#36 Weekly Report - 10 Gifts - MMT #3 - 43 US Prime Acquisition - Update NVDA/AMD/TSLA/AAPL Incoming

September shakeup Confirmed💥 - 52 prime acquisition 💸 - Deep keeps dipping 📈

Hi fellow investors and welcome back for a data driven analysis for the week ahead.

Updates:

I’ve launched my regularly updated MOAT of Midas Touch Portfolio Index Outperforming S&P500 for more than 10 years.

This Tuesday I will publish full technical analysis of NVDA/AMD/TSLA/AAPL

This Thursday MMT #3 release - A mix of US and International index

I have released a series of in-depth stocks which I will build into made-easy portfolio index.

43 US - 52 prime acquisition targets total

The week ahead

Our automated signal platform is in testing almost ready.

Short Term Update - Newest Additions

Market Movements: Navigating the Shifts

Recent updates show notable changes across various sectors:

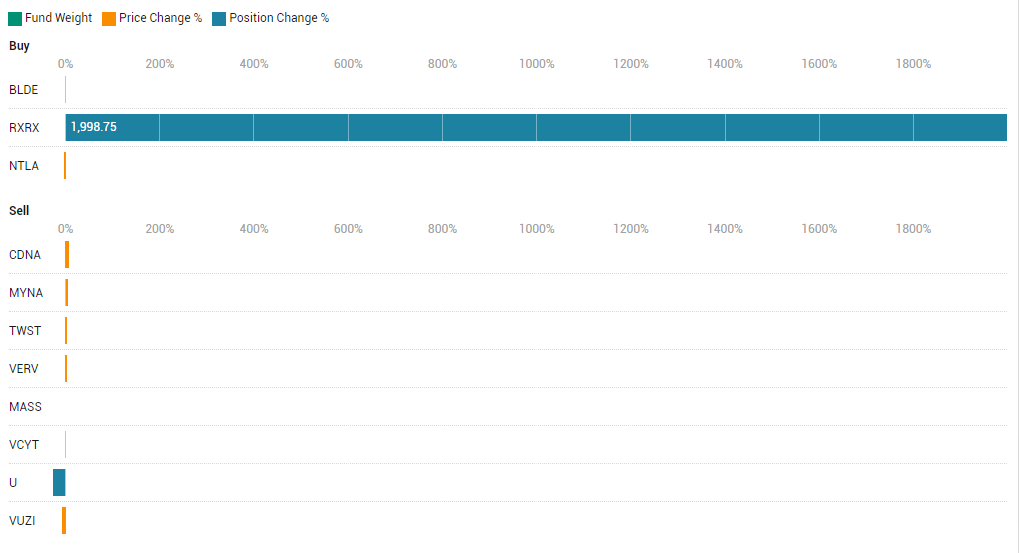

Recursion Pharmaceuticals ( RXRX 0.00%↑ ) has seen a significant increase in activity with a 0.194 fund weight and 726k shares. Despite a -0.99% price change, it has attracted 49 Buys, indicating strong investor confidence.

Intellia Therapeutics ( NTLA 0.00%↑ ) continues to capture attention with a 0.117 fund weight and 186k shares. A -3.49% price change hasn't deterred interest, with 127 Buys suggesting optimism in its prospects.

The Trade Desk ( TTD 0.00%↑ ) is experiencing a 0.136 fund weight with 32k shares. A slight -0.56% price change and 16 Sales may indicate some repositioning by investors.

Early week updates highlight these intriguing movements.

Strategic Shifts in Focus

Mid-week updates reveal ongoing strategic adjustments in key sectors:

Garmin ( GRMN 0.00%↑ )merges with a 0.101 fund weight and 1k shares. A 0.56% price change, coupled with 6 Sales, suggests a cautious approach by investors.

Vuzix ( VUZI 0.00%↑ ) shows a 0.014 fund weight with 137k shares. Despite a -7.53% price change, it has seen 23 Sales, indicating possible profit-taking.

Verve Therapeutics ( VERV 0.00%↑ ) presents a different picture with a 0.000 fund weight and 13 shares. A 2.52% price change and 32 Sales suggest a mixed sentiment.

Mid-week updates highlight these strategic shifts.

If you missed it:

Future Tech Trailblazers: 52 Emerging Startups blessed for outstanding Exits

A select group of startups stands out, promising to reshape industries and secure significant exits. Leveraging Eltoro's comprehensive data analysis, we've identified 52 emerging tech companies that demonstrate exceptional business momentum, visionary founding teams, and substantial exit potential.

Unveiling Tomorrow's Tech Giants

Our rigorous analysis sifted through thousands of startups that have secured funding in the past year, focusing on those most likely to make a substantial impact and achieve remarkable exits. This information is crucial for corporations navigating the rapidly changing tech ecosystem, particularly in areas like generative AI, as it highlights potential competitors, partners, new markets, and acquisition targets.

Data-Driven Selection Process

The selection of these Future Tech Trailblazers was based on Eltoro's proprietary metrics, including:

Exit Probability

Commercial Maturity

Scoring Grading

Headcount Growth

Patent Portfolio

Funding Rounds

These indicators collectively point to startups that will to exert significant influence in the next 5-10 years and secure strong exits.

Let’s look into:

A comprehensive list of the Future Tech Trailblazers

In-depth analysis of key themes and industry trends

Detailed explanation of our selection methodology

For Eltoro members, an exclusive Expert Collection featuring all 52 startups is available for further exploration and analysis.

Key Themes from the Cohort

AI as a Catalyst Across Industries: Nearly half of these emerging startups have AI as a core offering. Some focus on horizontal AI development, while others use AI to enhance value in sectors like cybersecurity and agriculture.

Business-Focused Models: Most startups cater to businesses, highlighting the stability and recurring revenue of the B2B model. Eight startups also target consumers, spanning healthcare, fintech, and video game development.

Strategic Partnerships: Since 2022, these startups have formed nearly 100 business relationships. Although many are still maturing commercially, they are accelerating growth through partnerships and integrations. Notably, Vectara, a leader in LLMOps, has established over a dozen partnerships with companies like LangChain and Airbyte.

Global Representation: The Future Tech Hotshots hail from eight countries, including the US, India, Canada, Germany, Singapore, Kenya, Sweden, and the UK. Some non-US startups, like Montreal-based Deep Sky, benefit from local advantages such as Quebec’s renewable energy resources to expand their carbon removal systems.