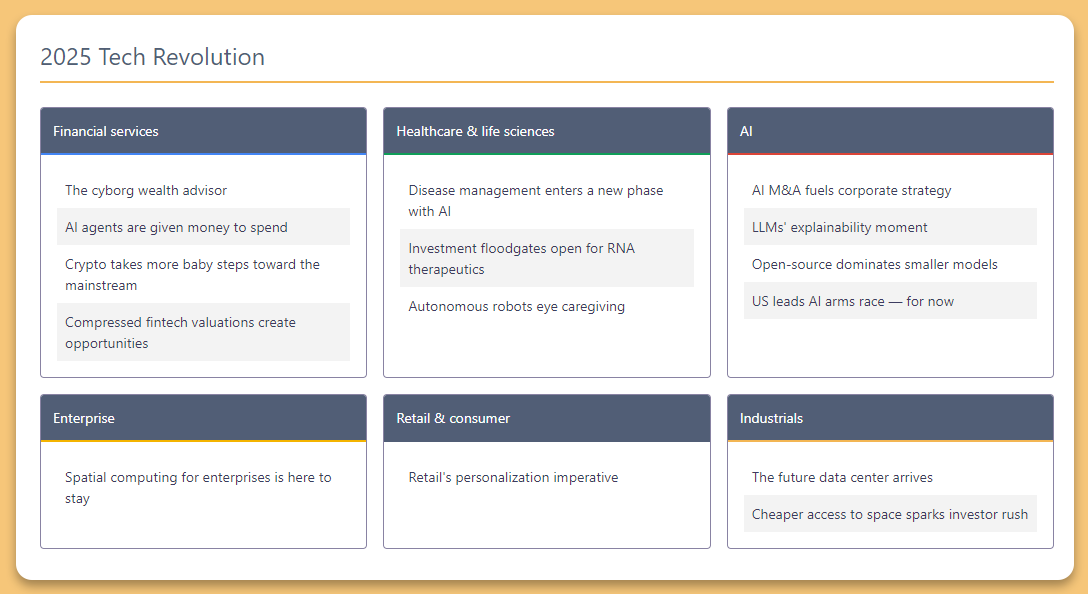

2025 Tech Revolution - 15 Trends To Watch That Will Redefine Everything

How AI and Innovation Are Reshaping Industries.

Hi fellow investors and welcome for a Quant data driven analysis. [Full Disclaimer]

I find myself both amazed and invigorated by the rapid advancements unfolding before us. The landscape of 2025 is not just a continuation of previous trends; it's a transformative leap that's redefining industries across the board. From finance to healthcare, AI to retail, we're witnessing a convergence of technologies that's creating unprecedented opportunities and challenges.

ICYMI:

#4 - AI Tech 2025 - The Mergers - The Money - and The Mayhem

Hello wise investors I’m back for a Quant data driven analysis. [Full Disclaimer]Become a Premium Member To get Live BUY/SELL Signal Alerts. Not a member yet? Upgrade your game. Secure your spot today before time runs out!

In the coming newsletters I will dissect each tech trend and analyze specific stock picks.

I'll dig into the key technological shifts that are to reshape our world. I'll explore how AI is augmenting human capabilities, the subtle yet significant strides crypto is making towards mainstream acceptance, the burgeoning field of RNA therapeutics, and much more.

Financial Services: The Rise of the Cyborg Wealth Advisor

Embracing AI to Enhance Human Expertise

In the realm of financial services, the integration of artificial intelligence is no longer a futuristic concept—it's a current reality that's redefining the advisor-client relationship. Financial advisors have long struggled with administrative burdens, spending less than 20% of their time with clients due to back-office tasks and compliance requirements. This inefficiency not only hampers advisors but also impacts the quality of service clients receive.

Enter the cyborg wealth advisor—a harmonious blend of human expertise and AI efficiency. By leveraging AI tools, advisors can automate routine tasks like data entry, scheduling, and compliance checks. This shift allows them to dedicate more time to what truly matters: understanding clients' needs and providing personalized financial guidance.

Morgan Stanley serves as a prime example. Their wealth management division has seen record net revenues, thanks in part to their investment in AI technologies. By integrating AI into their operations, they've enhanced advisor productivity, improved client engagement, and gained a competitive edge in the market.