Rollins' 42% Dividend Surge: Unleashing Pest Control's Hidden Profit Potential

Rollins' ability to generate substantial profits in an industry often overlooked

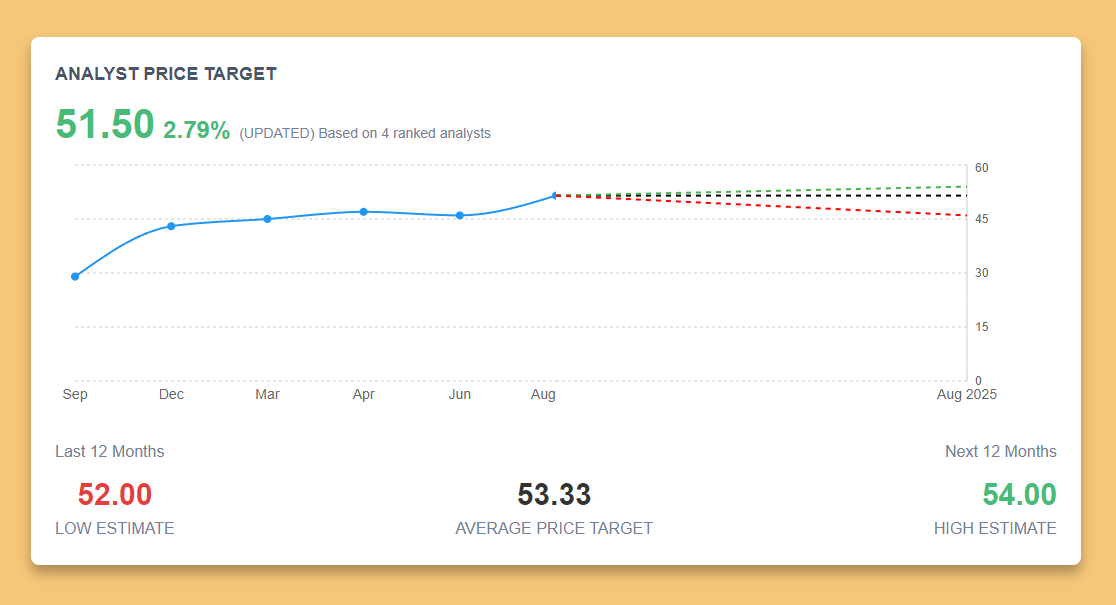

Rollins Inc. (NYSE: ROL) has experienced a positive movement

In the realm of consumer services, one company has been quietly exterminating not just pests, but also market expectations. Rollins, Inc. (NYSE: ROL 0.00%↑ ), the pest control titan, has seen its stock climb to new heights, leaving investors buzzing with excitement. But is this surge sustainable, or are we witnessing a bubble ready to burst? Let's dissect Rollins' financial health and market position to uncover the truth behind its impressive performance.

Financial Overview: A Fortress Built on Pest Control

Rollins stands tall with a market capitalization of $24.38 billion, its stock trading at $50.29. This valuation places Rollins at the forefront of the pest control industry, a sector that remains resilient even in economic downturns. With a price-to-earnings (P/E) ratio of 53.06, the market clearly anticipates significant growth ahead.

Founded in 1948, Rollins has grown from a small family business into a global powerhouse, employing over 19,000 people worldwide. Its services span residential and commercial pest control, showcasing the company's ability to adapt and thrive across various market segments.

In 2023, Rollins reported robust financial results:

Revenue: $3.20 billion

Net Income: Approximately $368.6 million (based on an 11.5% net margin)

Diluted EPS: $0.95 (trailing twelve months)

These figures underscore Rollins' ability to generate substantial profits in an industry often overlooked by investors seeking glamorous tech stocks or cutting-edge innovations.

Profitability and Debt Analysis: Margins That Bite

Rollins' financial ratios paint a picture of a company operating at peak efficiency:

Price-to-Sales (P/S): 7.53

Net Margin: 11.5% (estimated)

The elevated P/S ratio suggests investors are willing to pay a premium for Rollins' revenue, confident in the company's ability to convert sales into profits. This confidence is not misplaced, as evidenced by the impressive net margin of 11.5%, a figure that outpaces many in the broader services sector.

While specific debt figures were not provided, Rollins' consistent dividend growth and strong cash flow generation indicate a healthy balance sheet. The company's ability to fund operations, expansions, and shareholder returns without excessive leverage speaks volumes about its financial management.