2025 Investment Outlook - Calling Dumps Before They Happen - The Future of Markets - Hint, It's ma[th]gic 😏

🔥 ETF MOAT of Midas Touch #8 Coming this week - High risk, High Rewards

Hello wise investors I’m back for a Quant data driven analysis. [Full Disclaimer]

Yes you read that right. Called the dump before it happened. Why? Quant cares not about what we think!

I was offered $200K for my signal quant by my competitor! I said nop… Why sell a golden goose?

This is Your Last Chance to Transform Your Investing Journey Before Prices Double Next Week!

ICYMI:

In the coming newsletters I will dissect each tech trend and analyze specific stock picks.

I'll dig into the key technological shifts that are to reshape our world. I'll explore how AI is augmenting human capabilities, the subtle yet significant strides crypto is making towards mainstream acceptance, the burgeoning field of RNA therapeutics, and much more.

Let’s get into it.

Economic Framework

The U.S. economy enters 2025 with remarkable strength, building on the surprisingly strong growth of 2024. Analysts project continued expansion, though at a more moderate pace compared to the previous year. The Conference Board forecasts GDP growth of 2.0% for 2025, a slight slowdown from the 2.7% expected in 2024.

Growth Trajectory

Corporate America maintains strong fundamentals, supported by healthy consumer and business balance sheets. However, growth rates are expected to return to normal from previous cycle peaks. The economy benefits from positive supply-side factors, including higher productivity growth and increased labor availability. These changes have altered the baseline economic outlook and highlight potential risks on the horizon.

Inflation and Monetary Policy

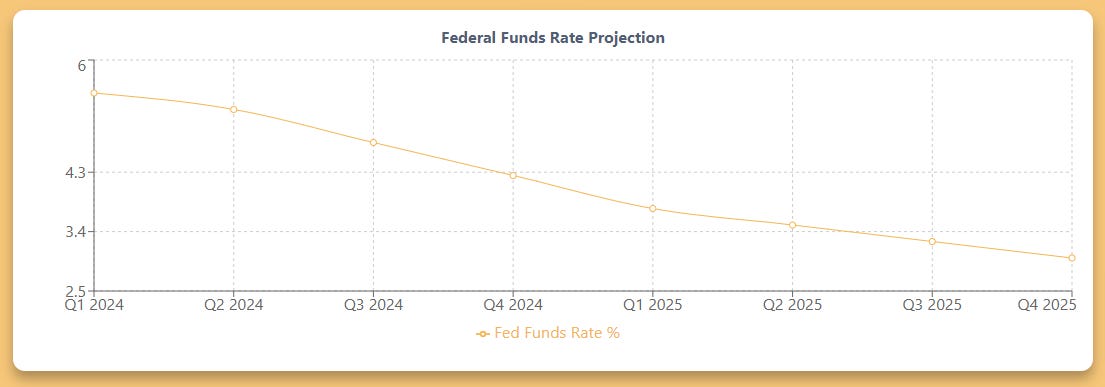

The Federal Reserve faces persistent above-target inflation as it enters 2025. Core inflation has stalled at just above 3% for the past six months, with the 3-month annualized rate picking up markedly since mid-2024. The Fed's preferred measure, the core PCE deflator, is expected to stabilize at the 2% target by Q4 2025, later than initially anticipated.

Given these inflation dynamics, the Federal Reserve is likely to adopt a more cautious approach to monetary policy in 2025. While the Fed is expected to continue gradual rate cuts, the pace and extent of easing may be more limited than previously thought. Analysts project the Fed funds rate to reach a neutral range of 3.00-3.25% by October 2025, several months later than original estimates.

Labor Market

The jobs market shows signs of cooling, but unemployment remains low entering 2025. This balance between labor market strength and gradual moderation supports the Fed's cautious approach to policy normalization.

Fiscal Policy and Trade

The incoming administration's proposed policies could impact both growth and inflation expectations. Potential expansionary fiscal measures, including tax cuts and increased spending, may support economic activity. However, the possibility of new trade tariffs introduces uncertainty and could put upward pressure on prices.

As 2025 unfolds, policymakers will need to handle a complex economic landscape, balancing growth objectives with the need to maintain price stability and manage inflation expectations over the longer term.

Market Projections

S&P 500 Outlook

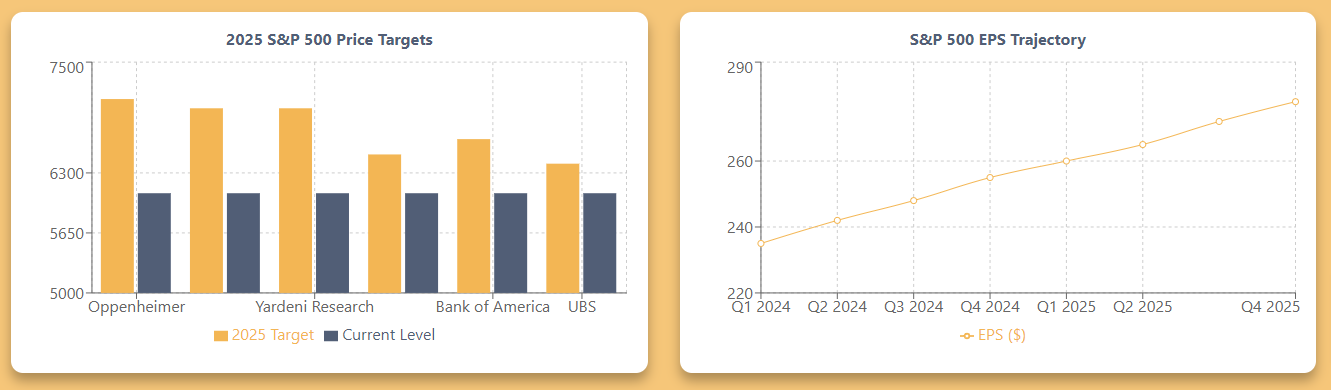

Wall Street's leading institutions have issued remarkably optimistic forecasts for 2025. Oppenheimer leads with the most hopeful target of 7,100, projecting a 17% increase from current levels. Deutsche Bank and Yardeni Research follow with targets of 7,000, while Goldman Sachs maintains a more cautious outlook at 6,500. Bank of America predicts 6,666, and UBS anchors the lower end at 6,400.

Earnings Trajectory

Corporate earnings show impressive momentum heading into 2025. The S&P 500 earnings growth rate accelerated to 12% in Q4 2024, surpassing initial analyst expectations. Wall Street consensus projects 2025 earnings per share between $248 and $285, with an average estimate of $268. The ratio of EPS increases to decreases has reached its highest level in three years at 5.6%, indicating robust corporate health.

Market Dynamics

2025 appears positioned as a tale of two halves:

First Half: Strong market performance expected, driven by economic resilience and continued AI expansion.

Second Half: Potential moderation as political and monetary policy factors come into play.

Sector Leadership

Information technology maintains its market leadership position, with AI-driven growth extending beyond the "Magnificent Seven" stocks. The broadening market rally suggests increasing participation from traditional sectors, particularly:

Energy: Benefiting from data center expansion and diverse power needs.

Defense: Growing global tensions driving increased spending.

Financial Technology: Digital payment evolution and blockchain adoption.

Cybersecurity: Rising demand amid escalating global threats.

Valuation Metrics

Forward price-to-earnings ratios are projected to expand beyond the five-year average of 20x, potentially reaching 25.8x. While these elevated valuations might typically signal caution, analysts argue that strong earnings growth and economic fundamentals justify the premium multiples.

The market's trajectory in 2025 will likely depend more on earnings growth than multiple expansion, marking a shift from recent years' valuation-driven gains.

Sector Analysis

Banking and Financial Services

The banking sector enters 2025 with strong momentum, driven by several catalysts. Equity capital markets activity shows significant potential for growth, with substantial capital awaiting deployment. The availability of financing across the banking industry stands at multi-year highs, creating favorable conditions for deal-making. Merger and acquisition activity is expected to accelerate, particularly under the new administration's proposed regulatory framework.

Technology and AI

The technology sector maintains its leadership position, with AI adoption extending beyond the initial wave. Software companies are capitalizing on enterprise AI implementation, with particular strength in:

Enterprise software modernization.

Cloud infrastructure expansion.

Cybersecurity solutions.

Data analytics platforms.

Healthcare Innovation

Healthcare technology presents compelling opportunities in 2025. Nearly 60% of industry executives express optimism about the sector's outlook, with 69% anticipating revenue growth. Key developments include:

Telemedicine expansion and digital health platforms.

AI-driven diagnostic tools.

Advanced analytics for patient care.

Cybersecurity improvements for medical data.

Energy Transformation

The energy sector faces a transformative year ahead. Traditional energy companies benefit from increased data center power demands, while renewable energy continues its expansion despite policy headwinds. Nuclear power emerges as a critical component of the energy mix, particularly in supporting AI infrastructure development.

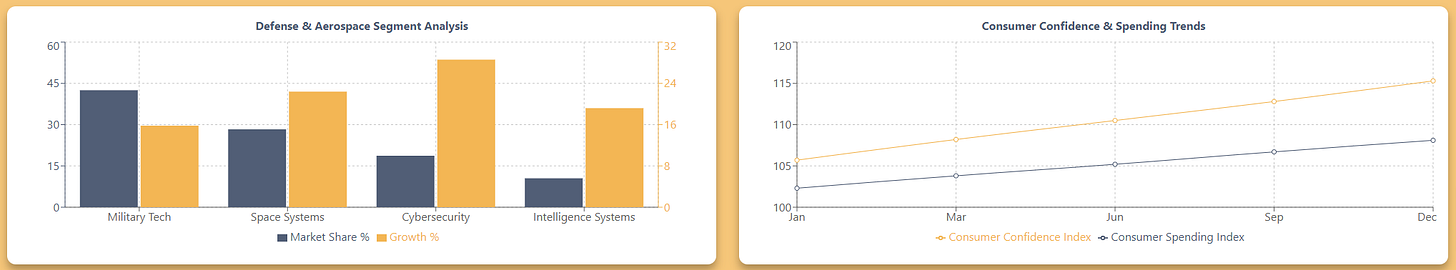

Defense and Aerospace

The defense sector shows robust growth potential, driven by:

Increased global security spending.

Modernization of military technology.

Space exploration initiatives.

Cybersecurity defense systems.

Consumer Discretionary

Consumer spending patterns indicate resilience, supported by:

Strong employment levels.

Healthy household balance sheets.

Normalized inflation levels.

Improved consumer confidence.

This diverse sector landscape presents multiple opportunities for strategic investment allocation, with technology integration and operational efficiency driving growth across all segments.

Risk Factors

Market Sentiment and Valuations

Current investor optimism levels have reached multi-decade highs, historically a potential warning signal. The S&P 500's remarkable advance through 2024 represents one of the strongest calendar-year performances ever recorded, creating an environment where valuations appear stretched. Price-to-earnings ratios have expanded beyond historical averages, though strong earnings growth partially justifies these premiums.

Policy Uncertainty

The incoming Trump administration presents several key uncertainties:

Proposed tariffs could disrupt global supply chains and increase consumer costs.

Immigration policy changes may impact labor markets and wage inflation.

Deregulation efforts could affect various sectors differently.

Government spending reductions might impact GDP growth.

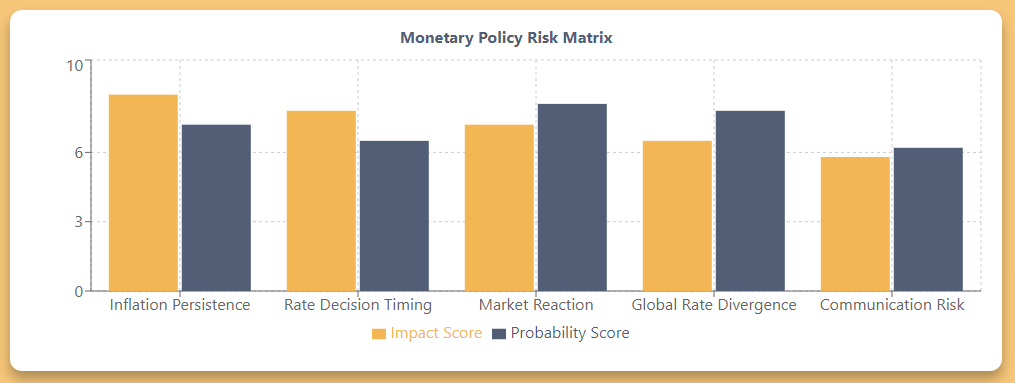

Monetary Policy Risks

The Federal Reserve faces a delicate balancing act in 2025. While markets expect multiple rate cuts, several factors could derail this trajectory:

Persistent core inflation above target levels.

Potential inflationary impacts from new trade policies.

Labor market resilience maintaining wage pressure.

Geopolitical tensions affecting commodity prices.

Global Economic Challenges

International risks loom large for 2025:

US-China trade tensions could escalate.

Supply chain vulnerabilities, particularly in semiconductor manufacturing.

European economic slowdown potentially affecting global growth.

Regional conflicts impacting energy markets.

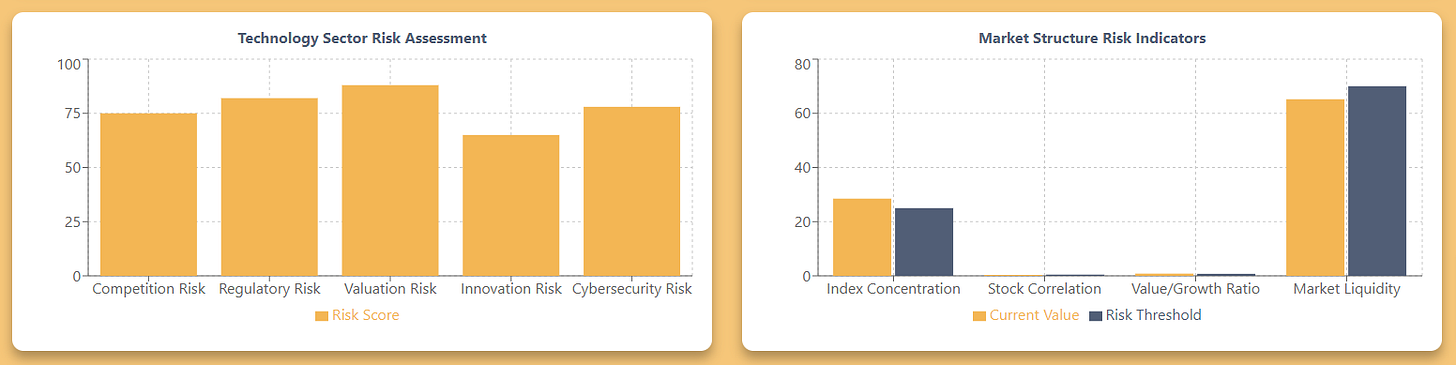

Technology Sector Risks

The AI-driven market rally faces potential headwinds:

Increasing competition in the AI space.

Regulatory scrutiny of major tech companies.

Valuation concerns for leading technology stocks.

Cybersecurity threats and AI-related breaches.

Market Structure

The market's internal dynamics present additional concerns:

Concentration risk in major indices.

Low correlation among stocks at 20-year lows.

Potential rotation from growth to value sectors.

Liquidity concerns in certain market segments.

These risk factors suggest investors should maintain disciplined position sizing and strong risk management strategies throughout 2025.

Technical Framework

Order Flow Analysis

Dark pool activity and institutional trading patterns provide critical market insights. Large block trades, particularly during the first two trading hours, often signal daily trend direction. The analysis of institutional order flow reveals:

Support and resistance levels formed by significant trade clusters.

Dark pool accumulation zones indicating potential price reversals.

Algorithmic trading patterns showing market sentiment shifts.

Market Breadth Indicators

Market internals demonstrate improving conditions entering 2025:

Advancing versus declining issues ratio shows healthy participation.

New highs versus new lows expanding across sectors.

Volume trends confirming price movements.

Reduced correlation among stocks suggesting stock-picking opportunities.

Momentum Analysis

Key technical indicators suggest sustained upward momentum:

Relative Strength Index (RSI) readings remain constructive.

Moving Average Convergence Divergence (MACD) shows positive divergence.

Volume-weighted average price (VWAP) anchors providing support levels.

Price action maintaining higher highs and higher lows pattern.

Institutional Support/Resistance

Major price levels where large institutions conduct business serve as key technical reference points:

Volume clusters identifying significant support zones.

Dark pool prints marking potential reversal points.

Algorithmic trading levels showing institutional interest.

Block trade analysis revealing accumulation patterns.

Volatility Framework

Volatility patterns indicate market stability:

VIX trending lower suggesting reduced fear.

Put-call ratios normalizing across major indices.

Options flow showing balanced positioning.

Institutional hedging activity decreasing.

This technical framework provides a complete approach to market analysis, combining traditional technical analysis with advanced order flow metrics to identify high-probability trading opportunities.

Investment Strategy

Portfolio Positioning

The investment landscape for 2025 demands a strategic balance between growth opportunities and risk management. Focus should be placed on companies demonstrating strong operational leverage and clear profit margin expansion potential. The strategy emphasizes three key areas:

Core equity positions in established corporations with robust fundamentals.

Strategic allocation to emerging technologies, particularly AI-driven enterprises.

Defensive positions in sectors benefiting from policy shifts.

Sector Allocation

A diversified approach across sectors is crucial:

Technology: Focus on semiconductor companies beyond AI applications.

Healthcare: Emphasis on digital health platforms and AI-diagnostic tools.

Energy: Balance between traditional energy and renewable infrastructure.

Financial Services: Target companies benefiting from potential deregulation.

Small-Cap Stocks: Particularly those with market capitalization above $1 billion.

Risk Management

Implement a three-tiered approach to risk:

Maintain disciplined position sizing.

Deploy strategic hedging through options strategies.

Keep adequate cash reserves for tactical opportunities.

Geographic Diversification

The U.S. market remains the primary focus, but strategic international exposure is warranted:

Japanese equities for potential market reforms.

Selective emerging market exposure.

GCC region investments for growth potential.

Alternative Investments

Consider alternative investments for portfolio diversification:

Private equity opportunities in high-growth sectors.

Real assets as inflation protection.

Impact investing aligned with ESG criteria.

The strategy emphasizes flexibility and adaptability, recognizing that policy changes under the new administration could create both opportunities and challenges. Regular portfolio rebalancing and active risk management will be crucial for navigating the evolving market landscape.

Trading Implementation

Advanced Technical Analysis

Market conditions in 2025 require sophisticated technical analysis approaches:

Volume-weighted average price (VWAP) anchoring for support/resistance.

Dark pool print analysis for institutional activity.

Order flow analysis during first two trading hours.

Relative Strength Index (RSI) divergence scanning.

Moving Average Convergence Divergence (MACD) trend confirmation.

Options Strategies

Implement strategic options positions to capitalize on market movements:

Long-dated protective puts for portfolio insurance.

Covered calls on high-volatility stocks.

VIX calls paired with S&P 500 put sales.

Custom basket dispersion trades.

Zero-day to expiry (0DTE) options for specific event risks.

Risk Management Framework

A three-tiered approach to position management:

Position sizing based on volatility metrics.

Stop-loss placement at key technical levels.

Portfolio beta adjustment through sector rotation.

Correlation analysis for diversification.

Regular rebalancing schedules.

Algorithmic Implementation

Deploy systematic trading strategies:

Mean reversion algorithms for range-bound markets.

Momentum-based trend-following systems.

Statistical arbitrage across correlated assets.

Machine learning models for pattern recognition.

High-frequency execution for large orders.

Market Timing

Focus on key market timing indicators:

Dark pool accumulation zones.

Institutional order flow patterns.

Options market sentiment indicators.

Volume profile analysis.

Market breadth indicators.

This complete trading framework combines traditional technical analysis with advanced order flow metrics to identify high-probability trading opportunities while maintaining strict risk management protocols.

Final Thoughts

The investment landscape of 2025 presents a complex combination of opportunities and challenges. While Wall Street maintains an overall optimistic stance, with most strategists projecting S&P 500 gains between 6,400 and 7,100, investors must navigate significant crosscurrents.

Market Dynamics

The U.S. economy continues to demonstrate exceptional resilience, though growth is expected to moderate to 1.6-2.4% in 2025. This economic backdrop, combined with anticipated Federal Reserve rate cuts, creates a supportive environment for risk assets. However, elevated valuations and persistent inflation above the Fed's 2% target warrant careful consideration.

Policy Considerations

The incoming administration's policies present both opportunities and risks. While potential tax cuts and deregulation could boost corporate profits, proposed tariffs and trade policies might spark inflationary pressures and global trade tensions. These policy shifts could significantly impact sector rotation and market leadership.

Investment Implications

Success in 2025 will require:

Strategic sector allocation favoring companies with strong operational leverage.

Focus on quality companies with robust cash flow generation.

Balance between growth opportunities and defensive positioning.

Active risk management through position sizing and portfolio diversification.

The market environment demands sophisticated analysis tools and disciplined execution strategies. While optimism prevails, investors should remain vigilant of elevated valuations and potential risks, maintaining flexibility to adapt to changing market conditions throughout the year.

The convergence of AI advancement, policy shifts, and global economic dynamics creates a market environment where careful security selection and risk management will prove crucial for investment success in 2025.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always do your own research and consider your financial situation before making investment decisions.

Remember what goes up must come down (eventually)

Stay safe and invest wisely and this is in no mean financial advice. [Full Disclaimer]Thank you for supporting this newsletter. It will keep improving.

Harry