Your Portfolio Revamped - Ultimate 10M Strategy for 2025 - Analyst Ratings Premium Members

Investing for Tomorrow: The Ultimate Strategy to Grow

Hi fellow investors, are you ready to revolutionize your portfolio and unlock new opportunities for growth?

Upgrade, Downgrades, Stock Price Targets and Analyst Ratings, yes or no ?

Stock Upgrades, Downgrades, Price Targets and Analyst Ratings will be added soon for Premium Members Only.

The Big Picture: Our 5-Pillar Approach

We approach 2025, the investments continues to evolve at a breakneck pace. With technological advancements, shifting global dynamics, and emerging trends reshaping the financial world, it's crucial for investors to stay ahead of the curve. In this comprehensive guide, we'll explore cutting-edge strategies to optimize your returns and position your portfolio for success in the coming year.

Our strategy for 2025 is built on five robust pillars, each designed to capitalize on key market trends and opportunities:

Core Holdings: Stability meets growth. (40%)

Thematic Investments: Riding the waves of change. (25%)

Disruptive Technologies: Betting on the future. (15%)

Alternative Investments: Diversification is key. (15%)

Cash and Equivalents: Staying liquid. (5%)

Let's dive deep into each pillar and uncover the potential they hold for your portfolio.

1. Core Holdings: Stability Meets Growth

In 2025, the foundation of a strong portfolio will still rely on a mix of blue-chip stocks, index funds, and high-quality bonds. However, the composition of these core holdings may need to evolve:

U.S. Equities (20%): $2,000,000 split between SPY and QQQ

International Equities (10%): $1,000,000 in VXUS

Bond ETFs (10%): $1,000,000 divided between AGG and TIPS

Your core holdings are the foundation of your portfolio. They provide stability and consistent growth over time.

Blue-Chip Stocks: Invest in companies with strong balance sheets, steady earnings, and a history of dividend growth.

Key Metrics:

Return on Equity (ROE) above 15%.

Debt-to-Equity Ratio below 0.5.

Dividend Yield of at least 2%.

Index Funds: Consider low-cost ETFs that track major indices.

Key Metrics:

Expense Ratio below 0.2%.

5-Year Average Annual Return exceeding 10%.

Sharpe Ratio above 1.0.

High-Quality Bonds: Allocate to government and investment-grade corporate bonds.

Key Metrics:

Credit Rating of AA or higher.

Yield to Maturity above 2%.

Duration matching your investment horizon to manage interest rate risk.

Why this mix? As we move into 2025, consider incorporating ESG (Environmental, Social, and Governance) criteria into your core holdings. ESG-focused investments have shown resilience during market downturns and are increasingly aligned with long-term value creation.

2. Thematic Investments: The Waves of Change

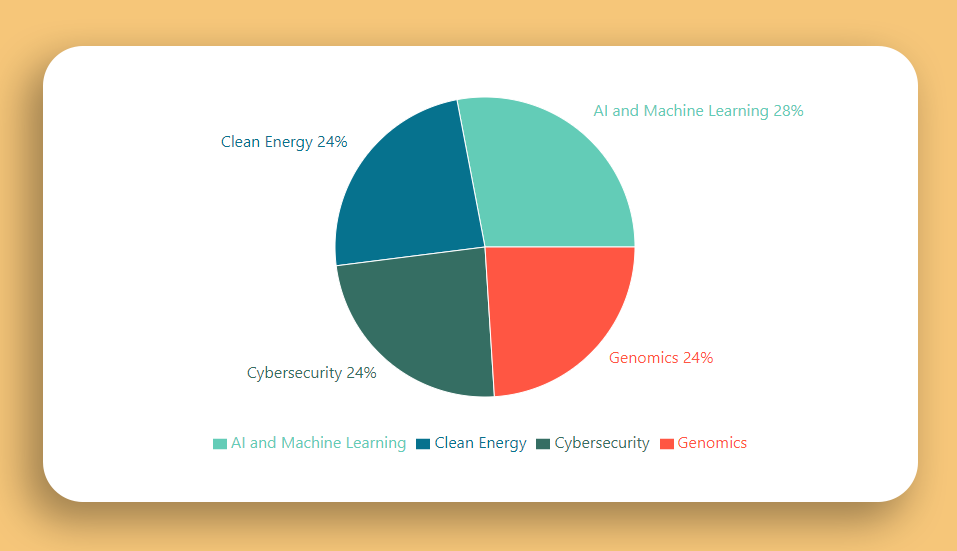

The next 25% of our portfolio is allocated to thematic investments, positioning us to capitalize on major global trends.

AI and Machine Learning (7%): $700,000 in AIAI

Clean Energy (6%): $600,000 in ICLN

Cybersecurity (6%): $600,000 in HACK

Genomics (6%): $600,000 in ARKG

Thematic investments allow you to capitalize on emerging trends reshaping the world.

Clean Energy and Sustainability: With the global push towards renewable energy, companies in this sector are poised for growth.

Key Metrics:

Revenue Growth over 20% in clean energy segments.

Carbon Intensity Reduction year-over-year.

Investment in R&D exceeding 10% of revenue.

Healthcare Innovation: Biotech and healthcare technology are transforming patient care.

Key Metrics:

Companies with at least 3 drugs in Phase III Clinical Trials.

Pipeline Success Rate above 30%.

R&D Expenditure growth over 15% annually.

Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are disrupting various industries.

Key Metrics:

R&D Investment in AI/ML of at least 15% of revenue.

AI Adoption Rate within key business processes.

AI-Driven Revenue Growth over 25%.

Cybersecurity: As cyber threats increase, so does the demand for security solutions.

Key Metrics:

Annual Recurring Revenue (ARR) growth over 25%.

Customer Retention Rate above 90%.

Gross Margin exceeding 70%.

These sectors represent the frontiers of innovation and are ready significant growth in the coming years. The rise of the circular economy is gaining momentum. Companies focused on recycling, upcycling, and sustainable product design are poised for growth as consumers and regulators push for more environmentally friendly practices.

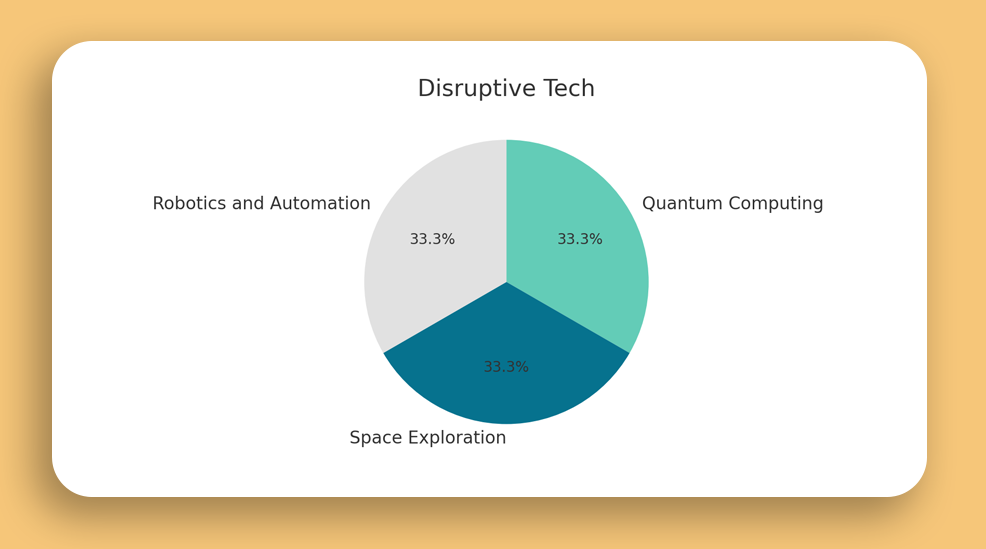

3. Disruptive Technologies: Betting on the Future

We're dedicating 15% of our portfolio to truly disruptive technologies:

Quantum Computing (5%): $500,000

Space Exploration (5%): $500,000 in UFO

Robotics and Automation (5%): $500,000 in BOTZ

Investing in disruptive tech positions you at the forefront of innovation.

5G and Connectivity: The rollout of 5G is expanding connectivity.

Key Metrics:

5G Market Share Growth year-over-year.

Capital Expenditure in 5G Infrastructure.

Patents Filed related to 5G technologies.

Electric Vehicles (EVs): The EV market is accelerating.

Key Metrics:

Year-over-Year Sales Growth exceeding 50%.

Battery Efficiency Improvements (e.g., Miles per kWh).

Global Market Penetration rates.

Blockchain Technology: Beyond cryptocurrencies, blockchain is revolutionizing industries.

Key Metrics:

Cost Savings over 10% due to blockchain adoption.

Number of Active Users on blockchain platforms.

Transaction Volume Growth on blockchain networks.

These investments are higher risk but offer the potential for exponential returns. They represent industries that could fundamentally reshape our world in the coming decades.

The metaverse and Web3 technologies are evolving rapidly. While still speculative, consider allocating a small portion of your portfolio to companies developing infrastructure, content, and services for these emerging digital ecosystems.

4. Alternative Investments: Diversification is Key

To further diversify our portfolio, we're allocating 15% to alternative investments:

Real Estate (5%): $500,000 in VNQ

Private Equity (4%): $400,000 in PSP

Commodities (3%): $300,000 in PDBC

Cryptocurrency ETFs (3%): $300,000

Alternative assets can enhance returns and reduce risk through diversification.

Real Estate Investment Trusts (REITs): Invest in REITs with solid growth potential.

Key Metrics:

Funds From Operations (FFO) Growth Rate above 5%.

Occupancy Rates over 90%.

Debt-to-Equity Ratio below 1.0.

Commodities: Gold and other precious metals can hedge against inflation.

Key Metrics:

5-Year Annualized Return exceeding 8%.

Correlation Coefficient with equities (seek lower correlation for diversification).

Private Equity and Venture Capital: These investments offer high growth potential.

Key Metrics:

Historical Internal Rate of Return (IRR) above 15%.

Investment Multiple (Total Value to Paid-In Capital) greater than 1.5x.

Average Holding Period aligning with your investment horizon.

This mix provides exposure to real assets, private markets, and the burgeoning world of digital currencies, offering additional avenues for growth and hedging against inflation.

The alternative investment landscape is becoming more accessible to retail investors through new platforms and products. Consider exploring fractional ownership in commercial real estate, art, or even collectibles through tokenization and blockchain technology.

5. Cash and Equivalents: Staying Liquid

Finally, we're keeping 5% ($500,000) in cash and cash equivalents. While it's tempting to be fully invested, maintaining a cash cushion is crucial for both peace of mind and taking advantage of opportunities:

High-yield savings (3%): $300,000. Shop around for competitive rates

Money market funds: Look for funds with a focus on government securities for added safety

Short-term bond ETFs: Provide slightly higher yields with minimal interest rate risk

Short-term Treasury bills (2%): $200,000

Maintaining liquidity allows you to seize new opportunities and weather market volatility.

High-Yield Savings Accounts: Keep some funds readily accessible.

Key Metrics:

Annual Percentage Yield (APY) above the national average by at least 0.5%.

FDIC Insurance coverage up to $250,000.

Money Market Funds: These offer stability and slightly higher returns.

Key Metrics:

7-Day Yield above 0.5%.

Net Asset Value (NAV) stability at $1 per share.

Short-Term Treasury Bills: Invest in government securities with maturities less than one year.

Key Metrics:

Yield to Maturity matching or exceeding current inflation rates.

Maturity Dates staggered for laddering strategies.

This allocation ensures we have liquidity to capitalize on unexpected opportunities or navigate any market downturns. As central banks explore digital currencies, keep an eye on developments in this space. Central Bank Digital Currencies (CBDCs) could offer new options for holding cash-like assets with potentially enhanced features and security.

Bringing It All Together: Key Strategy Components

To implement this 10-million strategy effectively:

Regular rebalancing: Aim to review and adjust your portfolio quarterly

Key Metrics:

Asset Allocation Drift: Keep deviations within 5% of target.

Portfolio Beta between 0.8 and 1.2.

Tax-efficient investing: Utilize tax-advantaged accounts and consider tax-loss harvesting strategies

Key Metrics:

Tax Efficiency Ratio over 95%.

Deferred Tax Liabilities management.

Risk management: Implement stop-loss orders and use options for hedging where appropriate

Key Metrics:

Maximum Drawdown limits.

Sharpe Ratio above 1.0 for risk-adjusted returns.

Stay informed: Keep up with global economic trends, policy changes, and technological advancements

Key Actions:

Dedicate 2 hours per week to financial news and analysis.

Follow key economic indicators like GDP Growth, Unemployment Rates, and Consumer Confidence Index.

Seek professional advice: Consider working with a financial advisor to tailor this strategy to your specific goals and risk tolerance

As markets become increasingly complex, consider leveraging AI-powered investment tools and robo-advisors to complement your strategy. These platforms can offer data-driven insights, automated rebalancing, and tax optimization features.

Positioned for The Hedge of Tomorrow

This $10 million investment strategy for 2025 is designed to capitalize on the opportunities of tomorrow while managing the risks of today. By blending stable core holdings with forward-looking thematic investments and cutting-edge technologies, we're positioning ourselves for strong growth potential in an ever-changing financial landscape.

The concept of "impact investing" is gaining significant traction. Consider allocating a portion of your portfolio to investments that not only offer financial returns but also contribute to positive social or environmental outcomes. This approach aligns your investments with your values and can potentially tap into emerging markets and innovative solutions to global challenges.

Remember what goes up must come down (eventually)

Stay safe and invest wisely and this is in no mean financial advice. [Full Disclaimer]Harry