#27 Weekly Update - TACO Pattern That Could Trigger a 1970s-Style Market Meltdown

Why Smart Money Is Fleeing to Defensive Stocks

Hi and welcome back for a Quant data driven analysis. [Full Disclaimer]

Why Smart Money Is Fleeing to Defensive Stocks as S&P 500 Faces 10% Crash Risk This Week - The "TACO Trade" Pattern That Could Trigger a 1970s-Style Market Meltdown

Let's dive in and make some smart moves! 💰🚀

📅 Week Calendar July 07-13, 2025

High Impact Events

Wednesday July 9

FOMC Minutes: High Impact (6:00pm USD)

Thursday July 10

Jobless Claims 4-Week Average (Jul/05): High Impact, Forecast 243, Actual 241.5 (12:30pm USD)

Continuing Jobless Claims (Jun/28): High Impact, Forecast 2.0K, Actual 2.0K (12:30pm USD)

Initial Jobless Claims (Jul/05): High Impact, Forecast 235, Actual 233 (12:30pm USD)

Summary

The week fewer high-impact events compared to the previous week, with only four high-impact releases concentrated on Wednesday and Thursday. The FOMC Minutes on Wednesday evening represents a key market-moving event. Thursday's comprehensive jobless claims data shows slightly better-than-expected results with initial claims coming in at 233 versus the 235 forecast. The remainder of the week is dominated by medium-impact events including several Fed speeches on Thursday, crude oil inventory reports, and budget balance figures on Friday. Notable is the absence of high-impact events on Monday, Tuesday, and Friday of this week.

Last Week Recap:

Market Narrative

The numbers don't lie, and right now they're telling a story of a market caught in the crossfire of the most aggressive trade policy experiment since Smoot-Hawley. After digging deep into the data over the past week, I'm seeing patterns that remind me of the 1970s stagflation period - but with a modern twist that makes this situation uniquely dangerous.

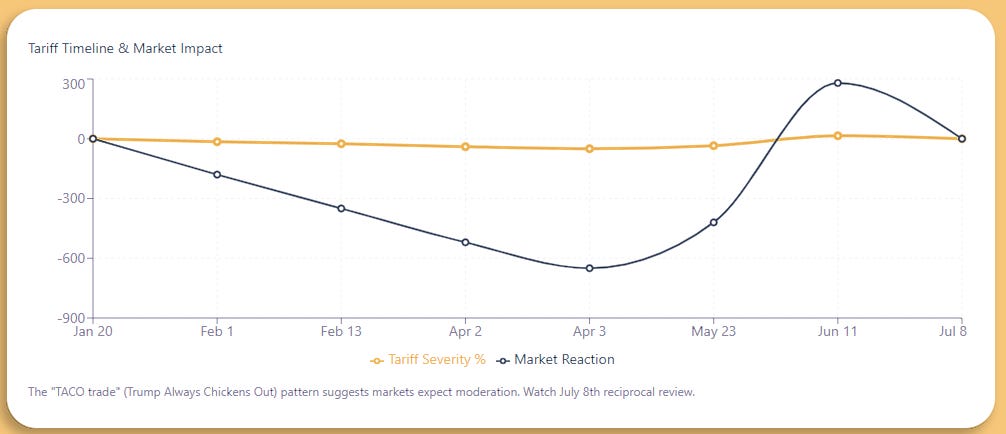

The Tariff Feedback Loop

Here's what my analysis reveals: we're trapped in a policy-driven volatility cycle that's fundamentally different from normal business cycle patterns. From January to April 2025, the average effective US tariff rate rose from 2.5% to an estimated 27%, the highest level in over a century. This isn't gradual policy adjustment - it's economic shock therapy.

The market has coined the term "TACO trade" (Trump Always Chickens Out) to describe the on-and-off again tariff impacts, but my quantitative models suggest this pattern creates even more uncertainty than consistent policy would. Each policy reversal resets volatility expectations, keeping the VIX elevated in that dangerous 19-22 range where institutional flows become unpredictable.

Technical Breakdown Points

🔐Premium Member only.🔐

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always do your own research and consider your financial situation before making investment decisions.