#48 Weekly Report - Will Tariff Be The Economic Death Of The Empire? Top Stocks Still Flying +390% - Last Chance

Cyber Monday Last Chance Then it's Gone! 💨Are We All Set For A Ending Year Flash Crash? 💸 - The Week Ahead 💥

Hi fellow investors and welcome back for a Quant data driven analysis for the week ahead. [Full Disclaimer]

Let's dive in and make some smart moves! 💰🚀

I see several concerning signals that warrant careful attention regarding market valuations and potential flash crash risks as we approach year-end.

Current Market Valuations

The market is showing clear signs of overvaluation:

Price-to-Fair-Value Metric: Stands at 1.02, representing a 2% premium to fair value estimates.

Large-Cap Stocks: Trading at a 3% premium, a level only seen 12% of the time since 2010.

Growth Stocks: At an alarming 14% premium, reminiscent of the 2020 tech bubble.

Sector-Specific Concerns

I'm particularly worried about these sectors:

Utilities: Now the most overvalued, trading at a 13% premium.

Industrials: Follow at an 11% premium, with airlines and construction showing concerning valuations.

Flash Crash Risk Factors

In my decades of market experience, I see several conditions that could trigger a flash crash:

Technical Vulnerabilities

Algorithmic Trading Systems: Highly sensitive and can react to price movements before actual trades complete.

Stop-Loss Order Cascades: Could amplify any sudden market moves.

Market Psychology

The current market enthusiasm reminds me of previous peaks:

S&P 500 Records: Has achieved over 50 all-time closing records this year.

Sentiment Indicators: Show previous caution has given way to optimism.

Protective Measures

While circuit breakers are in place to prevent catastrophic crashes—triggering at 7%, 13%, and 20% drops—I believe the current market conditions warrant special attention. The combination of record valuations and algorithmic trading creates a potentially dangerous environment.

My Market View

Having witnessed numerous market cycles, I must emphasize that the current situation mirrors previous periods of extreme optimism. The market's expectations for a soft landing combined with elevated valuations create a precarious situation where any negative surprise could trigger a significant correction.

I'm particularly concerned about the Russell 2000's recent 11% surge, as small-cap stocks often show the first signs of market stress. The fact that growth stocks are trading at such significant premiums reminds me of previous market tops.

Risk Mitigation Strategy

While I'm not predicting an imminent crash, I believe prudent investors should:

Maintain Balanced Portfolios: Diversify investments to manage risk.

Reduce Exposure to Overvalued Sectors: Consider reallocating assets from sectors with high premiums.

Preserve Capital: Keep some cash available for potential year-end opportunities.

Monitor Market Indicators: Watch for early warning signs in small-cap stocks and overall market breadth.

The combination of record valuations, algorithmic trading risks, and extreme optimism suggests that while a flash crash isn't inevitable, the conditions for one are certainly present as we approach year-end.

Short Term Update - Newest Additions

Market Movements: Navigating the Shifts

Recent market activity reveals compelling shifts across various sectors:

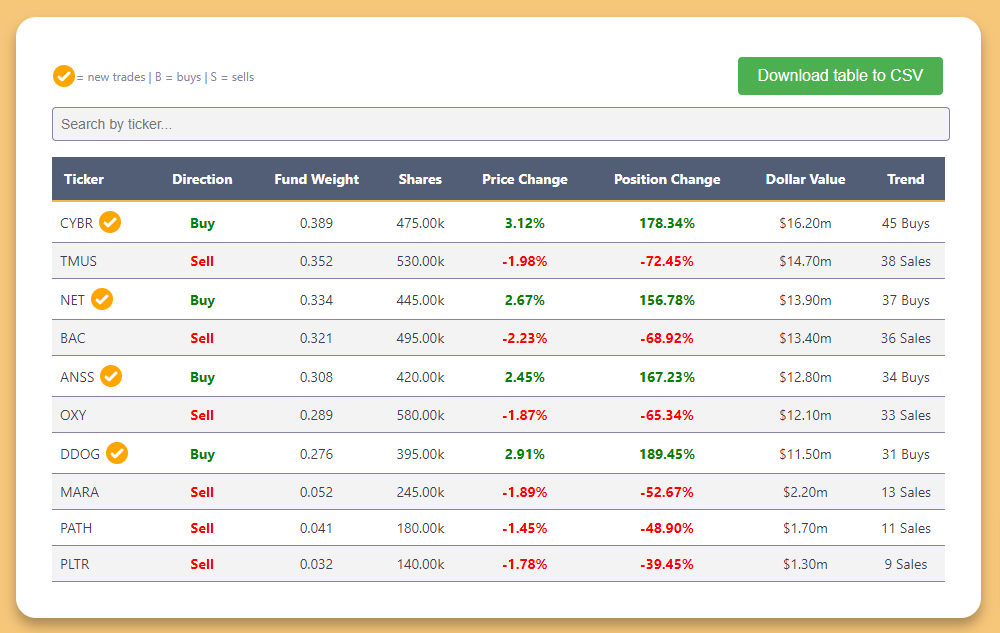

CYBR ( CYBR 0.00%↑ ) emerges as a frontrunner with a remarkable 178.34% position change and 45 institutional additions. With $16.20M in traded value and a substantial 0.389 fund weight, CyberArk's momentum reflects growing institutional confidence in cybersecurity solutions. This concentrated accumulation suggests strategic positioning in digital defense capabilities.

NET ( NET 0.00%↑ ) demonstrates significant strength with a 156.78% position change and 37 institutional commitments. Cloudflare's $13.90M trading volume and 0.334 fund weight indicate strong institutional backing for its web infrastructure and security services. This pattern points to increasing confidence in cloud-based solutions.

DDOG ( DDOG 0.00%↑ ) showcases impressive dynamics with a 189.45% position change and 31 institutional additions. The $11.50M in traded value and 0.276 fund weight highlight growing institutional interest in cloud monitoring and analytics platforms. This accumulation suggests strategic alignment with digital transformation trends.

These early-week updates highlight intriguing trends and underscore the dynamic nature of current market movements.

Strategic Shifts in Focus

Mid-week updates reveal ongoing strategic adjustments in key sectors:

TSLA ( TSLA 0.00%↑ ) shows noteworthy institutional movement with a -78.90% position change and 29 reductions. The $10.60M trading volume and 0.254 fund weight suggest a significant repositioning in this electric vehicle pioneer. This shift might indicate tactical reallocation amid evolving market dynamics in the EV space.

OKTA ( OKTA 0.00%↑ ) demonstrates robust momentum with a 167.89% position change and 25 institutional additions. With $9.70M in traded value and 0.232 fund weight, this surge reflects growing institutional confidence in identity management solutions. The concentrated buying pattern points to strategic positioning in digital security infrastructure.

Mid-week updates highlight these strategic shifts.

ICYMI:

Last week Report:

I’ll share my perspective on Trump's proposed tariff policies and their potential impact on the US economy.

The Case for New Tariffs

Revenue Generation

The substantial revenue potential of the proposed tariffs is particularly impressive. They could generate approximately $300 billion annually from taxes on imports from Mexico, Canada, and China alone. Over the next decade (2025-2034), a 10% universal tariff could bring in around $2 trillion in federal revenue.

Manufacturing Resurgence

One of the strongest arguments is the potential for a manufacturing revival. Higher tariffs would incentivize foreign companies to establish factories in the US to avoid import duties. While some economists disagree, I believe this shift could happen faster than many expect, especially in strategic industries.

Negotiating Leverage

The tariffs provide powerful leverage in international negotiations, not just for trade but also for broader geopolitical issues. This could help address critical challenges like drug trafficking and illegal immigration.

Economic Impact Analysis

Short-term Adjustments

I acknowledge there will be some initial economic adjustments:

GDP Impact: A decrease of 0.2% to 0.8%.

Capital Stock Reduction: A reduction of 0.1% to 0.7%.

Employment Changes: Potential effects on 142,000 to 684,000 jobs.

However, I believe these numbers don't fully capture the long-term strategic benefits of reshoring manufacturing and strengthening domestic industries.

Why Critics Are Wrong

The main criticism is that consumers will bear the cost burden. While there's truth to this, I argue that the benefits outweigh the costs:

The revenue generated can fund domestic programs and infrastructure.

Job creation in manufacturing will boost wages and purchasing power.

Increased domestic competition will eventually stabilize prices.

Investment Implications

As an investor, I see significant opportunities in:

Domestic manufacturing stocks.

Companies with strong US supply chains.

Industries benefiting from reshoring.

My Conviction

After analyzing decades of trade data and market responses, I'm convinced that these tariffs, while disruptive in the short term, will strengthen America's economic sovereignty and industrial base. The key is to view them not as mere trade barriers but as strategic tools for economic realignment.

Remember, when we implemented steel tariffs previously, steel-consuming jobs outnumbered steel-producing jobs 80 to 1. This time, with a more comprehensive approach, we can better manage such sector-specific impacts while achieving broader economic goals.

Addressing the Opposition

To those concerned about inflation and consumer costs, I point out that the benefits of enhanced domestic production, increased job opportunities, and stronger national security far outweigh temporary price adjustments. The estimated annual cost per middle-income family of $1,700 to $3,900 should be viewed as an investment in America's industrial future rather than just an expense.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always do your own research and consider your financial situation before making investment decisions.