The Future of AI Unveiled - NVIDIA's Bold Vision and Surprising Undervaluation

AI Supercomputers For All And GPUs In Every Car

Hi fellow investors and welcome back for a guest newsletter. [Full Disclaimer]

TL;DR

NVIDIA just announced some very exciting new products and services at the CES in Las Vegas.

The company is re-imagining the future of AI and literally empowering everyone to benefit from it.

NVIDIA continues to be the head and shoulders above the rest, and I am very excited by what the next year will bring.

Despite this, enthusiasm for NVIDIA seems to have fizzled out. Trading at a PEG of under 1, NVIDIA actually seems undervalued here.

Expect To Learn

What The Next Stage Of AI Will Look Like

How NVIDIA Is Democratizing AI

Why NVIDIA’s Revenue Will Still Go Much Higher

The Outlook For Chip Policy Under Trump

Why I Believe NVIDIA Is Undervalued

But first, a little bit about me, The Pragmatic Investor

An approach that assesses the truth of meaning of theories or beliefs in terms of the success of their practical application.

That is Pragmatism, and it guides my investment philosophy.

Through many years of analyzing markets, I have found this is what works.

The Pragmatic Investor sticks to what works. The problem is that thousands of different strategies can work for certain people.

However, simplicity is key, which is why I have narrowed my investing ethos down into three key ideas. Together, these ideas create what I like to call The Pragmatic Investing Pyramid.

Macro, Fundamentals and Technical.

This three-pronged approach has helped me beat markets over the seven years.

For long-term investing, there’s nothing better than understanding business cycles, macroeconomic trends and geopolitics.

On the other hand, technical analysis is the best tool for predicting short-term market moves.

And not just a specific form of technical analysis but a robust set of tools that can all work together to help us find great setups.

I actually recently designed my own algorithm. You can see it here:

My Substack is designed to guide investors of all levels in their journey.

Understand markets with the weekly newsletter.

Build a diversified global portfolio that will stand the test of time.

Get actionable trade ideas to take your investment returns to the next level.

Every week, I provide a macro update and technical analysis on the main indexes and stocks. I also cover a stock in depth, examining its fundamentals.

The Future Of AI; Jensen Keynote Speech at CES

Artificial Intelligence spans a broad spectrum, far beyond just ChatGPT and Large Language Models. During his keynote speech at CES, Jensen Huang delved into the evolution and future potential of AI.

Generative AI, the form most people associate with AI today, represents only the starting point of a much larger journey.

The next phase, Agentic AI, is already taking shape. This advancement transforms AI capabilities into actionable services, such as coding assistance and customer support. These AI agents are set to reshape the global economy, and their impact is already becoming apparent.

For instance, large tech companies have noticeably slowed their hiring rates. Salesforce (CRM) has even announced it will not be hiring in 2025—a move that reflects the growing reliance on AI-driven solutions.

The ultimate stage of AI evolution is Physical AI. This phase will emerge when AI seamlessly integrates with robotics to interact dynamically with the physical world. When this becomes a reality, the possibilities will be limitless.

NVIDIA’s New Suite Of Products

NVIDIA is getting us much closer to this new AI future. Proof of this was the unveiling of a range of groundbreaking products and initiatives at the CES event in Las Vegas.

New Chips

Nvidia introduced the GeForce RTX 50 Series GPUs, powered by the cutting-edge Blackwell architecture. These GPUs feature DLS44 technology and AI multi-frame capabilities for enhanced efficiency. The flagship RTX 5090 is priced at $1,999, while the more affordable RTX 5070 is available at $549.

New Auto Partnerships

The company announced exciting new collaborations with major automotive players, including Toyota, which will leverage Nvidia's DriveOS for autonomous vehicle development. Additionally, Nvidia is partnering with Aurora to advance autonomous truck technologies.

Project DIGITS

Nvidia revealed Project DIGITS, an AI supercomputer boasting the capability to independently run 200 billion parameters. Priced at just $3,000, these systems aim to lower the cost of AI operations and reduce reliance on cloud-based solutions.

The Cosmos Model

Finally, Nvidia introduced Cosmos, an advanced AI model designed to generate photorealistic videos and images. This innovation aims to create virtual environments where autonomous systems can be trained effectively.

Picks And Shovels For The Future

I was personally quite impressed by NVIDIA’s showcase at the CES. The company is clearly working hard to stay ahead of the curve, and providing massive value to its customers.

I am particularly bullish on the Cosmos Model and Project DIGITS. Let’s crunch some numbers.

AI PC’s For Everyone

According to MarketResearchFuture, the AI supercomputer market is projected to grow at a compound annual growth rate (CAGR) of 19.18% between now and 2034, reaching an impressive size of $38.79 billion by 2034.

This is far from insignificant. If Nvidia maintains dominance in this space, it could contribute several billion dollars annually to the company’s bottom line. However, these estimates might ultimately prove conservative.

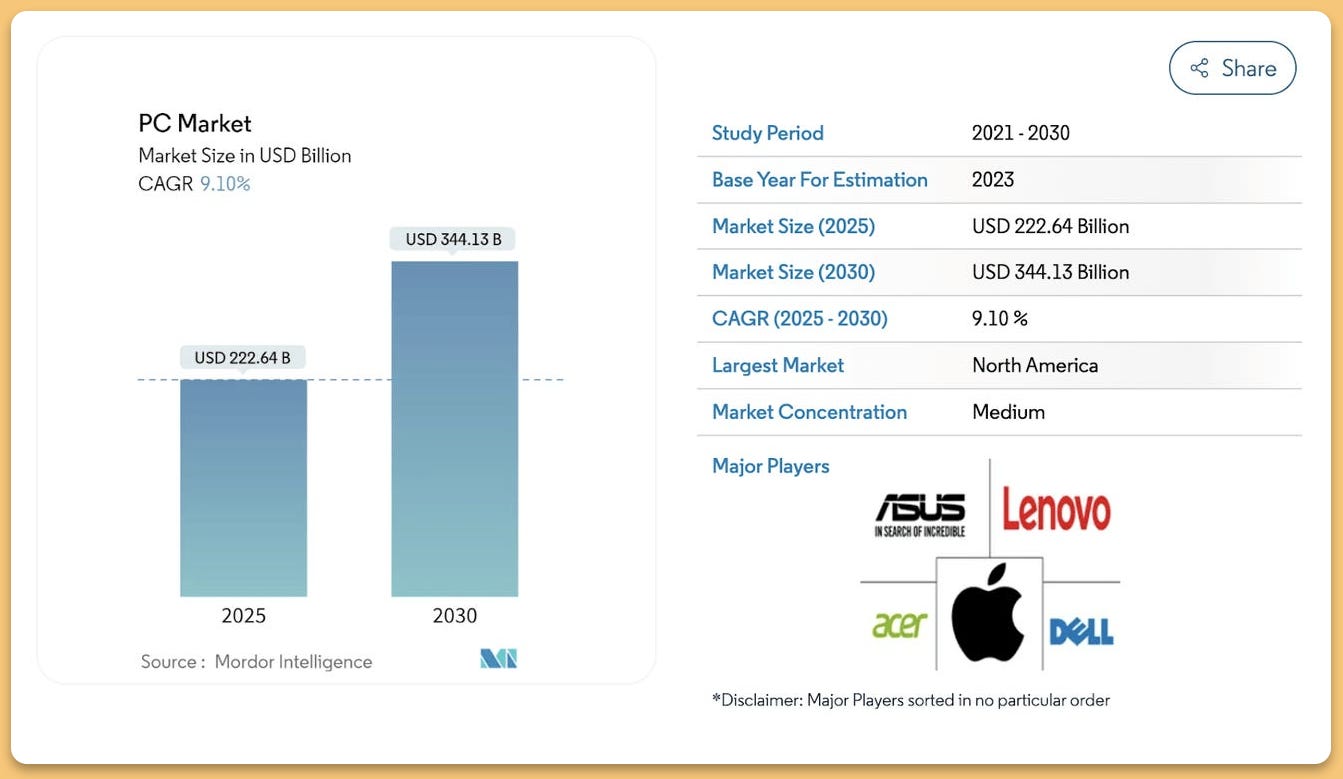

The current PC market, valued at $222 billion, is projected by Mordor Intelligence to grow to over $344 billion by 2030. But the key question remains: how many of these PCs will incorporate AI capabilities?

If just 25% of PCs are AI-powered by 2030, that would represent an $86 billion market. With Nvidia already commanding around 90% of the GPU market share, capturing even 50% of this segment seems plausible. This could translate into more than $40 billion in additional revenue for Nvidia by 2030.

NVIDIA’s Cosmos Model; A GPU In Every Car

The Cosmos Model will likely lay the groundwork for breakthroughs in the autonomous vehicle space. It’s just a matter of time before autonomous vehicles begin to dominate the market.

Zion estimates this market will grow at nearly a 20% CAGR, reaching $251 billion by 2032. It’s likely NVIDIA hardware will become quite commonplace, and this is only the beginning.

AVs will lay the foundation for much more interesting advances in robotics. Once machines can interact seamlessly with their environment, Physical AI will become reality, and the sky truly will be the limit.

China, Trump And Other Risk Factors

The Biden administration has implemented stringent export controls to limit the sale of advanced AI chips to countries like China and Russia, aiming to protect U.S. national security and maintain technological leadership. These measures have faced criticism from industry leaders, including Nvidia, who argue that such restrictions could hinder innovation and economic growth.

As President-elect Donald Trump prepares to assume office, there is speculation about potential shifts in chip policy. While specific plans remain unannounced, Trump's previous administration was known for imposing tariffs and trade restrictions on China, particularly concerning technology and intellectual property.

For companies like Nvidia, these policy directions could have significant implications. Continued or heightened restrictions may limit access to key markets, affecting revenue and global operations. Conversely, a policy shift towards promoting domestic AI development could present new opportunities within the

Valuation

Hopefully, we’ve proven by this point that NVIDIA continues to be a dominant player in a highly exciting market and fast-growing market.

And yet, it seems like excitement over the company has fizzled out. After such a monumental rally, it’s normal to expect some consolidation, but NVIDIA actually looks cheap to me now.

The market appears eager to assign a premium to anything tech-related, even highly speculative areas like quantum computing.

Meanwhile, Nvidia continues to deliver profitable growth with no indication of slowing down.

With a PEG ratio of 0.24 and a forward PEG of 1.24, the company seems undervalued.

At the very least, it offers a compelling opportunity to own a business with immense potential at a reasonable price.

Final Thoughts

Nvidia stands at the forefront of the AI revolution, consistently delivering innovations that redefine industries and pave the way for transformative change. From cutting-edge GPUs to groundbreaking projects like Cosmos and DIGITS, the company is not only shaping the AI landscape but also creating immense value for its stakeholders.

With the AI supercomputer market and AI-powered PC segments poised for exponential growth, Nvidia is well-positioned to capture significant market share. While geopolitical risks and policy shifts pose challenges, Nvidia’s adaptability and relentless innovation continue to drive its success.

At its current valuation, Nvidia presents a compelling opportunity for investors seeking exposure to one of the most dynamic and promising sectors of the global economy. The future of AI is bright, and Nvidia is leading the charge.

Disclaimer: This article is for informational purposes only and does not constitute financial investment advice. Always do your own research and consider your financial situation before making investment decisions.

Remember what goes up must come down (eventually)

Stay safe and invest wisely and this is in no mean financial advice. [Full Disclaimer]Thank you for supporting this newsletter. It will keep improving.

Harry