#14 Weekly Update - +1000% Low Caps! Friday Meltdown And Tariff Tsunami - Recession Deepens - Fed Signals Loading

Are You Paying Attention? It Get's Worse. What Happened and What's Next.

Hi and welcome back for a Quant data driven analysis. [Full Disclaimer]

ICYMI: I said it 7 weeks ago.

Friday's Market Meltdown: Tariff Wars Trigger Global Sell-off

What a week. Friday's session was one for the books - The S&P 500 tanked 6%, the Dow plummeted 2,231 points (5.5%), and the Nasdaq got absolutely crushed, down 962 points (5.8%). This wasn't your garden variety pullback - this was full-on panic mode.

So what the hell happened? Trump dropped a bombshell after Thursday's close, announcing sweeping tariffs - 25-35% on $325 billion of Chinese imports. Beijing wasted no time hitting back with their own 34% tariff on all U.S. goods. The market reaction was swift and brutal. The volatility Index fear gauge exploded higher, hitting an 8-month high. If you were wondering what institutional panic looks like, well, now you know. A true financial crises.

The breadth of selling was what really caught my attention. When I dug into the numbers, over 90% of NYSE stocks were down, with trading volume more than double the average. This wasn't retail investors freaking out - this was calculated institutional repositioning on a massive scale. The big money doesn't sit around waiting for clarity in times like these - they shoot first and ask questions later.

You think this was bad? We’re not “near bad“.

The over evaluations were next to ridiculous. And therefore the fast, deep, flesh cutting sell off.

Let's dive in and make some smart moves! 💰🚀

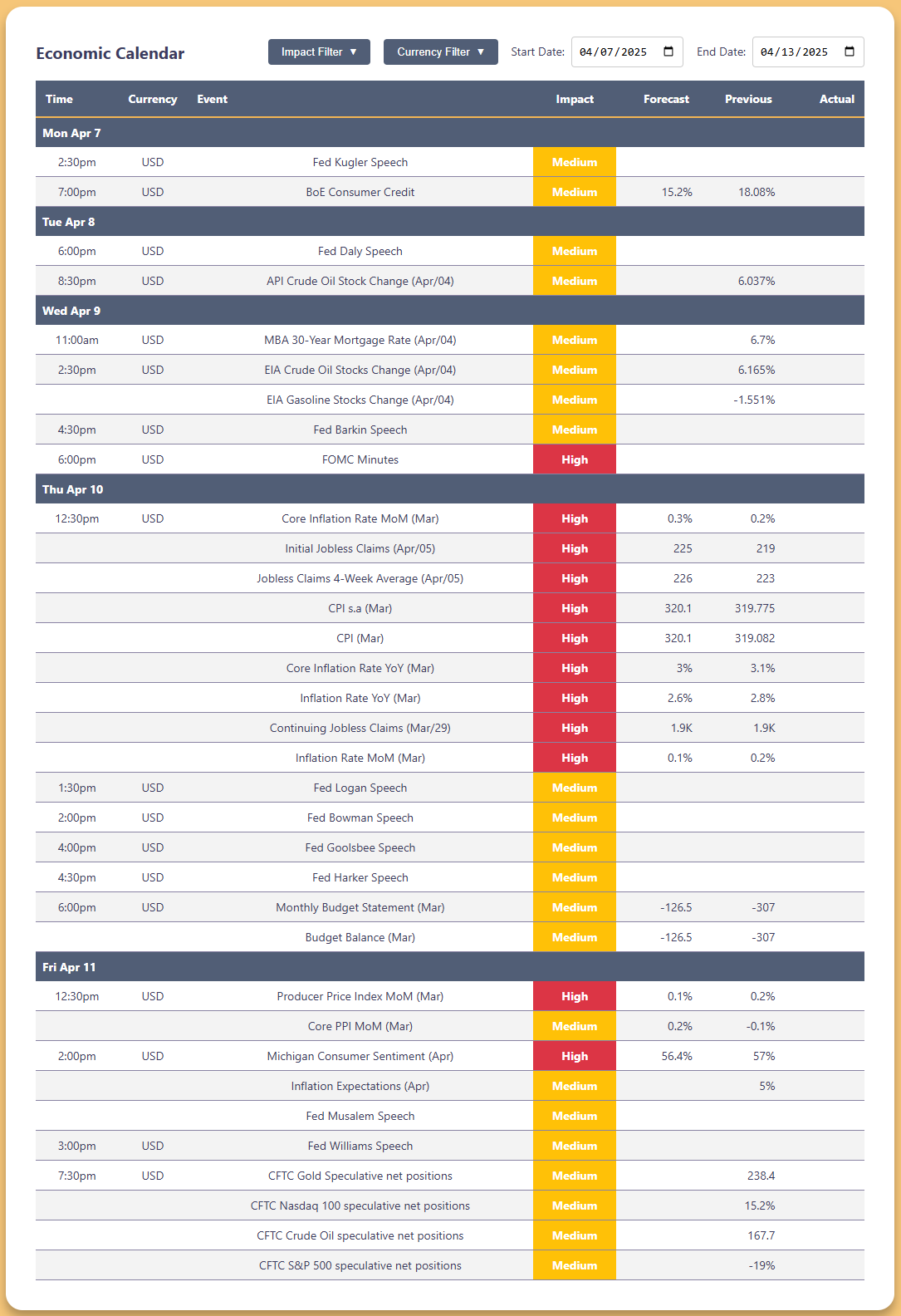

📅Week's Calendar April 07-12, 2025

Economic Calendar Highlights (Apr 7-11)

Key Inflation Data (Apr 10)

Core Inflation YoY: Expected 3.0%, Prior 3.1%

Headline Inflation YoY: Expected 2.6%, Prior 2.8%

Core Inflation MoM: Expected 0.3%, Prior 0.2%

PPI MoM (Apr 11): Expected 0.1%, Prior 0.2%

Critical Policy Events

Apr 9

FOMC Minutes Release (High Impact)

Fed Barkin Speech

Apr 10

Comprehensive Inflation Report

Multiple Fed Speakers (Logan, Bowman, Goolsbee, Harker)

Initial Jobless Claims: Expected 225K, Prior 219K

Apr 11

Michigan Consumer Sentiment: Expected 56.4%, Prior 57%

Fed Williams & Musalem Speeches

CFTC Positioning Data

Notable Data Trends

Consumer Credit (Apr 7): Expected 15.2%, Prior 18.08%

Budget Statement (Apr 10): Expected -126.5, Prior -307

Oil Inventory Data (Apr 8-9): Previous API 6.037%, EIA 6.165%

Mortgage Rate (Apr 9): Prior 6.7%

Market Impact: Thursday (Apr 10) shows concentrated high-impact releases with inflation and employment data. FOMC minutes on Wednesday evening could reveal key insights into Fed policy direction. The week concludes with sentiment data and PPI figures that might influence rate cut expectations.

Critical Economic Data and Market-Moving Events

Economic events to watch this week:

Short Term Update - Newest Additions (Tuesday)

Last Week Recap:

#13 Weekly Update - Bear Trend In - EU Caved In - Valuation Updated Levels

Hi and welcome back for a Quant data driven analysis. [Full Disclaimer]

In-Short

Anatomy of a Selloff

Digging through Friday's carnage, the breadth numbers absolutely blew my mind. Out of 6,814 stocks traded, a mind-boggling 5,517 (80.9%) went down while only 870 (12.8%) managed to go up.

714 stocks dropped MORE THAN 10% (ouch!)

2,037 stocks fell between 5-10% (double ouch)

1,746 stocks declined between 2-5% (still hurts)

1,020 stocks lost up to 2% (paper cuts)

Meanwhile, just 110 stocks gained more than 10%. Normally this kind of extreme imbalance screams "capitulation bottom" - but honestly? I think there's probably more pain coming. This tariff thing ain't going away with a tweet.

Fund flows confirmed. NYSE saw $4.24 billion worth of money heading for the exits, with another $310+ million fleeing NASDAQ. The pattern was classic institutional panic: heavy selling at the open, that fake midday "maybe it's over" breather, then another wave of "oh god no" selling into the close. Big money wasn't even pretending to buy this dip.

Technology Bears the Brunt

No surprise which sectors got hammered worst. Tech stocks - especially anything with Chinese manufacturing exposure - got absolutely destroyed. When Apple makes like 90% of their stuff in China, what did we expect?

🔐Premium Member only.🔐

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always do your own research and consider your financial situation before making investment decisions.