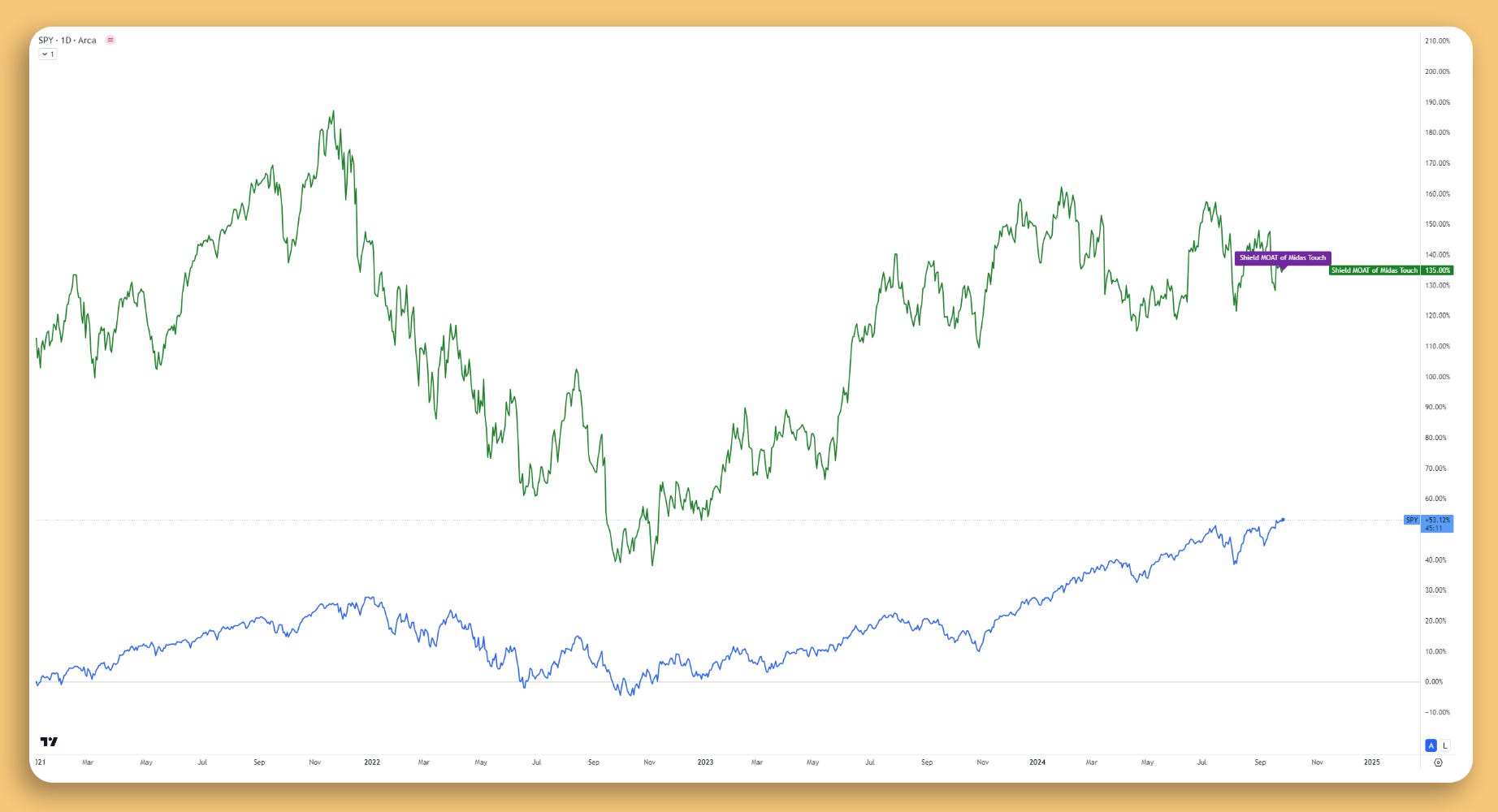

Shield MOAT of Midas Touch #4 - Outdoing SPX by +95% - 36 Disruptive Tech.

⭐⭐⭐⭐⭐ - Shield MMT#4: Shield of 36 Strong - ☢️☢️☢️⚪⚪

MOAT of Midas Touch #4! Technology is evolving at breakneck speed, reshaping industries and redefining the way we live and work. Amidst this rapid change, investors are seeking opportunities that not only promise growth but also surf the waves of these transformative trends. Wield the Disruptive Shield MMT Portfolio — a curated collection of the top 36 technology stocks from megatrend sectors like internet evolution, digitalization, e-commerce, cloud technology, artificial intelligence (AI), and fintech.

A Snapshot of Stellar Performance @ 84.8% Win-Rate:

Before we dive deeper, let's take a quick look at how the Shield MMT Portfolio has performed:

August Return: +2.82%

Year-to-Date Return: +14.72%

1-Year Return: +29.88%

5-Year Return: +99.68%

Annualized Return Over 5 Years: +14.83%

With a track record spanning five years, this portfolio has nearly doubled in value, a testament to its robust selection of disruptive stocks.

Who's Behind Shield MMT Portfolio

Investment Intelligence is the brain behind the Shield MMT #4 Portfolio. Founded by experts with decades of experience in asset management and market analysis, their mission is clear: to add value for investors through insightful analysis, advanced tools, and well-curated portfolios. Our approach is independent and investor-focused, ensuring that the strategies align with long-term growth objectives.

Understanding the Portfolio's Composition

The Shield MOAT Portfolio isn't just a random assortment of tech stocks. It's a thoughtfully assembled collection, focusing on sectors poised for explosive growth.