Tesla's Robotaxi Gamble and the Uber Killer? - Make-or-Break of the next Decade

💥 The Ultimate Test for Autonomous Driving 💰

Tesla’s Robotaxi event is upon us, and this will be a huge moment in the company’s history.

After months of telling investors Tesla is “transitioning” to AI, it’s time for Musk to deliver some results.

So what will investors be looking for at Thursday’s event?

Why is this moment so important for Tesla?

How will the stock price react?

And, as always, how can we benefit?

It’s time to put the piece of the Puzzle together.

But first, a little bit about me, The Pragmatic Investor

An approach that assesses the truth of meaning of theories or beliefs in terms of the success of their practical application.

That is Pragmatism, and it guides my investment philosophy.

Through many years of analyzing markets, I have found this is what works.

The Pragmatic Investor sticks to what works. The problem is there are thousands of different strategies that CAN work for certain people.

But simplicity is key, and that is why I have narrowed down my investing ethos into three key ideas, which combined create what I like to call, The Pragmatic Investing Pyramid.

Macro, Fundamentals and Technical.

This is the three-pronged approach that has helped me beat markets over the seven years.

For long-term investing, there’s nothing better than understanding business cycles, macroeconomic trends and geopolitics.

On the other hand, when it comes to short-term moves in markets, the best tool we have is technical analysis.

And not just a specific form of technical analysis but a robust set of tools that can all work in conjunction to help us find great setups.

I actually recently designed my own algorithm, you can see it here:

My Substack is designed to guide investors of all levels in their journey.

Understand markets with the weekly newsletter.

Build a diversified global portfolio that will stand the test of time.

Get actionable trade ideas to take your investment returns to the next level.

Every week I give a macro update, a technical analysis update on the main indexes and stocks and I cover a stock in-depth, looking at its fundamentals.

Robotaxi Event: What Do We Know?

Tesla’s highly anticipated Robotaxi event, "We, Robot," is just days away, happening on Thursday, October 10th at Warner Bros. Discovery Studios in Hollywood. Those who RSVP after receiving invites from the shareholder raffle can expect their tickets a couple of days before the event.

Tesla’s been prepping intensively, gathering FSD data in Los Angeles and surrounding areas like San Francisco and the Bay Area. Camouflaged Robotaxi prototypes have been spotted at the Studio grounds and elsewhere, adding to the buzz.

There’s plenty to look forward to.

Tesla’s Robotaxi, tentatively called Cybercab, might be a compact two-seater, somewhat resembling the Model 3 in body style. However, it's expected to be a stripped-down, production-efficient vehicle, built for autonomous driving without the luxury features like rotating seats or massive displays. Tesla is likely focusing on functionality and affordability, meaning a single screen in the middle may be the norm.

One of the big attractions is a possible hands-on experience, where attendees could summon a Robotaxi using their Tesla app. Tesla’s been tight-lipped about the full details, but wireless EV charging patents and some speculations about the Robotaxi network have surfaced, fueling excitement. We also anticipate insights into Tesla's FSD hardware and how they plan to manage a fully autonomous fleet.

There’s much we still don’t know, but one thing’s for sure: this event is set to showcase the future of mobility in a big way.

Why Is This So Important?

Tesla isn’t being valued like your typical automaker. Instead, the market sees it as an AI and robotics company, which is why its valuation is so high.

If Tesla were priced like other auto companies—say, at a 10-20x price-to-earnings ratio—the stock would be trading much lower, at around $30-60 per share. But the real value investors are betting on is Tesla’s future in autonomy—FSD, Dojo, Optimus.

Without those, Tesla’s market cap would likely be under $200 billion. The $500 billion difference? That’s what’s being ascribed to its AI ambitions.

Elon Musk has made it clear: Tesla’s value lies overwhelmingly in its autonomy potential. If you don’t believe they’ll solve full self-driving, you shouldn’t own the stock. But if they do, Tesla’s worth could go through the roof—possibly into the trillions, especially with long-term plays like Optimus.

The bet on Tesla is simple: autonomy or bust.

Can Tesla Win the Autonomy Race?

Tesla's Robotaxi venture faces significant hurdles, both financial and competitive. Building a large fleet would require enormous upfront investment, with Tesla needing up to $30 billion to manufacture 1 million Robotaxi .

This cost could strain Tesla’s resources, requiring external capital to scale effectively. Moreover, Tesla faces stiff competition from deep-pocketed rivals like Amazon’s Zoox and Alphabet’s Waymo, both of which have advanced in the Robotaxi space.

Tesla’s advantage, however, resides in its already-established production capacity and its seemingly superior technology, which can’t be underestimated.

For starters, Tesla’s Dojo supercomputer is accumulating miles faster than anyone else.

Tesla’s Full Self-Driving (FSD) software is a core competitive advantage, continuously improving as it accumulates more real-world driving data. Each Tesla vehicle acts as a data-generating unit, contributing valuable information to train Tesla’s machine-learning models.

Elon Musk has even suggested that Tesla could sell cars at a loss and still extract value from this extensive data network. This network is key to Tesla’s future ambitions, including potentially operating a large fleet of Robotaxis, leveraging its ever-growing pool of autonomous driving data.

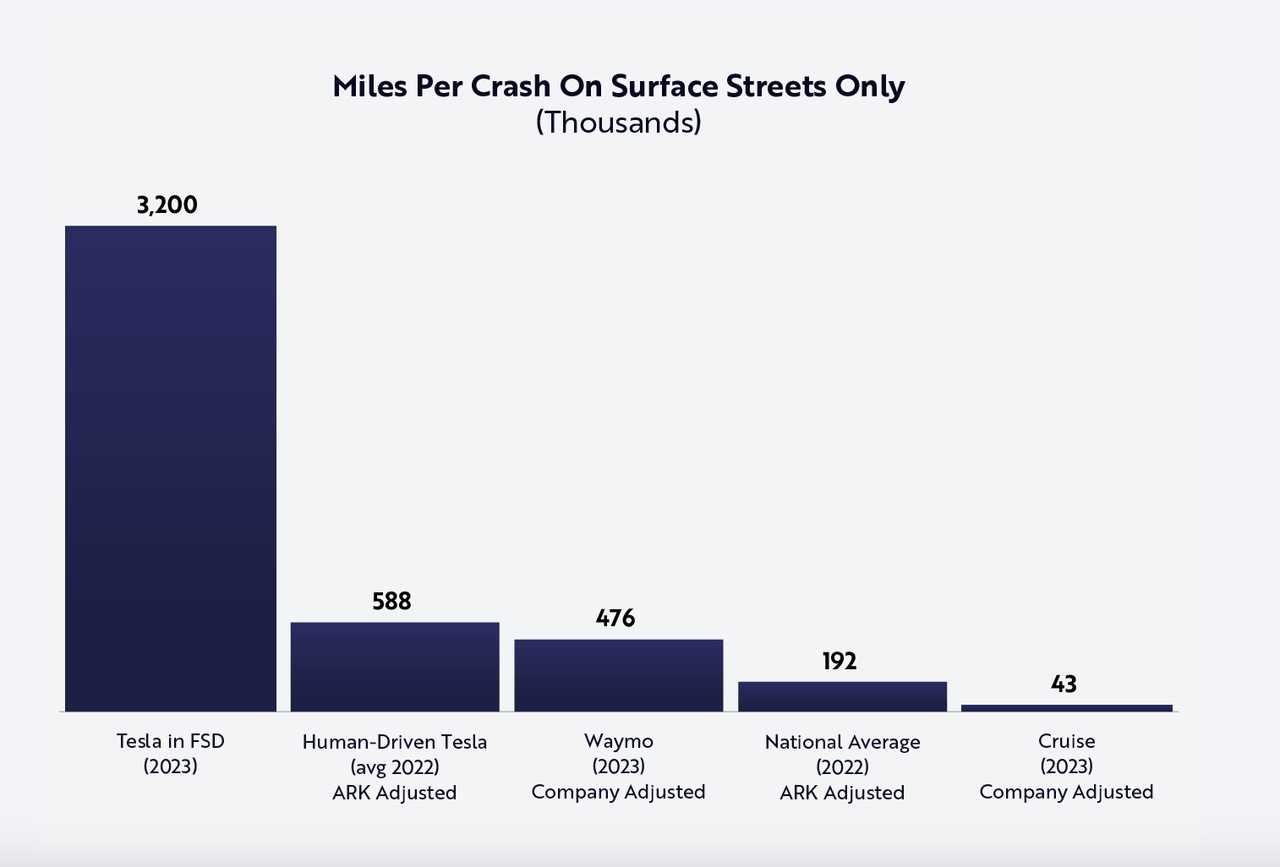

And though Tesla’s FSD is far from perfect, Ark’s data suggests it is indeed the safest.

So, while Tesla has advantages like production efficiency and technology, other tech giants have operational strengths, capital, and user integration capabilities that Tesla currently cannot match.

It will be a tight race, but one Tesla can win, and we will know a lot more about it after Robotaxi Day.

Is Tesla Stock A Buy?

Now, let’s try to apply our three-step process to Tesla stock, by digging into the macro, fundamentals and technical analysis.

The EV and AI markets

From a macro perspective, as pertains to Tesla, we have to analyze the outlook for the EV market and also its potential AI innovations.

BNEF forecasts global EV sales will continue growing but at a slower rate. From 13.9 million in 2023, sales are expected to surpass 30 million by 2027. While growth averaged 61% from 2020 to 2023, it’s projected to slow to 21% annually through 2027. By then, EVs will make up 33% of global new passenger vehicle sales, with China leading at 60% and Europe at 41%. This shift highlights the expanding adoption of EVs, though the pace of growth is tempering compared to earlier years.

So, while the EV industry is still in growth mode, this has certainly slowed down in the last few years, which is perhaps why Tesla is looking to move beyond this industry.

So what about AI?

The truth is Tesla has some pretty exciting AI projects and “other bets”, including:

Dojo Supercomputer

Energy Business

Optimus

The Optimus Gen 2 humanoid robot is Tesla's latest leap into robotics, designed to walk and perform basic tasks. Its potential is immense.

The global robotics industry is projected to reach $270 billion by 2032. Musk noted that Tesla is already the largest robot maker in the world, as their cars are essentially four-wheeled robots, suggesting that Tesla is well-positioned to lead the robotics revolution in the coming years.

Tesla’s Fundamentals

Fundamentally speaking, where’s Tesla at though? We have to dig into the growth, profitability and valuation.

In the chart above, we can see Tesla’s stock chart, below the PS ratio, then revenue growth and then operating margins.

It’s not hard to see, why Tesla’s stock has struggled to move up.

Revenue growth began to plateau back in 2023 and margins have actually been decreasing all of which has lead to a reduction in the PS multiple.

However, we may be seeing signs of a reversal since around Q1-Q2 of this year. Margins have begun to turn up and revenue has recovered.

Moving forward the revenue and margins may be completely different and unpredictable as Tesla is undergoing a deep transformation.

But it does seem like the worst could have already been priced in.

Technical Analysis

Lastly, a quick look at the technical.

What we can see here is the chart for Tesla on Trenspider, where I developed my own proprietary algorithm using MACD, RSI and EMAs.

As we can see, this algorithm has managed to outperform a buy-and-hold strategy by quite a margin and the algo had us go long near the recent lows.

Right now, we are holding support just above the 50 EMA on the 4h chart, but Tesla has failed to break above the $260 area for a second time.

IMO, the Robotaxi event could be the catalyst that helps us gap above this level, and begin a rally to new highs.

If we look at the bottom right, we can also see seasonality data for Tesla, and Nov and December have generally been strong months for Tesla.

Final Thoughts

Tesla’s "We, Robot" event on October 10th promises to showcase its ambitious plans for autonomous Robotaxis. With potential hands-on experiences, wireless EV charging, and insights into Tesla’s Full Self-Driving (FSD) technology, the event could mark a significant leap in autonomous mobility.

Tesla’s ability to gather extensive real-world driving data through its FSD-enabled vehicles gives it an edge, though scaling a Robotaxi fleet will require massive investment and faces competition from giants like Amazon and Alphabet.

The event will offer a clearer picture of Tesla’s roadmap toward autonomy and its competitive standing in the AI-driven mobility space.

Subscribe to The Pragmatic Investor

By James Foord · Launched 2 years ago

Macroeconomics, fundamental stock analysis and technical charts. These are the three foundations of the Pragmatic Investing Pyramid.

Disclaimer: This article is for informational purposes only and does not constitute financial investment advice. Always do your own research and consider your financial situation before making investment decisions.

Remember what goes up must come down (eventually)

Stay safe and invest wisely and this is in no mean financial advice. [Full Disclaimer]Thank you for supporting this newsletter. It will keep improving.

Harry

Let's focus on what really matters: the $500 billion question. That's the premium the market's slapping on Tesla for its AI potential. This could be a make-or-break moment for Tesla's AI ambitions.

If they nail it, we could be looking at the next trillion-dollar tech giant. But if they fumble, that $500 billion premium could evaporate faster than you can say "autonomous driving."

Watch this event, sure, but don't forget the fundamentals. What Tesla needs to show is that they can turn AI promises into cold, hard cash flow. Until then, tread carefully.