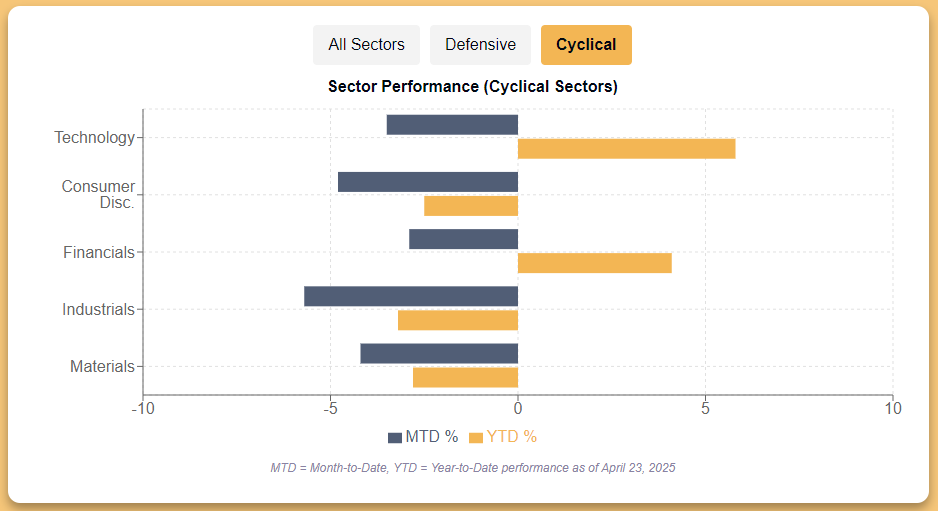

Underneath the headline index numbers, the sector performance tells an even more interesting story. Industrials, materials, and energy are getting hammered - down 5.7%, 4.2%, and 6.3% month-to-date. These sectors are directly in the firing line of trade wars. Meanwhile, utilities and consumer staples are actually up 1.5% and 0.5%. That's a classic risk-off rotation if I've ever seen one.

The Economic Damage Is Real

The IMF just slashed their global growth forecast to 2.8% from 3.3%, and the U.S. forecast got cut to 1.8% from 2.7%. That's a massive 0.9 percentage point cut. JPMorgan now puts recession odds at 60%, up from 40% before this tariff mess started.

These aren't just numbers. They reflect eroding business confidence, supply chain chaos, and a freeze in corporate decision-making. The Tax Foundation estimates these tariffs will cost the average household $1,243 in 2025. That's real money coming out of people's pockets.

We're already seeing the shipping data collapse in real time. It's been just three weeks since these tariffs hit, and ocean container bookings from China are already down over 60% across the entire industry. That's staggering. We're talking about roughly half a trillion dollars in imports from China that retail for around $2 trillion annually, so this isn't some minor trade spat.

The first ships carrying goods that'll get slapped with the full 145% tariffs just arrived Monday. The real pain hasn't even filtered through the system yet - we've got weeks of cascading effects ahead as inventories get drawn down. And here's the kicker: if Trump suddenly reverses course on these tariffs, we'll face a whole different mess. Shipping companies are already repositioning vessels globally. A sudden surge of orders after a reversal could completely overwhelm the network, especially if businesses think the reprieve is temporary and rush to get goods in before the next flip-flop.

Nobody really knows how this plays out. A huge chunk of these imports are intermediate goods and components for finished products, not just direct consumer items. My bet? We'll see an explosion in transshipment tricks and outright smuggling as businesses try to evade the tariffs. But it could just as easily become another supply chain disaster like COVID, or somehow result in surprisingly little disruption. We're in completely uncharted waters.

The Fed meets on May 7, and markets are pricing in a 92% probability they'll keep rates unchanged at 4.25-4.50%. But what happens after that meeting? Will Trump start bashing Powell again? Will he threaten Powell's job security as he did before? Given his track record, I wouldn't rule it out.

Where to Hide?

With every day that the tariffs stay in place, the global economic outlook erodes further - even if nothing else happens. The hard data will start rolling in over the next few weeks, and reality will come knocking.

That said, I'm finding some interesting pockets of opportunity. The biotech sector is particularly compelling right now. These companies are largely insulated from trade tensions since they're focused on innovation rather than manufacturing, and healthcare demand stays stable regardless of economic conditions.

Five names have caught my eye