#37 Weekly Report - 10 Game-Changing Portfolios - 7 Low Cap Stocks & Key Stocks to Monitor - Portfolio Update Incoming

The Unstoppable Fiscal Train downcycle 💥 - Market Movements 💸 - Insider Intel: Following the Smart-Money 📈

Hi fellow investors and welcome back for a data driven analysis for the week ahead.

Updates:

Revealed our MOAT of Midas Touch #3 Portfolio Index

This Wednesday in-depth analysis portfolio update

Friday I will be adding in the in-depth stocks which I will build into made-easy portfolio index. So stay tune.

The Unstoppable Fiscal Train: Why U.S. Deficits Are Here to Stay (members)

7 Low Cap Stocks Not to miss (members)

The Week ahead (members)

The Future of ETF Only Investing

🚀 10 Game-Changing Portfolios

Over the next quarter, I'll be pulling back the curtain on 10 innovative portfolios that could revolutionize your investment strategy. Trust me, some of these will make you rethink everything you thought you knew about Indexes and ETFs.

💼 Insider Intel: Following the Smart Money

Get exclusive insights to our AI data and insider trading insights. I'll break down significant entry and exit from industry insiders, complete with my expert interpretation of what these moves might mean for you.

🔮 Recap & Next Week's Forecast

Dive deep into our comprehensive analysis. But that's not all – data-driven predictions for the coming week, including events that could shake things up.

🌟 Leveling Up the Plain Field

Exciting news! I've taken a massive leap forward by assembling our financial experts. We're now fully dedicated to bringing you the best ACTIONABLE market analysis and insights on Eltoro. But wait, there's more...

🔧 New Tool Alert to Supercharge Your Investment Strategy

We're close to finish a game-changing addition to our toolkit. This powerful new feature is designed to streamline your investment process and give you a competitive edge in the market. Stay tuned for more details on how to leverage this tool for maximum impact.

Let's dive in and make some smart moves! 💰🚀

Short Term Update - Newest Additions

Market Movements: Navigating the Shifts

Recent updates reveal notable changes across various sectors:

Amazon ( AMZN 0.00%↑ ) has seen a significant increase in activity with a 0.507 fund weight and 20k shares. Despite a -2.32% price change, it has attracted 6 Buys, indicating strong investor confidence.

Iridium Communications ( IRDM 0.00%↑ ) continues to capture attention with a 0.504 fund weight and 40k shares. A -0.67% price change hasn't deterred interest, with 34 Buys suggesting optimism in its prospects.

Coinbase ( COIN 0.00%↑ ) is experiencing a 0.330 fund weight with 53k shares. A -0.79% price change and 50 Buys may indicate strategic positioning by investors.

Early week updates highlight these intriguing movements.

Strategic Shifts in Focus

Mid-week updates reveal ongoing strategic adjustments in key sectors:

Palantir Technologies ( PLTR 0.00%↑ ) emerges with a 0.118 fund weight and 184k shares. A 0.44% price change, coupled with 9 Sales, suggests a cautious approach by investors.

Intuitive Surgical ( ISRG 0.00%↑ ) shows a 0.305 fund weight with 4k shares. Despite a -0.06% price change, it has seen 15 Sales, indicating possible profit-taking.

Butterfly Network ( BFLY 0.00%↑ ) presents a different picture with a 0.017 fund weight and 109k shares. A -3.33% price change and 10+ Sales suggest a mixed sentiment.

Mid-week updates highlight these strategic shifts.

The latest data shows a dynamic with notable shifts in biotech and technology sectors. Biotech advancements in gene therapy and personalized medicine are driving interest but also raising regulatory concerns. Technology innovations in AI and cloud computing generate both excitement and caution.

Stock patterns reveal high volatility in some, while others remain stable due to strong fundamentals. This underscores the need for thorough analysis beyond surface metrics. Diversification and risk management are crucial as sectors respond differently to market forces.

If you missed it:

Last week Report:

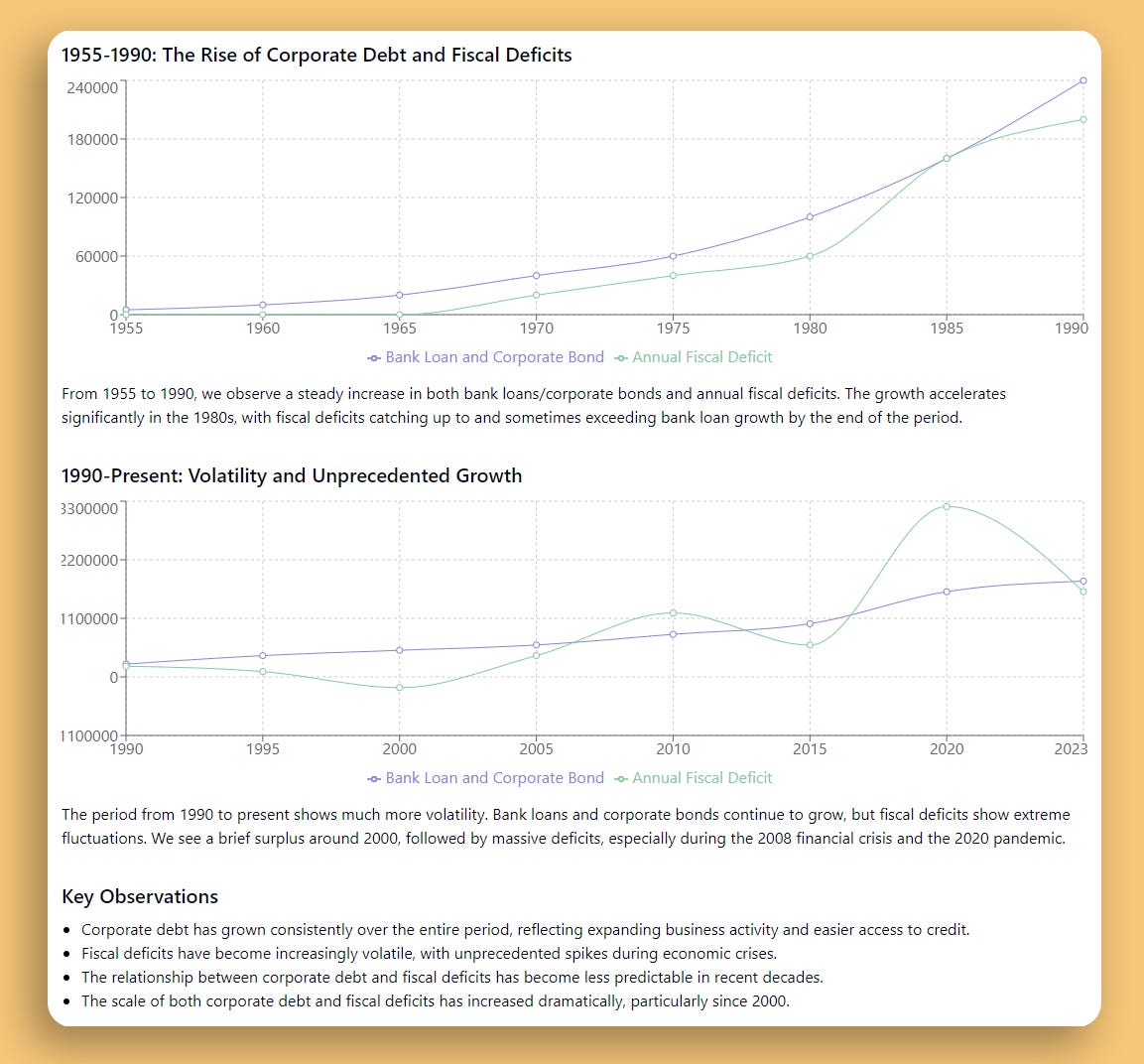

The Unstoppable Fiscal Train: Why U.S. Deficits Are Here to Stay

This analysis examines the structural causes of high fiscal deficits in the U.S. economy, explores why meaningful reduction is unlikely in the near future, and considers the potential investment implications.

The Congressional Budget Office projects persistently high deficits for the foreseeable future, barring significant policy changes. Their conservative baseline estimates over $20 trillion in new public debt over the next decade, even assuming no recessions occur. This projection underscores the severity of the fiscal challenges facing the United States.

Background: The Rise of Fiscal Dominance

Why Deficits Are So Persistent

The fiscal deficits are more challenging to address than many realize. Several factors contribute to this situation:

Unbalanced Social Security: The system's math breaks down as population growth slows, leading to fewer workers supporting each retiree. The social security fund is expected to be depleted by 2035, potentially leading to an inability to make full payouts if left unfixed.

Inefficient Healthcare Spending: The U.S. spends more on healthcare than other countries, despite poorer outcomes for the average citizen. Key statistics include:

The U.S. has the highest infant mortality rate among developed countries at 5.4 deaths per 1000 live births.

U.S. maternal mortality in 2020 was over 3 times the rate of most other high-income countries, with 23.8 maternal deaths per 100,000 live births.

The U.S. has the highest rate of people with multiple chronic conditions and an obesity rate nearly twice the OECD average.

Americans see physicians less often and have among the lowest rates of practicing physicians and hospital beds per 1,000 population.

Foreign Military Engagements: The post-9/11 War on Terror is estimated to have cost around $8 trillion. Ongoing baseline military spending exceeds $800 billion per year, with additional contingency spending.

Accumulated Debt Interest: For decades, the U.S. had a rising debt/GDP ratio offset by falling interest rates. Now, with interest rates no longer declining, the rising debt/GDP ratio poses a significant challenge.

Political Polarization: Despite their differences, both major parties now agree on maintaining major spending areas. The Republican party, which once advocated for cuts to Social Security, has incorporated protecting entitlements into their 2024 platform. The Democratic party is less inclined to cut military spending than in the past.

Financialization of Tax Receipts: U.S. tax revenues are highly correlated with asset prices, making deficit reduction more challenging. The stock market's performance has a significant lagged effect on tax receipts, independent of unemployment rates.