#18 Weekly Update - Pharmaceutical +900% ! The State Of DRIV

Portfolio and Updates Coming This Week

Hi and welcome back for a Quant data driven analysis. [Full Disclaimer]

Let's dive in and make some smart moves! 💰🚀

📅Week's Calendar May 05-11, 2025

High Impact Events

Monday May 5

S&P Global Services PMI (Apr): Forecast 51.4%, Prior 54.4%

ISM Services PMI (Apr): Forecast 50.6%, Prior 50.8%

ISM Non-Manufacturing Prices (Apr): Prior 60.9%

ISM Non-Manufacturing PMI (Apr): Forecast 50.6%, Prior 50.8%

Wednesday May 7

Fed Interest Rate Decision: Forecast 4.5%, Prior 4.5%

FOMC Minutes & Press Conference

Thursday May 8

Continuing Jobless Claims (Apr/26): Forecast 1.9K, Prior 1.9K

Initial Jobless Claims (May/03): Forecast 246, Prior 241

Jobless Claims 4-Week Average (May/03): Forecast 231.5, Prior 226

Key Economic Data

Tuesday May 6

Trade Balance (Mar): Forecast -124.7, Prior -122.7

Atlanta Fed GDPNow (Q2): Forecast 1.1%, Prior 1.1%

Wednesday May 7

MBA 30-Year Mortgage Rate (May/02): Prior 6.89%

EIA Crude Oil Stocks Change (May/02): Prior -2.696%

EIA Gasoline Stocks Change (May/02): Prior -4.002%

BoE Consumer Credit: Forecast 9.9%, Prior -0.81%

Market Positioning (Friday May 9)

CFTC Nasdaq 100 speculative positions: 30.9%

CFTC Crude Oil speculative positions: 177.2

CFTC Gold Speculative positions: 163.3

CFTC S&P 500 speculative positions: -78.7%

This week features critical economic indicators including Fed interest rate decision, employment data, and services sector indices that could significantly impact market sentiment. Multiple Fed speakers are scheduled throughout Friday May 9, including Fed Barr, Kugler, Goolsbee, Waller, Williams, Cook, Musalem and Hammack speeches.

Last Week Recap:

A Short Look at Driv

I've been tracking the EV market closely, and it's one of the most fascinating stories playing out right now. Here's my breakdown of what's happening and where we're headed:

Current Market Situation

Tesla's stock has been on a wild ride - hitting $480 in December 2024, crashing to $240 by March, and now hovering around $290

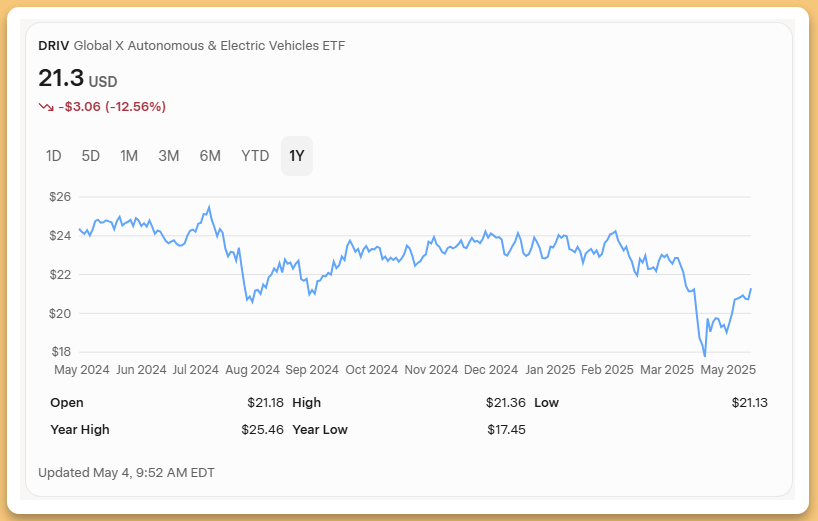

The DRIV ETF has bounced between $25 and $17 over the past year, currently sitting around $21

Chinese manufacturers are gaining ground at an astonishing pace

BYD captured 24% of the global EV market in January (up from 19.8% last year)

Tesla's share has dropped to 8% (down from 10.7%)

Chinese February NEV sales jumped 87% year-over-year

Key Competitive Developments

BYD isn't just winning on volume - they're innovating faster

Their new charging tech claims to add 250 miles in just five minutes

Tesla's Superchargers need 15 minutes for 200 miles

Tesla is launching a more affordable model in June 2025 to fight back

Rivian continues focusing on premium adventure vehicles but faces pressure from Tesla's price cuts

The Tariff Situation

Trump's 90-day tariff pause in April sparked the recent rally in EV stocks

The pause maintained a base 10% duty that started April 5th

More severe tariffs on Chinese EVs and batteries are scheduled to start August 1st

Some increases won't come into effect until January 2025 or 2026

This policy whiplash makes long-term planning extremely difficult

My Outlook for Next 6-12 Months

Short-term: Expect Tesla to trade between $250-$350

DRIV should stay in a $20-$25 range

60% chance DRIV ends 2025 above $22.50 (assuming no major policy disasters)

Also a meaningful chance it drops below $20 if incentives get cut or competition intensifies

Volatility will remain high - expect big swings with policy announcements and earnings reports

The Bigger Picture

The EV market is transitioning from early adopter phase to mass market. Easy growth is over - now it's about manufacturing efficiency and cost control. Companies that can deliver good EVs under $30,000 will likely win. Charging speed might end up mattering more than range. BYD has a huge advantage with their vertically integrated model. The intersection of technology, policy, and geopolitics makes this market uniquely complex. The EV revolution isn't going away, but the path forward is messier than expected

Newest Additions Movements and Shifts

Recent market activity shifts across various sectors:

🔐Premium Member only.🔐

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always do your own research and consider your financial situation before making investment decisions.