#21 Weekly Update - More Tariff On EU - Support/Resistance - What's Next?

Tariff Maze: A Data-Driven Look at the Week Ahead

Hi and welcome back for a Quant data driven analysis. [Full Disclaimer]

Let's dive in and make some smart moves! 💰🚀

📅Week Calendar May 26-31, 2025

High Impact Events

Tuesday May 27

Durable Goods Orders Ex Transp MoM (Apr): Forecast -0.2%, Actual -0.4%

Durable Goods Orders MoM (Apr): Forecast -8%, Actual 7.5%

Durable Goods Orders ex Defense MoM (Apr): Forecast -8.1%, Actual 8.9%

Wednesday May 28

FOMC Minutes (High Impact)

Thursday May 29

GDP Growth Rate QoQ (Q1): Forecast -0.3%, Previous 2.4%

Gross Domestic Product QoQ (Q1): Forecast -0.3%, Previous -0.3%

Friday May 30

Personal Income MoM (Apr): Forecast 0.3%, Previous 0.5%

Personal Spending MoM (Apr): Forecast 0.2%, Previous 0.7%

Core PCE Price Index MoM (Apr): Forecast 0.1%, Previous 0%

Goods Trade Balance (Apr): Forecast -141.8B, Previous -161.99B

Core PCE Price Index YoY (Apr): Forecast 2.6%, Previous 2.6%

Michigan Consumer Sentiment (May): Forecast 50.8%, Previous 52.2%

Key Market Positioning (Latest Available)

CFTC S&P 500 speculative positions: -96.6%

CFTC Nasdaq 100 speculative positions: 14.5%

CFTC Crude Oil speculative positions: 186.4

CFTC Gold Speculative positions: 164

Notable Fed Speakers throughout the week include Kashkari, Williams, Waller, Barkin, Goolsbee, Kugler, Logan, and Bostic, with multiple speeches scheduled. The week features significant economic data releases including GDP figures, PCE price index, and consumer sentiment readings.

Last Week Recap:

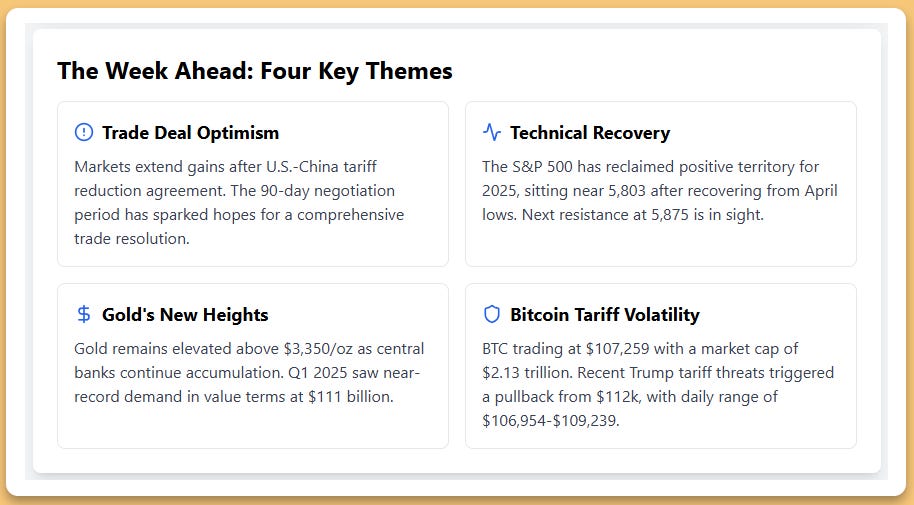

I've been drinking from the firehose of market data this week, and the picture that emerges is one of cautious consolidation mixed with some surprisingly clear technical setups. This week's 2.9% pullback in the SPX has brought the index right back to its 200-day Simple Moving Average, where the index is testing this long-term moving average as potential support, and we're heading into what could be another pivotal week.

Market Performance Snapshot

The Tariff Overhang

Trump also said that Apple iPhones will be subject to a 25% tariff if they are not made in the U.S. The administration continues to use tariffs as a negotiating tool, and markets are growing weary of the uncertainty. Updated: 2025/05/25. S&P 500 index closed at 5803 the previous day, putting us squarely in a consolidation pattern.

our economists' expectation of a steady and above-trend pace of US growth in 2025 favors the performance of the S&P 493, which is more sensitive to changes in growth compared with the Magnificent 7. This rotation thesis is playing out in real-time as tech giants struggle while broader market indices show relative strength.

What strikes me is how the market continues to digest each tariff announcement with less volatility than before. Declining issues outnumbered advancers by a 1.97-to-1 ratio on the NYSE where there were 132 new highs and 68 new lows during the most recent session. The internals aren't great, but they're not signaling panic either.

Technical Crossroads

Looking at the S&P 500, we're at 5,803 - sitting right at a critical juncture. In technical terms, this type of a re-test of previously cleared resistance (meaning the 200-day SMA in this case) is called a "throwback".

The key level everyone's watching: 5,445. That's where Maximum value 6167, minimum value 5251 for the month intersect with major technical support. Break that, and we're likely headed to test 5,260, where the 50-day moving average converges with the March peak.

Expectations around potential rate cuts from the Federal Reserve continued to ease this week. Per Bloomberg, expectations for a 25-basis-point cut at the June Federal Open Market Committee (FOMC) meeting are down to 2% from 5%. The Fed put is gone, at least for now.

Gold's Message

While equities wobble, gold has been sending a different signal entirely. The current gold price as of 25.05.2025 is $3 357.84. This isn't just another commodity rally - it's a referendum on fiscal and monetary policy.

🔐Premium Member only.🔐

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always do your own research and consider your financial situation before making investment decisions.

![F[ail]ed Auctions - Macro Market Dislocations and Volatility on Polymarket](https://substackcdn.com/image/fetch/$s_!XWJO!,w_140,h_140,c_fill,f_auto,q_auto:good,fl_progressive:steep,g_auto/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F5a19e0cf-3e94-42f1-a45f-ebaba4d63ac0_1456x816.png)