Palantir Technologies +60% - Evaluating the Path to a $50 Price Target?

Company's market capitalization stands at approximately 81.06 billion

Palantir Technologies (NYSE: PLTR 0.00%↑ ) has been a topic of intense interest among investors, with its stock demonstrating significant volatility and growth potential. The question on many minds is whether Palantir is heading toward a $50 price target. Let's dig into the latest data and analyses to understand the factors that could influence this trajectory.

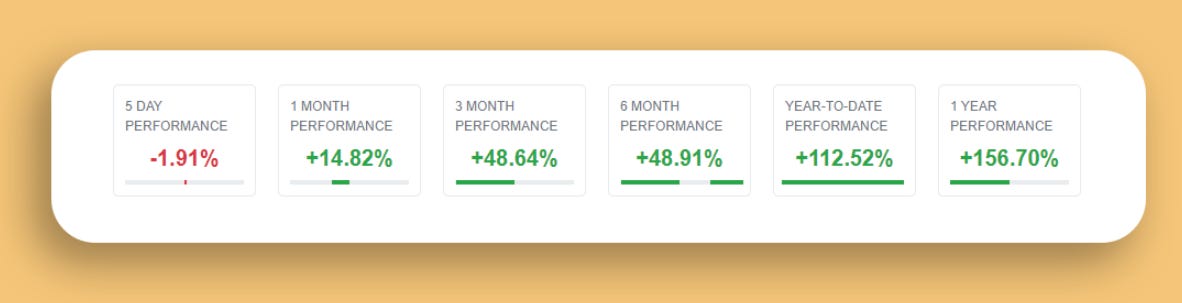

Overview of Recent Stock Performance

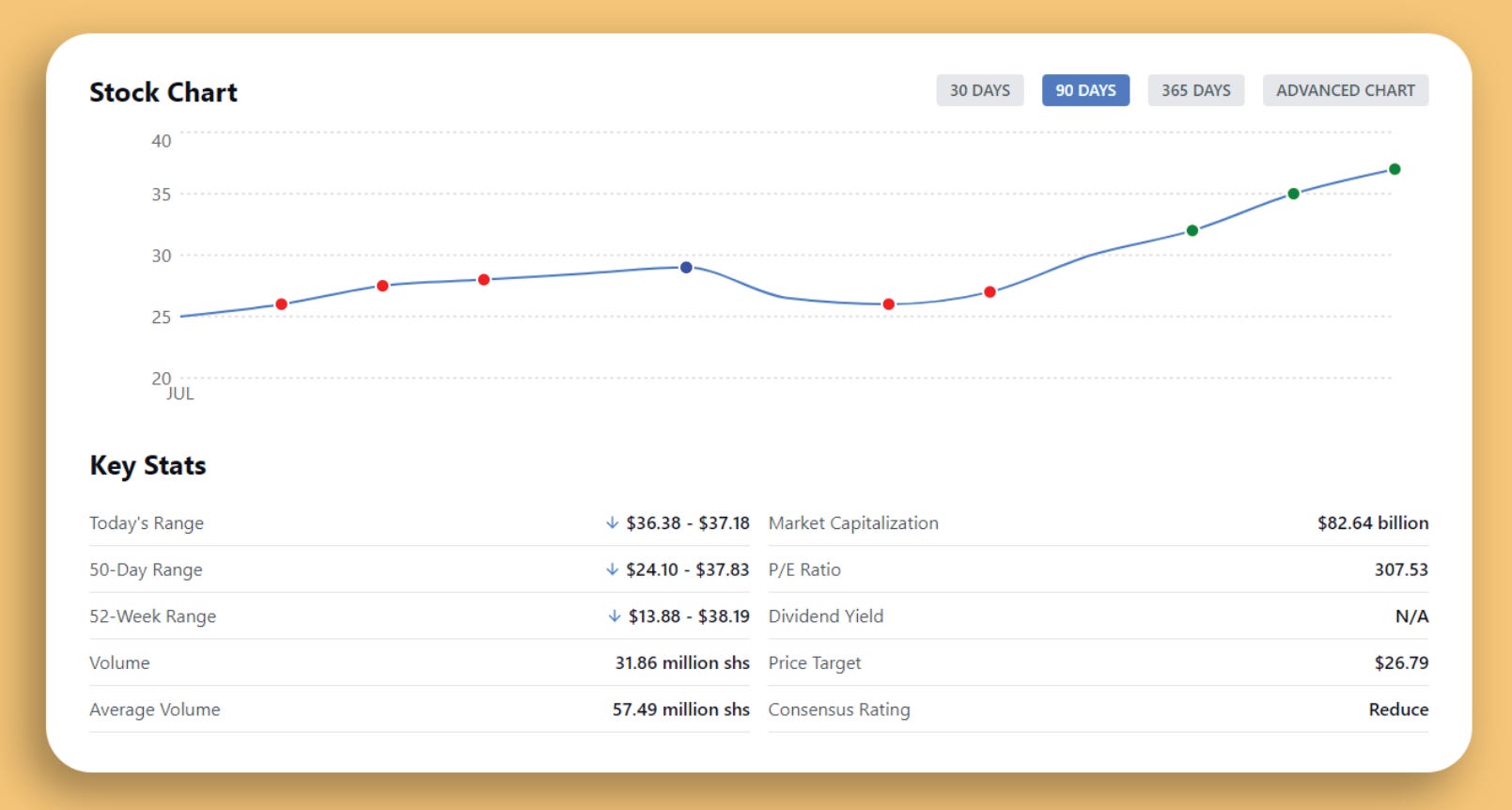

As of September 25, 2024, Palantir's stock is trading at $37.12, reflecting a slight decrease of -0.30% from the previous trading session. The company's market capitalization stands at approximately $81.06 billion, positioning it as a significant player in the technology sector.

ICYMI

Technical Analysis

An examination of Palantir's stock chart over the past year reveals a pattern of sharp gains followed by periods of consolidation. The stock has formed higher highs and higher lows, which is typically considered a bullish signal.

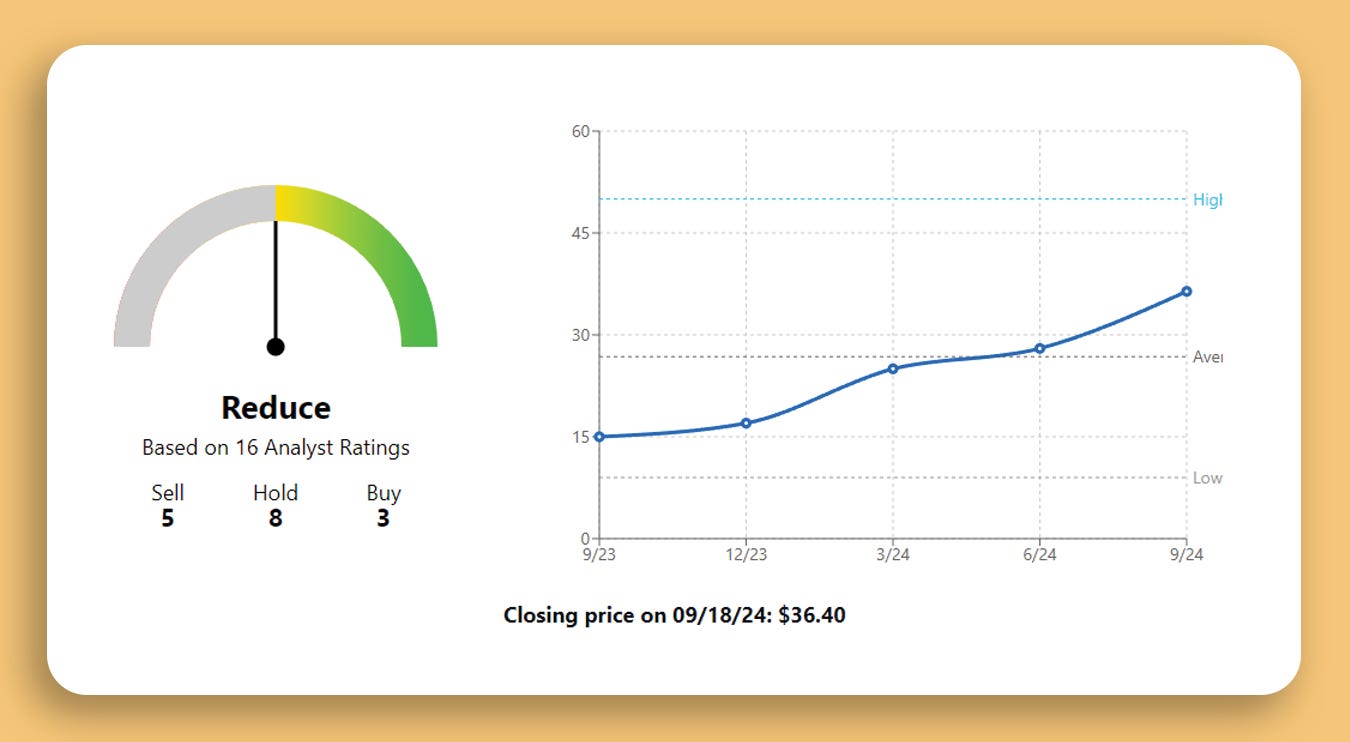

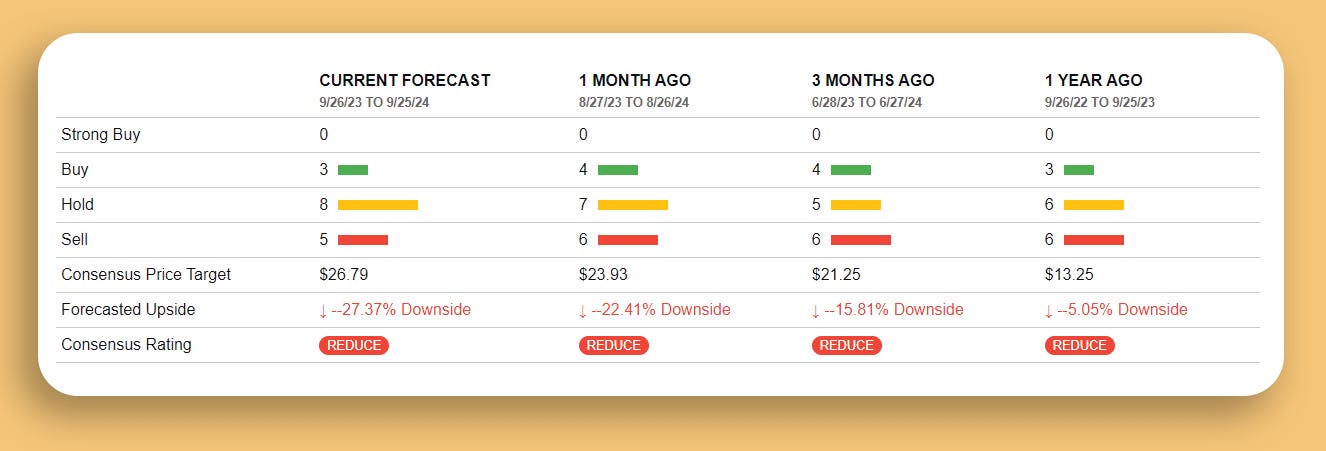

Analyst Ratings and Price Targets

Palantir Technologies Stock Price Performance

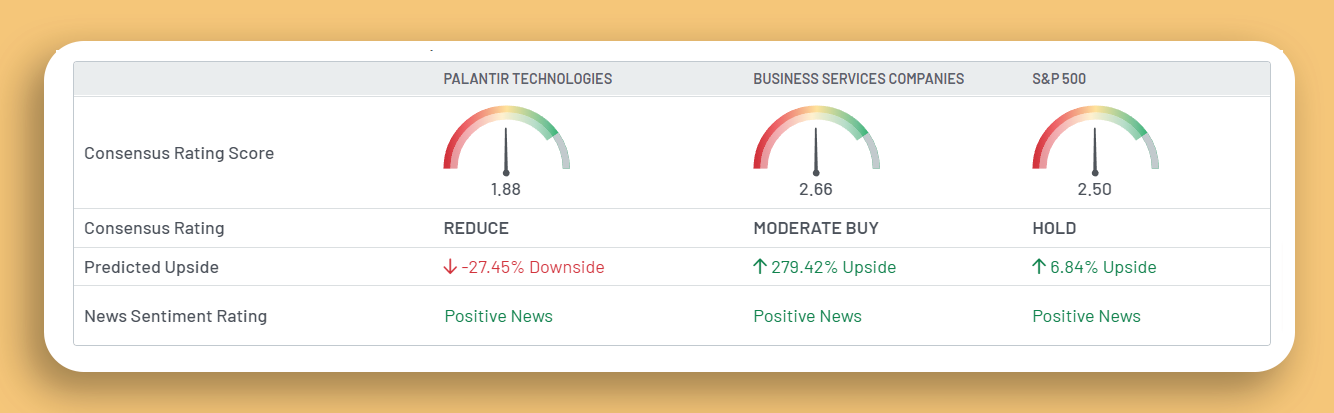

Consensus Rating

According to data compiled from 16 Wall Street analysts, Palantir currently holds a consensus rating of "Reduce":

Sell Ratings: 5

Hold Ratings: 8

Buy Ratings: 3

This consensus suggests a cautious outlook from analysts, with a majority recommending holding or selling the stock.

Consensus Price Target

The average 12-month price target among these analysts is $26.79, which implies a potential downside of -27.01% from the current price. The price targets vary significantly:

High Estimate: $50.00

Low Estimate: $9.00

The high estimate of $50.00 represents a bullish outlook, suggesting substantial growth potential, while the low estimate indicates concerns about a significant decline.

Key Factors Influencing Palantir's Prospects

Bull Case Considerations

Consistent Revenue Growth: Palantir has demonstrated steady revenue increases over recent quarters, highlighting strong demand for its data analytics platforms.

Strategic Positioning: The company's specialization in big data analytics and its contracts with government agencies and commercial clients position it favorably in a data-driven economy.

Market Expansion: Palantir's ongoing expansion into new industries and international markets could drive future revenue growth.

Bear Case Considerations

High Valuation Metrics: With a P/E ratio of 303.33, Palantir appears overvalued compared to industry averages, raising concerns about the stock's current price justification.

Stock Volatility: A beta of 2.72 indicates that Palantir's stock is highly volatile, which may not suit risk-averse investors.

Analyst Skepticism: The predominance of sell and hold ratings suggests that many analysts are wary of the company's ability to meet high growth expectations.

Recent Developments

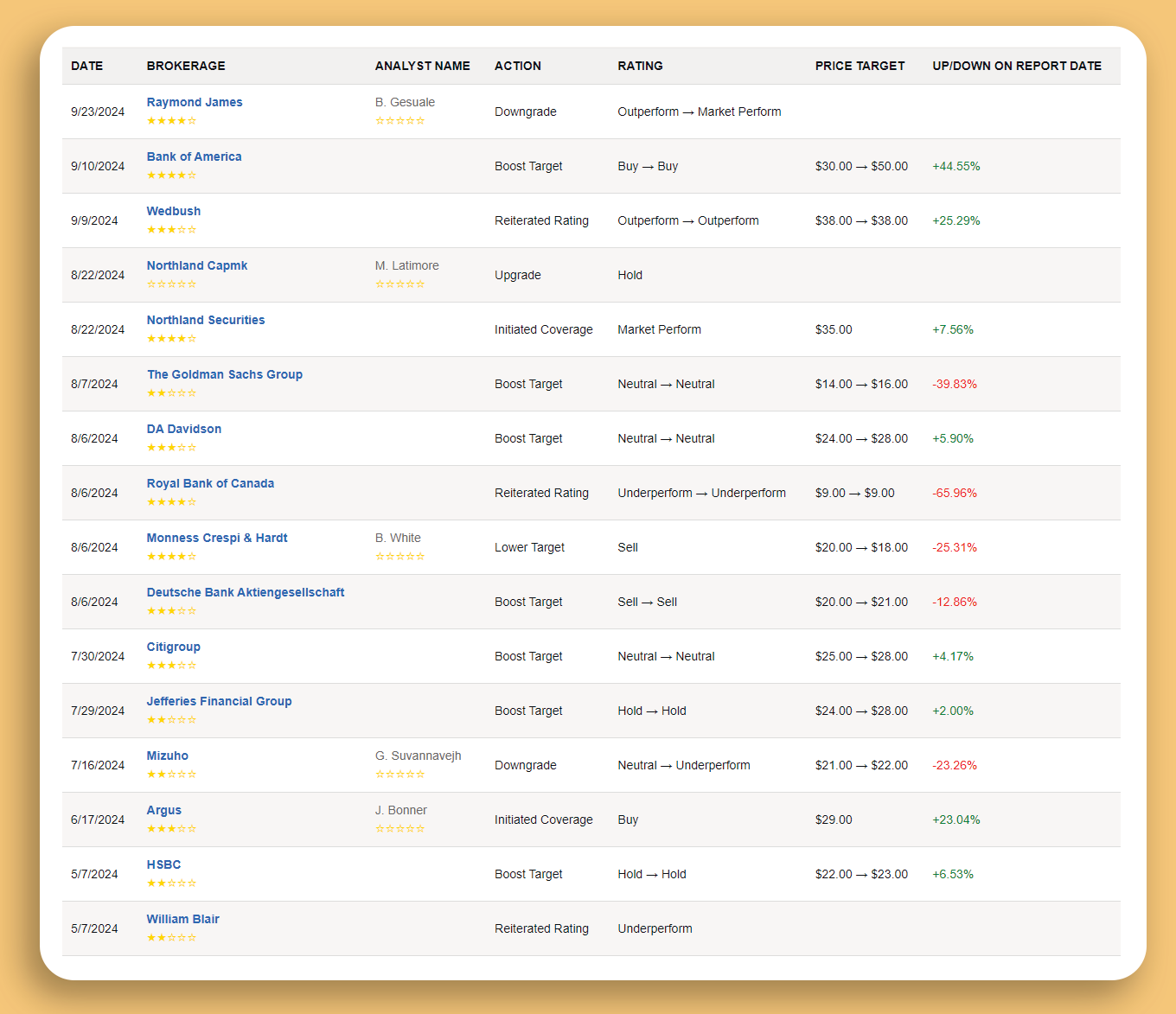

Analyst Actions

Bank of America upgraded its price target from $30.00 to $50.00, reflecting a significant bullish stance.

Raymond James downgraded the stock from Outperform to Market Perform, indicating a more cautious outlook.

Mizuho downgraded Palantir to Underperform, highlighting potential challenges ahead.

Inclusion in the S&P 500

Palantir's addition to the S&P 500 index is a notable milestone. This inclusion often leads to increased exposure and investment from institutional funds that track the index, potentially providing underlying support for the stock price.

Market Sentiment and News

News sentiment around Palantir remains positive, with coverage focusing on the company's growth initiatives and strategic partnerships. However, investors should remain mindful of the broader market conditions and sector-specific risks.