MicroStrategy (MSTR) Set for the Moon? +550% Blasting Competition Into Dust

🚀 - Financial and Technical Analysis - 📈

Hi fellow investors and welcome back for a Quant data driven analysis.

Into the fourth quarter of 2024, MicroStrategy Incorporated (NASDAQ: MSTR 0.00%↑) continues to stand out in the tech sector. The company uniquely blends its business intelligence software offerings with a significant Bitcoin investment strategy. This analysis covers MicroStrategy's current financial position, recent performance, and technical outlook as of October 14, 2024.

ICYMI:

Financial Overview

Navigating Market Complexities

(ad) In the ever-evolving stock market, access to reliable and timely market intelligence is crucial. Without The Empirical Collective, you might miss important market insights that could enhance your trading. While others use unique data to make informed decisions, you could be navigating trades without essential information.

Don't let outdated methods or guesswork impact your financial goals. Our service offers a high success rate and exclusive tools that provide genuine value.

Imagine not having access to resources that reveal where major institutional money is flowing or highlight the latest market trends. While you might be uncertain, savvy traders using The Empirical Collective gain these insights every day.

Why leave your trades to chance when you could have expert guidance and advanced technology supporting each decision?

Check Out How The Empirical Collective can make a difference in your trading journey.

Recent Performance

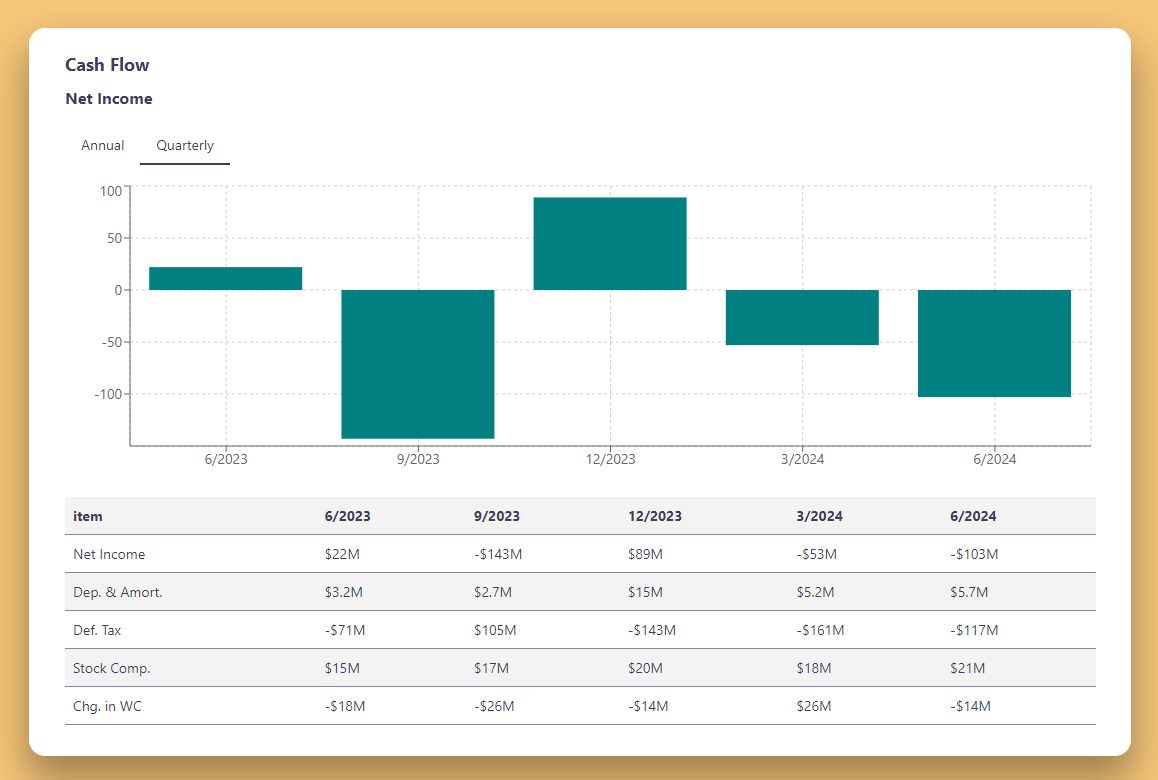

While Q3 2024 results are pending, we can examine the most recent quarterly report available. In Q2 2024, MicroStrategy reported:

Total revenues: $111.4 million (a 7.4% decrease year-over-year)

Subscription services revenues: $24.1 million (a 21.1% increase year-over-year)

Gross profit: $80.5 million (a 72.2% gross margin)

Net loss: $102.6 million ($5.74 per share on a diluted basis)

The revenue decline was primarily due to the ongoing shift from traditional on-premise offerings to cloud services. However, the strong growth in subscription services revenue is a positive sign for the company's future [6].

Bitcoin Holdings

As of July 31, 2024, MicroStrategy held 226,500 Bitcoins, acquired at a total cost of $8.3 billion, or an average price of $36,821 per Bitcoin [6]. With the current Bitcoin price at $63,126.50 (as of October 14, 2024), the market value of MicroStrategy's holdings is approximately $14.3 billion, representing an unrealized gain of $6 billion.

Key Financial Metrics

Cash and cash equivalents: $66.9 million (as of June 30, 2024)

Total assets: $15.23 billion (primarily driven by Bitcoin holdings)

Total liabilities: $3.12 billion

Stockholders' equity: $12.11 billion

Revenue Projections

Analysts project MicroStrategy's software revenue to grow at a compound annual growth rate (CAGR) of 4.2% over the next three years, reaching approximately $500 million by 2027. This growth rate is lower than the software technology sector's projected CAGR of 12% in the United States [8].

Technical Analysis

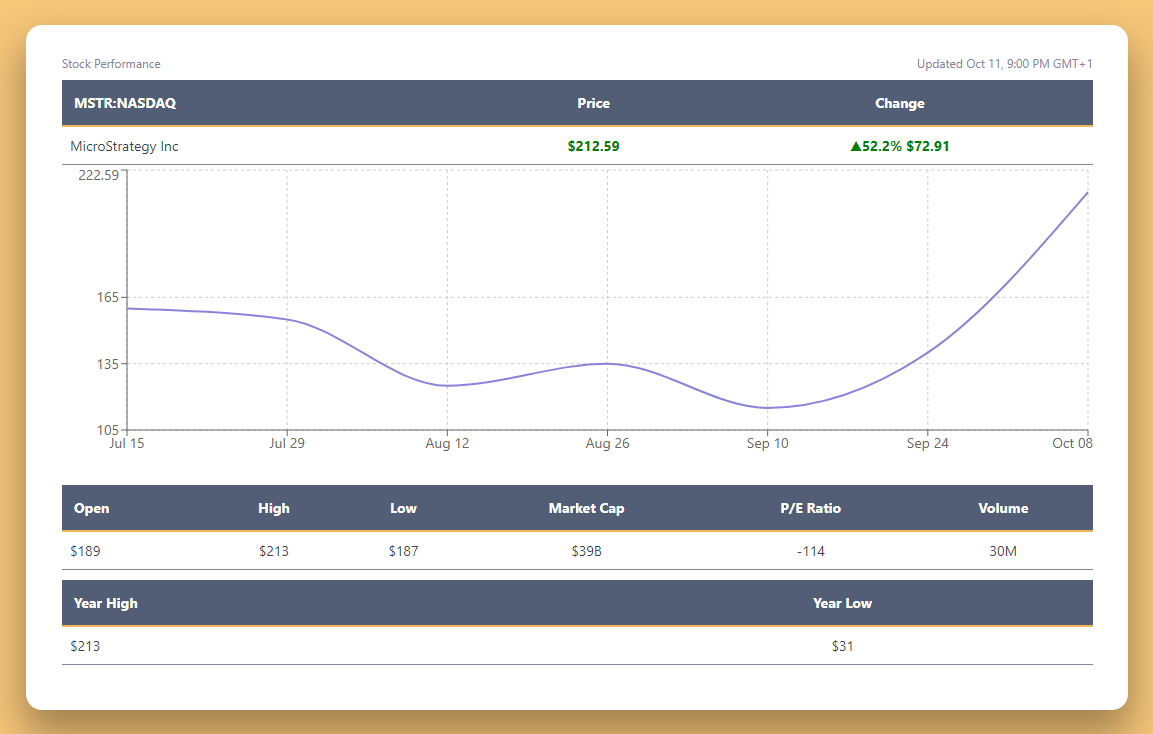

Current Stock Price and Performance

As of October 14, 2024, MSTR's stock price stands at $201, representing a significant increase from its price at the beginning of the year. The stock has exhibited high volatility throughout 2024, closely correlated with Bitcoin price movements.

Key Technical Indicators

Relative Strength Index (RSI):

Current RSI (14): 70.27

This suggests the stock is approaching overbought territory.

Moving Average Convergence Divergence (MACD):

Current MACD: 10.57

The positive MACD indicates bullish momentum.

Moving Averages:

50-day Simple Moving Average (SMA): $142.71

200-day SMA: $125.39

The stock is trading well above both its 50-day and 200-day SMAs, indicating a strong uptrend.

Bollinger Bands:

The stock is trading near the upper Bollinger Band, suggesting strong upward momentum but also the possibility of a short-term pullback [3].

Support and Resistance Levels:

Key support levels: $120, $150

Key resistance levels: $300, $325

Technical Outlook

The technical indicators suggest a bullish trend for MSTR, with the stock trading above its major moving averages. However, the high RSI indicates that the stock may be overbought in the short term, which could lead to a potential pullback.

Market Position and Industry Comparison

Software Industry Metrics

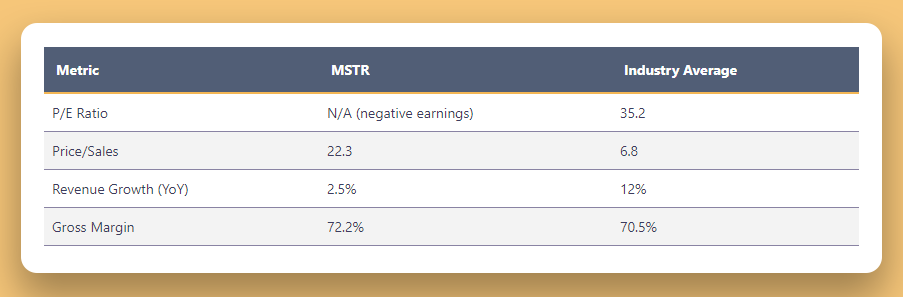

Comparing MicroStrategy to its peers in the software industry:

MicroStrategy's valuation metrics are significantly higher than industry averages, primarily due to its Bitcoin holdings [2].

Bitcoin Holdings Comparison

Among publicly traded companies holding Bitcoin:

MicroStrategy: 226,500 BTC

Tesla: 9,720 BTC (as of last reported holdings)

Marathon Digital Holdings: 13,380 BTC (as of last reported holdings)

MicroStrategy remains the largest corporate holder of Bitcoin by a significant margin [2].

SWOT Analysis

Strengths

Largest corporate Bitcoin holder

Strong brand in business intelligence software

High gross margins in software business (72.2%)

Growing subscription services revenue (21.1% YoY growth)

Weaknesses

Volatile earnings due to Bitcoin impairments

Declining revenue in traditional software segments

High debt levels

Lower revenue growth compared to industry average

Opportunities

Potential gains if Bitcoin price appreciates

Growing market for cloud-based BI and AI solutions

Synergies between Bitcoin strategy and software business

Threats

Regulatory risks in cryptocurrency markets

Intense competition in the BI software space

Potential losses if Bitcoin price declines sharply

Future Outlook and Projections

Software Business

MicroStrategy's software business is expected to continue its transition to cloud-based services. The company's focus areas include:

Expanding cloud-based subscription services

Integrating AI capabilities into BI offerings

Potential new product launches in the data analytics space

Bitcoin Strategy

MicroStrategy has stated its intention to continue acquiring Bitcoin. The success of this strategy will depend on:

Bitcoin price movements

Ability to raise capital on favorable terms

Regulatory environment for cryptocurrencies

Financial Projections

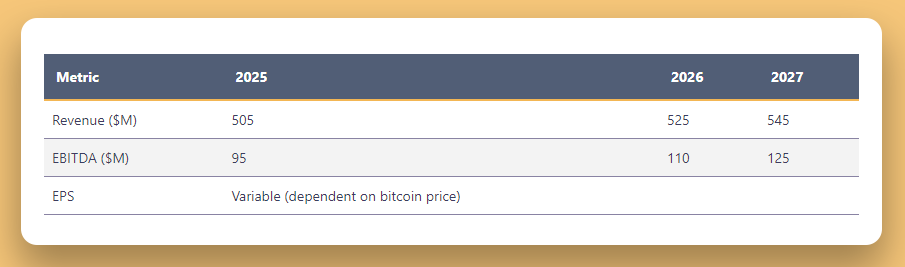

Based on current trends and analyst estimates:

Note: These projections do not account for potential Bitcoin price fluctuations, which could significantly impact earnings.

Risks and Challenges

Bitcoin Price Volatility: The company's financial performance is heavily tied to Bitcoin's price movements, introducing significant earnings volatility.

Regulatory Uncertainty: Potential changes in cryptocurrency regulations could impact MicroStrategy's Bitcoin strategy.

Debt Obligations: High debt levels could become problematic if interest rates rise or if Bitcoin prices decline significantly.

Software Market Competition: Intense competition in the BI software market could pressure MicroStrategy's traditional business segments.

Technological Disruption: Rapid advancements in AI and data analytics could potentially render some of MicroStrategy's current offerings obsolete.

As of October 14, 2024, MicroStrategy presents a unique investment proposition, blending a traditional software business with a significant Bitcoin investment strategy. The company's financial performance shows a mixed picture, with declining overall revenues but strong growth in subscription services. The substantial Bitcoin holdings continue to be the primary driver of the company's valuation and stock performance.

Technically, MSTR's stock shows strong momentum, trading well above its major moving averages. However, the high RSI suggests that the stock may be approaching overbought territory in the short term.

Investors considering MSTR should be aware of the high risk-reward profile associated with the stock. While there is potential for significant gains if Bitcoin prices appreciate, the company also faces substantial downside risk in the event of a cryptocurrency market downturn.

Looking ahead, MicroStrategy's success will depend on its ability to balance growth in its software business with the management of its Bitcoin holdings. The company's aggressive Bitcoin acquisition strategy sets it apart from traditional software firms, making it a unique and potentially volatile investment option in the tech sector.

References:

[2] Investing.com: Earnings Call - MicroStrategy Q1 2024 Results and Bitcoin Focus

[6] MicroStrategy Announces Second Quarter 2024 Financial Results

[8] Seeking Alpha: MicroStrategy Major Breakout Ahead, Rating Upgrade

Disclaimer: This article is for informational purposes only and does not constitute financial investment advice. Always do your own research and consider your financial situation before making investment decisions.

Remember what goes up must come down (eventually)

Stay safe and invest wisely and this is in no mean financial advice. [Full Disclaimer]Thank you for supporting this newsletter. It will keep improving.

Harry