#19 Weekly Update - Choppy Waters & Trade Ease - Next Tech +688%!

This week will dive into why some company are flying 3 digits!

Hi and welcome back for a Quant data driven analysis. [Full Disclaimer]

Let's dive in and make some smart moves! 💰🚀

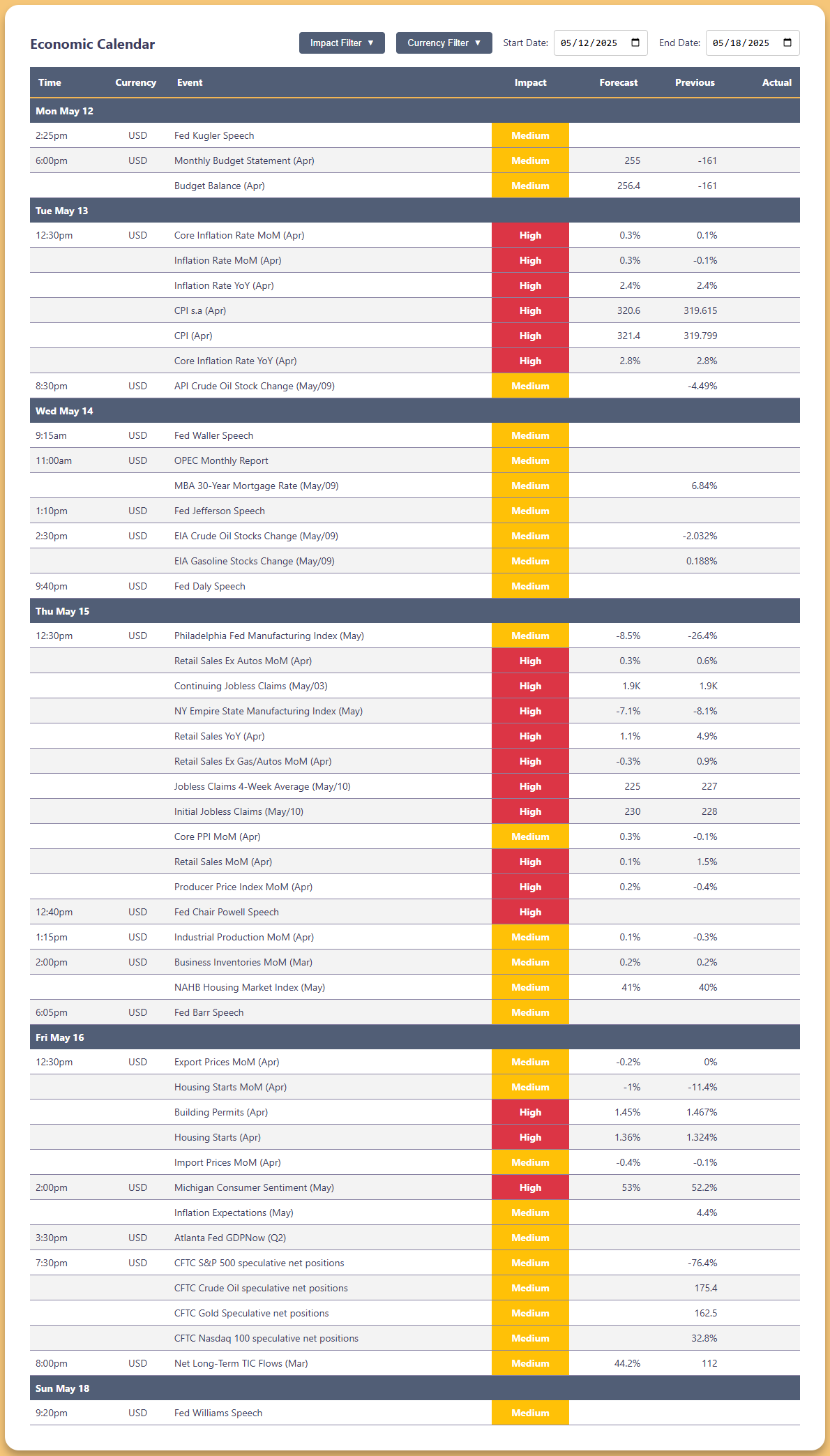

📅Week Calendar May 12-18, 2025

High Impact Events

Tuesday May 13

Core Inflation Rate MoM (Apr): Forecast 0.3%, Prior 0.1%

Inflation Rate MoM (Apr): Forecast 0.3%, Prior -0.1%

Inflation Rate YoY (Apr): Forecast 2.4%, Prior 2.4%

CPI s.a (Apr): Forecast 320.6, Prior 319.615

CPI (Apr): Forecast 321.4, Prior 319.799

Core Inflation Rate YoY (Apr): Forecast 2.8%, Prior 2.8%

Thursday May 15

Retail Sales Ex Autos MoM (Apr): Forecast 0.3%, Prior 0.6%

Continuing Jobless Claims (May/03): Forecast 1.9K, Prior 1.9K

NY Empire State Manufacturing Index (May): Forecast -7.1%, Prior -8.1%

Retail Sales YoY (Apr): Forecast 1.1%, Prior 4.9%

Initial Jobless Claims (May/10): Forecast 230, Prior 228

Fed Chair Powell Speech

Producer Price Index MoM (Apr): Forecast 0.2%, Prior -0.4%

Friday May 16

Building Permits (Apr): Forecast 1.45%, Prior 1.467%

Housing Starts (Apr): Forecast 1.36%, Prior 1.324%

Michigan Consumer Sentiment (May): Forecast 53%, Prior 52.2%

Key Economic Data

Monday May 12

Monthly Budget Statement (Apr): Forecast 255, Prior -161

Budget Balance (Apr): Forecast 256.4, Prior -161

Wednesday May 14

OPEC Monthly Report

MBA 30-Year Mortgage Rate (May/09): Prior 6.84%

EIA Crude Oil Stocks Change (May/09): Prior -2.032%

EIA Gasoline Stocks Change (May/09): Prior 0.188%

Market Positioning (Friday May 16)

CFTC S&P 500 speculative net positions: -76.4%

CFTC Crude Oil speculative net positions: 175.4

CFTC Gold speculative net positions: 162.5

CFTC Nasdaq 100 speculative net positions: 32.8%

Net Long-Term TIC Flows (Mar): Forecast 44.2%, Prior 112

Multiple Fed speakers are scheduled throughout the week, including Fed Kugler, Waller, Jefferson, Powell, and Williams speeches. The week features critical economic indicators including inflation data, retail sales, housing market metrics, and consumer sentiment that could significantly impact market direction.

Last Week Recap:

The stock market had the S&P 500 finishing flat around 5,705 after the early May sell-off when trade tensions escalated.

The Fed Sits Tight While Watching Tariffs

The Fed minutes confirmed they've shifted into a holding pattern with rates at 4.25-4.50%. Consumer prices rose 2.4% year-over-year in April, with energy prices down 3.3% while services inflation remains sticky at 3.8%.

I was talking to fixed income traders on Tuesday - consensus is we won't see rate moves until at least September. The market has priced this in, explaining the muted reaction to the CPI print.

A Game of High-Stakes Poker

US-China trade tensions dominate markets now, with tariffs on Chinese imports hitting 145% in April. The Geneva talks on May 10 went nowhere, with China demanding removal of all unilateral tariffs - a non-starter for Trump.

JPMorgan slashed China's 2025 growth forecast to 4.4% and cut US GDP projections to 1.6%. Companies like Levi Strauss are excluding tariff impacts from guidance because they can't quantify the hit.

Tech's Resiliency and Energy's Decline

Tech stocks continue showing strength, with Nasdaq around 20,300. Nvidia and Microsoft posted gains of 3.2% and 2.1% respectively. The AI sector is delivering massive returns - Upstart Holdings up 180%, SoundHound AI 142%, and Nvidia 64% over the past year.

Meanwhile, energy got hammered with crude down to $82.35 and natural gas sliding 3.4%. Despite geopolitical chaos, supply dynamics are winning as economic slowdown dampens demand forecasts.

Bitcoin Breaks Six Figures

Bitcoin crossed $100,000, currently trading around $102,450. Bitcoin ETFs are driving inflows, with iShares Bitcoin Trust leading at $385 million weekly. The Trump administration's Strategic Bitcoin Reserve executive order has legitimized the asset class in unprecedented ways.

Markets are buzzing about possible Bitcoin bonds - Treasury bonds with 10% Bitcoin exposure, potentially creating a direct link between US debt and cryptocurrency performance.

The International Rotation

International markets are finally challenging US stocks. European stocks gained 1.2% last week and the Nikkei rose 1.3%, both beating the S&P's 0.8% gain. This trend's been developing since February.

The dollar's dropped from 110 to 104 since January, easing pressure on countries with dollar debt. Europe's increased military spending is creating stimulus exactly when the US is pulling back.

After 15 years of US dominance, conditions for a shift are aligning, but I'm not betting everything on it after being burned before.

What's Next?

Next week will be dominated by US-China trade talk developments. With earnings season wrapped up, focus shifts to economic data, especially housing numbers.

Rather than timing market swings, I'm focusing on companies with pricing power and geographic diversification. I've added to non-US positions, picked up discounted tech names, and am looking at businesses benefiting from lower energy costs, while avoiding companies heavily dependent on Chinese manufacturing.

Newest Additions Movements and Shifts

Recent market activity shifts across various sectors:

🔐Premium Member only.🔐

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always do your own research and consider your financial situation before making investment decisions.