Rocket Lab USA the Space Stock Set to Skyrocket? +95% MOAT of Midas Touch #4 Outdoing SPX

🚀🚀 - Rocket Lab to fly or not to fly? - 💥💥

Ever heard about Rocket Lab USA (NASDAQ: RKLB 0.00%↑ )? If you're curious about investing in the burgeoning space industry, Rocket Lab might already be on your radar. Let's explore what analysts are saying about its stock forecast for 2024 and whether it could be a smart addition to your portfolio.

Shield MMT #4 released:

Shield MOAT of Midas Touch #4 - Outdoing SPX by +95% - 36 Disruptive Tech.

MOAT of Midas Touch #4! Technology is evolving at breakneck speed, reshaping industries and redefining the way we live and work. Amidst this rapid change, investors are seeking opportunities that not only promise growth but also surf the waves of these transformative trends.

A Quick Recap: Who Is Rocket Lab?

Founded in 2006, Rocket Lab USA is a space company based in Long Beach, California. They specialize in:

Launch Services: Utilizing their Electron rocket to deploy small satellites into orbit.

Space Systems: Designing and manufacturing spacecraft components.

Future Projects: Developing the Neutron, an 8-ton payload class launch vehicle.

Their innovative approach to space technology has positioned them as a key player in the small to medium satellite launch sector.

Current Stock Snapshot

As of September 26, 2024, here's how RKLB 0.00%↑ is performing:

Current Price: $8.69

52-Week Range: $3.47 - $8.98

Market Cap: $4.32 billion

Analyst Rating: Moderate Buy

Average Price Target: $6.86

Potential Downside: -21.05%

The stock has experienced notable growth, nearing its 52-week high. However, the average analyst price target suggests a potential downside of approximately 21%.

What Are Analysts Saying?

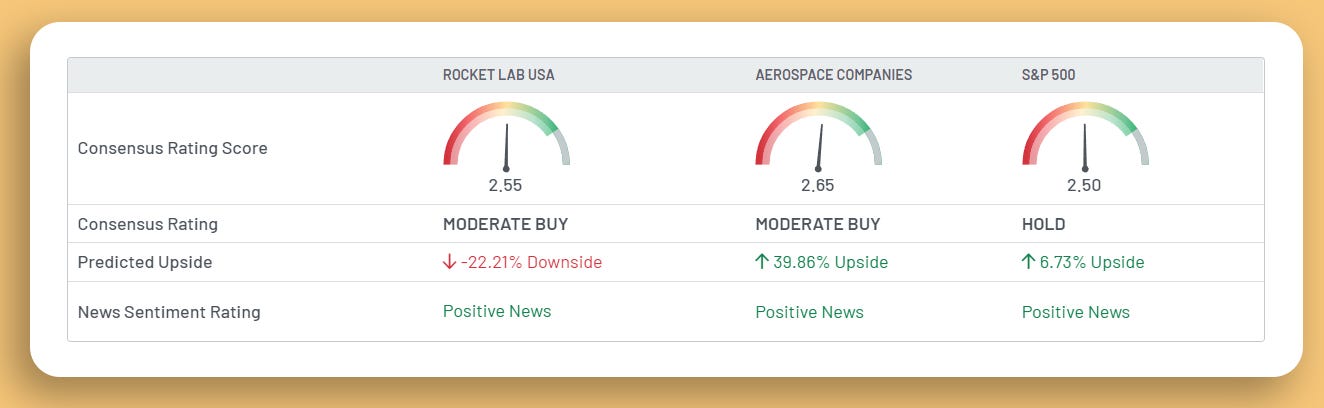

Consensus Rating: Moderate Buy

Out of 11 Wall Street analysts:

Buy Ratings: 6 analysts

Hold Ratings: 5 analysts

Sell Ratings: 0 analysts

The consensus leans towards a Moderate Buy, indicating cautious optimism about RKLB's future performance.

Price Targets

High Estimate: $10.00

Average Estimate: $6.86

Low Estimate: $4.25

Despite the current trading price of $8.69, the average price target is $6.86, suggesting analysts anticipate a price correction.

Recent Analyst Forecasts

Here's a summary of the most recent analyst actions:

Factors Influencing the Forecast

Positive Indicators

Industry Growth: The space industry is expanding, with increasing demand for satellite launches.

Technological Advancements: Rocket Lab's development of the Neutron rocket could open new market opportunities.

Concerns

Profitability: The company is not yet profitable, with a net loss of $182.57 million.

Valuation: High Price-to-Sales ratio of 17.77 may indicate the stock is overvalued relative to sales.

Analyst Price Targets: Average targets are below the current trading price, suggesting potential overvaluation.

So, should you consider adding RKLB to your investment portfolio, or is it wise to wait?

The Road Ahead: What Investors Should Watch

Financial Performance

Keep an eye on Rocket Lab's quarterly earnings reports. Improvement towards profitability could positively impact stock performance.

Technological Milestones

Successful development and deployment of the Neutron rocket may significantly boost investor confidence and open new revenue streams.

Market Competition

Understanding how Rocket Lab positions itself against competitors is crucial. Innovations and partnerships can give them an edge in the market.

Final Thoughts

Investing in Rocket Lab USA offers exposure to the exciting and potentially lucrative space industry. However, it's essential to balance the optimism with cautious analysis of financial indicators and market sentiment. As always, consider your investment horizon and risk tolerance before making decisions.

Remember what goes up must come down (eventually)

Stay safe and invest wisely and this is in no mean financial advice. [Full Disclaimer]Harry