Strategy For Stagflation - Companies And Sectors To Watch - [Guest Post]

A Trumpcession Is Coming?

Hi and welcome back for a guest analysis. [Full Disclaimer]

TL;DR

The markets are flashing warning signs, and the latest economic data suggests we may already be in a recession. Stocks are selling off, job cuts are rising, and the wealth effect that kept consumers strong is beginning to unwind. Historically, investors have relied on the Fed to step in with rate cuts and stimulus, fueling market rebounds. But this time could be different.

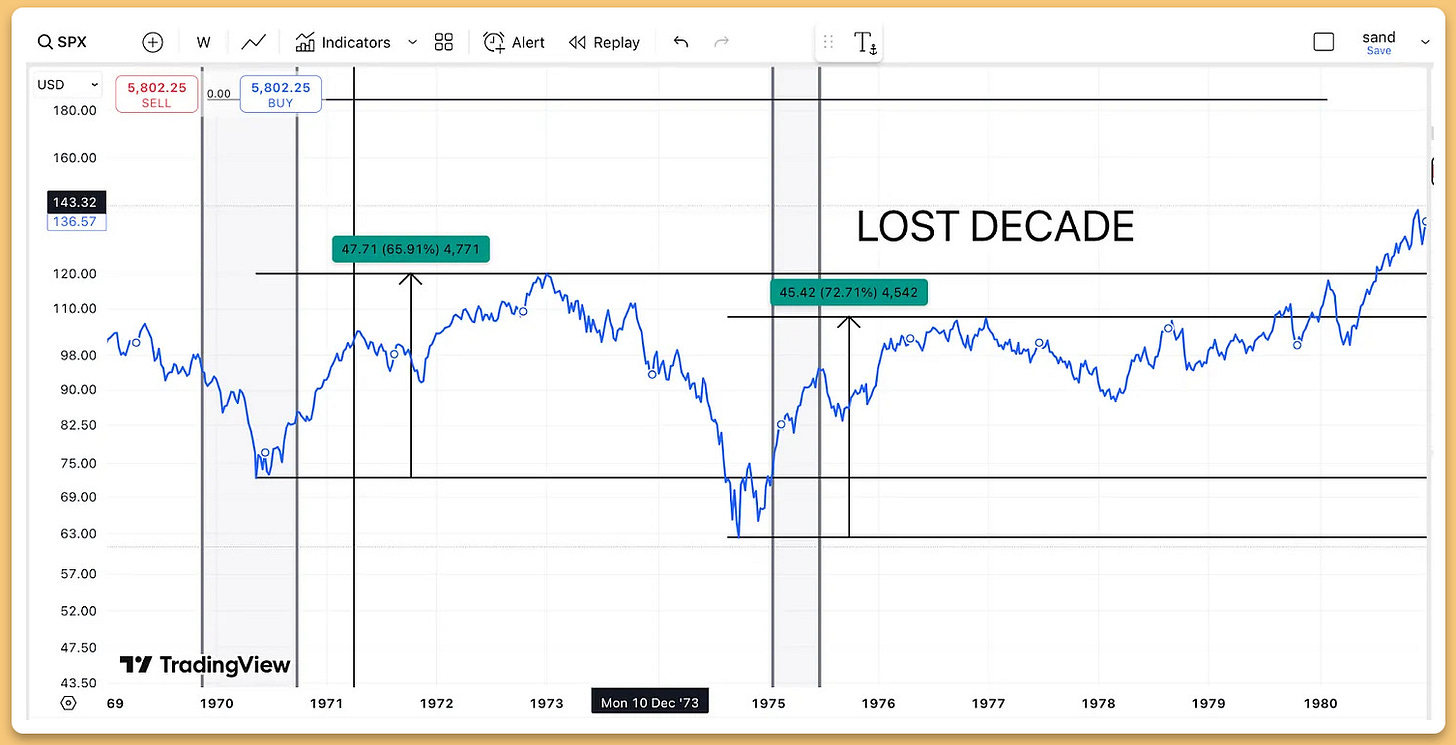

Inflation remains stubbornly high, and long-term yields continue to rise. Could we be on the brink of a lost decade, much like the 1970s? If so, investors will need a new playbook to navigate what’s ahead.

Expect to Learn:

Why the latest GDP and job market data signal an economic downturn.

How inflation and bond yields could trigger a long-term market reset.

What made the 1970s a lost decade—and why history may be repeating.

Which assets thrive in stagflation and how to position for survival

Keep reading to uncover why the usual strategies may no longer work—and what to do next.

But first, a little bit about me, The Pragmatic Investor

An approach that assesses the truth of meaning of theories or beliefs in terms of the success of their practical application.

That is Pragmatism, and it guides my investment philosophy.

Through many years of analyzing markets, I have found this is what works.

The Pragmatic Investor sticks to what works. The problem is there are thousands of different strategies that CAN work for certain people.

But simplicity is key, and that is why I have narrowed down my investing ethos into three key ideas, which combined create what I like to call, The Pragmatic Investing Pyramid.

Macro, Fundamentals and Technical.

This is the three-pronged approach that has helped me beat markets over the seven years.

For long-term investing, there’s nothing better than understanding business cycles, macroeconomic trends and geopolitics.

On the other hand, when it comes to short-term moves in markets, the best tool we have is technical analysis.

And not just a specific form of technical analysis but a robust set of tools that can all work in conjunction to help us find great setups.

I actually recently designed my own algorithm, you can see it here:

My Substack is designed to guide investors of all levels in their journey.

Understand markets with the weekly newsletter.

Build a diversified global portfolio that will stand the test of time.

Get actionable trade ideas to take your investment returns to the next level.

Every week I give a macro update, a technical analysis update on the main indexes and stocks and I cover a stock in-depth, looking at its fundamentals.

A Trumpcession Is Coming

With the latest market sell-off, it seems like a lot of investors are pricing in a growth slowdown, and perhaps even a recession.

It’s hard to deny the mounting evidence.

Recession Signs Emerging – The Atlanta Fed’s GDPNow model is signaling economic contraction, even though other GDP measures remain more optimistic. Historically, GDPNow has been among the most reliable indicators.

The most recent Jobs data from the Challenger Jobs shows a big increase in job cuts, and this usually precedes a big increase in initial jobless claims.

Wealth Effect and Market Selloff – The strength of the consumer has been supported by asset price inflation post-COVID. However, a major stock market decline could create a negative wealth effect, reducing spending and further worsening economic conditions.

This is already unfolding. Trillions have been wiped away from the market. A lot of people believe market sell-offs precede the recession, because they are forward-looking, while in reality, they are a big contributing factor.

Plus, in the next few months, we’ll truly begin to feel the effects of DOGE policies and tariffs

The Fed Won’t Save Us This Time

If a recession is truly underway, then all we have to do is wait and buy the dip right?

This has been the mantra of the last 20 years, and it has worked wonders with the help from the Fed.

But I fear this time could be very different. Recession is already running hotter than expected, as we saw in the last CPI print. And most importantly, inflation expectations are already heading much higher.

Inflation is a highly psychological factor. Before, COVID this phenomenon was unknown to investors, but the latest inflationary bout has, for lack of a better term, left investors scarred.

Next time the Fed begins to lower interest rates and even buy assets (Quantitative easing) the market reaction could be very different.

If inflation explodes higher, then don’t expect stocks to simply bounce higher like they do whenever the Fed starts printing.

Instead, we could see a much more challenging environment, akin to the “Lost decade we witnessed in the 1970s.”

The tale-tale signs will be what happens to long-term yields.

The Lost Decade: A Return to 1970s Stagflation?

High inflation inevitably drives bond yields higher. As inflation expectations become entrenched, bond markets demand greater compensation, leading to structurally higher interest rates. If this cycle repeats, the next leg up in yields could push the 10-year Treasury beyond 7%, reminiscent of the 1970s.

In that era, inflation surged, cooled temporarily due to a recession, and then roared back stronger—dragging yields higher and crushing equity returns. If history rhymes, we could be on the cusp of another lost decade for stocks.

While the S&P 500 remained range-bound for much of the 1970s, it still experienced significant rallies. However, those who bought at the peaks often saw their returns eroded by inflation and rising bond yields.

Several structural factors point toward a similar outcome:

Equity Allocation Peaks: The percentage of financial assets allocated to stocks has surpassed 40%—a level last seen before the 1970s stagflation and the 2000 dot-com bust, both of which led to prolonged periods of weak market performance.

Valuation-Driven Low Returns: Forward P/E ratios suggest that expected annual returns for the S&P 500 over the next decade could be close to zero in real terms. This aligns with historical precedents where periods of high valuation, followed by economic stress, resulted in stagnant equity markets.

This environment is one where a buy-and-hold strategy could deliver lacklustre returns for an entire decade. Investors who can adapt to cycles of inflation, rate cuts, and market corrections may fare better than those who simply ride out the storm.

What Assets Do Well In Stagflation?

Stagflation is characterized by high inflation and slow economic growth. This poses a challenge for investors, as traditional stock and bond portfolios often struggle.

However, certain assets historically perform well in such an environment:

Commodities & Hard Assets: Inflation boosts prices for real assets like gold, oil, and industrial metals, making them strong hedges. During the 1970s stagflation, gold surged over 1,500%, while oil prices skyrocketed.

Inflation-Protected Bonds: Treasury Inflation-Protected Securities (TIPS) and short-term bonds help preserve capital while providing real returns.

Value Stocks & Defensive Sectors: Companies with strong cash flows, such as consumer staples, utilities, and healthcare, tend to outperform growth stocks as rising rates compress valuations.

Real Estate & REITs: While higher interest rates can hurt the housing market, real estate with inflation-linked rental income (like apartments and commercial REITs) often maintains value.

Some Alternative Assets: Bitcoin and other scarce digital assets are gaining traction as inflation hedges. Bitcoin specifically, could do well as the world begins to recognize the asset as digital gold.

Final Thoughts

The warning signs are clear—rising job cuts, market sell-offs, and economic slowdown signals point to an incoming recession. Unlike past downturns, the Fed’s usual playbook may not work. Inflation remains high, and rate cuts could fuel another inflationary surge, driving bond yields even higher.

Much like the 1970s, we could be facing a lost decade where stocks struggle to generate real returns. Investors may need to pivot toward inflation-resistant assets like gold, oil, and defensive stocks. If inflation surges again, markets won’t rally as before—this time, a far more challenging investment environment may be ahead.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always do your own research and consider your financial situation before making investment decisions.

Remember what goes up must come down (eventually)

Stay safe and invest wisely and this is in no mean financial advice. [Full Disclaimer]Thank you for supporting this newsletter. It will keep improving.

Harry