Lumen Technologies (LUMN) Up 700%! Remarkable Turnaround and Market Implications.

Lumen recently announced a game-changing influx.

Evolving landscape of telecommunications, Lumen Technologies (NYSE: LUMN) has emerged as a focal point for investors and market analysts alike. With a staggering 341.51% surge in stock price over the past month, reaching $4.68 as of the latest trading session, Lumen's trajectory demands a thorough examination. This analysis will delve into the factors driving this remarkable turnaround, assess the company's financial health, and explore the broader implications for the telecom sector and adjacent industries.

The Catalyst: Billions’ Boost

Analyzing sudden interest in Lumen.

Lumen recently announced a game-changing $5 billion in new business, primarily driven by the surging demand for AI-related infrastructure. This development is multifaceted:

Revenue Projection: The $5 billion influx represents a significant portion of Lumen's annual revenue, which stood at $16.03 billion in 2023. Assuming this new business is spread over 3-5 years, it could add $1-1.67 billion annually, potentially reversing the recent trend of revenue decline.

Margin Impact: AI-related services typically command higher margins. If we conservatively estimate a 40% gross margin on this new business (compared to Lumen's overall gross margin of 31.4% in Q1 2024), it could add $400-668 million in annual gross profit.

Market Share Implications: This deal positions Lumen as a key player in the AI infrastructure space, potentially capturing market share from competitors like AT&T (NYSE: T) and Verizon (NYSE: VZ).

Infrastructure Expansion

To support this AI-driven growth, Lumen is embarking on a massive fiber network expansion. Key points include:

Capital Expenditure: Lumen's CapEx was $2.37 billion in 2023. The new expansion could necessitate a 20-30% increase, pushing annual CapEx to $2.84-3.08 billion.

ROI Projections: Assuming a 5-year payback period on the additional CapEx, Lumen would need to generate $94-142 million in additional annual cash flow to justify the investment.

Competitive Positioning: This expansion could give Lumen a significant edge in network capacity and speed, crucial for AI applications that require high bandwidth and low latency.

Financial Health: A Closer Look

Q1 2024 Results and Q2 Projections

Revenue: Q1 2024 saw revenue of $3.29 billion, down 11.99% YoY. Analysts project Q2 revenue around $3.69 billion, indicating a potential stabilization.

Earnings Per Share (EPS): Q1 EPS was -$0.04, a 140% decline YoY. Q2 projections of $0.07 suggest a possible return to profitability.

Free Cash Flow: A bright spot in Q1 was the 262.10% YoY increase in free cash flow to $409.63 million. This improvement is crucial for debt management and future investments.

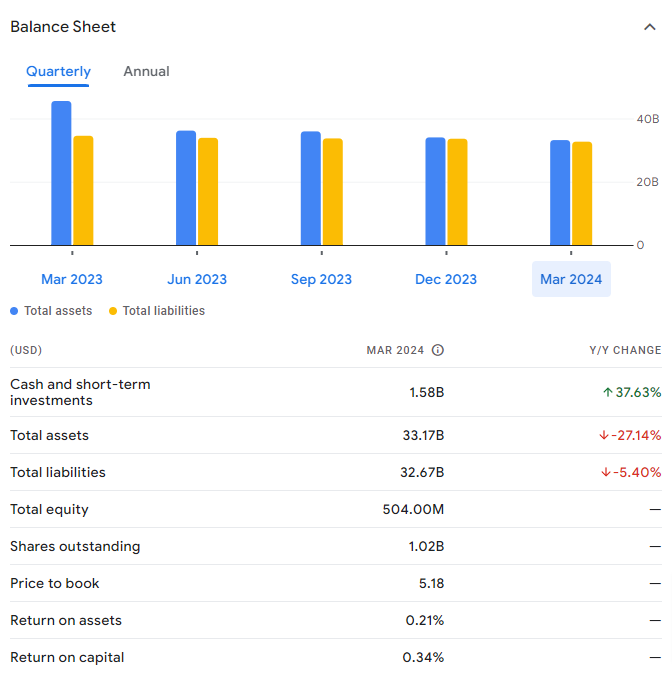

Balance Sheet Analysis

As of Q1 2024:

Cash Position: $1.58 billion, up 37.63% YoY, providing a liquidity cushion.

Total Assets: $33.17 billion, down 27.14% YoY, reflecting ongoing restructuring.

Total Liabilities: $32.67 billion, down 5.40% YoY, indicating some progress in debt reduction.

Debt-to-Equity Ratio: With total equity at $504 million, the D/E ratio stands at a concerning 64.82, highlighting the need for continued deleveraging.

Market Implications and Sector Analysis

Telecom Sector Dynamics

5G and Fiber Race: Lumen's fiber expansion aligns with industry trends. AT&T plans to cover 30 million locations with fiber by 2025, while Verizon aims for 50 million households.

AI Infrastructure Market: The global AI infrastructure market is projected to reach $309.4 billion by 2026, growing at a CAGR of 23.1%. Lumen's $5 billion deal represents a significant capture of this growing market.

Enterprise Focus: Lumen's emphasis on enterprise solutions differentiates it from more consumer-focused telecoms, potentially leading to higher margins and more stable revenue streams.

Cross-Industry Implications

Cloud Computing: Lumen's expansion could benefit cloud providers like Amazon Web Services and Microsoft Azure by providing enhanced connectivity for their services.

Edge Computing: The expanded fiber network positions Lumen well in the edge computing market, projected to reach $87.3 billion by 2026.

Content Delivery Networks (CDNs): Improved infrastructure could make Lumen a more attractive partner for CDN providers like Akamai and Cloudflare.

Risk Assessment and Future Outlook

Key Risks

Debt Burden: With a debt-to-equity ratio of 64.82, managing the $32.67 billion in total liabilities remains a significant challenge.

Execution Risk: The success of the AI-focused strategy and network expansion hinges on effective implementation and market adoption.

Competitive Pressure: Giants like AT&T and Verizon have deeper pockets and established AI partnerships, potentially outmaneuvering Lumen.

Future Outlook

Short-term Catalysts: Q2 earnings and further details on the AI-related deals could drive near-term stock performance.

Medium-term Goals: Watch for progress on network expansion and any improvements in enterprise market share over the next 12-18 months.

Long-term Positioning: Lumen's success in establishing itself as a key AI infrastructure player will be crucial for sustained growth and profitability.

Wrapping it up

Lumen Technologies stands at a pivotal juncture, with its recent AI-driven deals and network expansion plans offering a potential path to revitalization. The 341.51% stock surge over the past month reflects growing investor confidence, but significant challenges remain, particularly in debt management and competitive positioning.

For investors, Lumen represents a high-risk, high-reward proposition. The company's ability to execute its AI strategy, successfully expand its network, and improve its financial health will be critical in determining whether it can sustain its recent momentum and emerge as a leader in the evolving telecom landscape.

Remember what goes up must come down (eventually)

Stay safe and invest wisely and this is in no mean financial advice. [Full Disclaimer]Harry