Hi dear investors and welcome to Eltoro Market insights.

First don’t miss out our fully back tested simple portfolio to build you kids wealth!

Money Makes Money!

Unlocking the Secrets of Wealth Building

Have you ever heard these phrases? Money makes money. The rich get richer. The more you have, the more you make. Today, I'm taking you behind the scenes to reveal why these sayings exist and why your net worth skyrockets at 100K. I'll give you tips to reach this crucial number and what to focus on along the way.

Why Does Your Net Worth Explode at 100K?

Let's start with the big question: Why does your net worth explode at 100K? Many believe reaching this threshold unlocks exclusive opportunities leading to better investments and higher returns. But that's not the whole story. There are two critical factors at play, neither related to investment access.

The First Reason: Scale of Capital

Let's talk about the scale of capital. Imagine three scenarios, all with a 10% annual return:

Invest $1,000: after a year, you have $1,100 - a $100 profit.

Invest $10,000: it grows to $11,000 - $1,000 profit.

Invest $100,000: it becomes $110,000 - a whopping $10,000 profit.

Same percentage, vastly different results. This is the power of scaling capital. Larger investments mean bigger absolute returns, accelerating your wealth growth.

The Second Reason: Compound Interest

Now, let's explore the eighth wonder of the world: compound interest. It's not just earning on your principal but also on the interest you've already gained. Let's break it down:

Save $1,000 monthly at 8% annual return. After 7 years, you hit $100,000. Sounds slow, right? But watch this. The next $100,000 takes just 4 years. The following? Just over 3 years.

Each milestone comes faster as your money works for you, then that money works for itself, creating an unstoppable cycle. At $1 million, you're earning an extra $100,000 in interest alone in just over a year.

$100,000 at around 7 years

$200,000 at around 11 years

$300,000 at around 14 years

$1,000,000 at about 20 years

The Challenge of Getting Started

The beginning is the toughest; you're doing all the heavy lifting. That's why early financial advice focuses on penny-pinching and deprivation. Every small win feels hard-earned. But these small victories add up to your first 100K. After that, success snowballs and wealth-building becomes easier.

How to Accelerate Your Journey to 100K?

So, how can you accelerate this process if you're not at 100K yet?

Tip 1: Increase Your Investment Time

Want to supercharge your journey to financial freedom? Let's break down a powerful strategy using a realistic scenario:

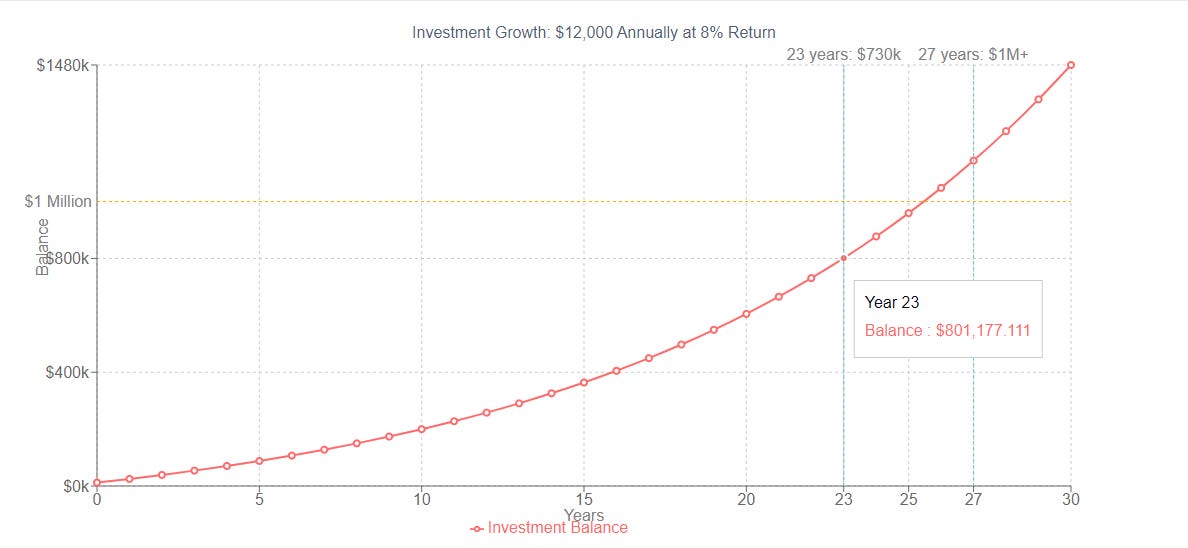

You earn $60,000, investing 20% or $12,000 annually. After 23 years at 8% return, you'll have $730,000. But just four more years pushes you over $1 million. The real gains come later, so start now. Every day you wait is a missed opportunity. Time is your greatest ally. Start with what you have, no matter how small. Think of it as a snowball rolling downhill, gaining size and speed until it's an unstoppable force with exponential gains.

The Scenario:

✅ Annual Income: $60,000

✅ Investment: 20% of income ($12,000 per year)

✅ Return Rate: 8% annually

The Power of Time

Here's where it gets exciting:

🚀 After 23 years: Your investment grows to $730,000

🚀 Just 4 more years: You blast past $1 million!

Patience Pays: The real gains come later in your investment journey.

Start Now: Every day you wait is a missed opportunity for growth.

Consistency is Key: Regular investments, no matter how small, add up over time.

The Snowball Effect: Your investments gain momentum, just like a snowball rolling downhill.

Time is Your Ally: The longer you invest, the more your money works for you.

Your financial journey is a marathon, not a sprint. Start early, stay consistent, and watch your wealth grow exponentially over time!

Tip 2: Increase Your Investment Amount

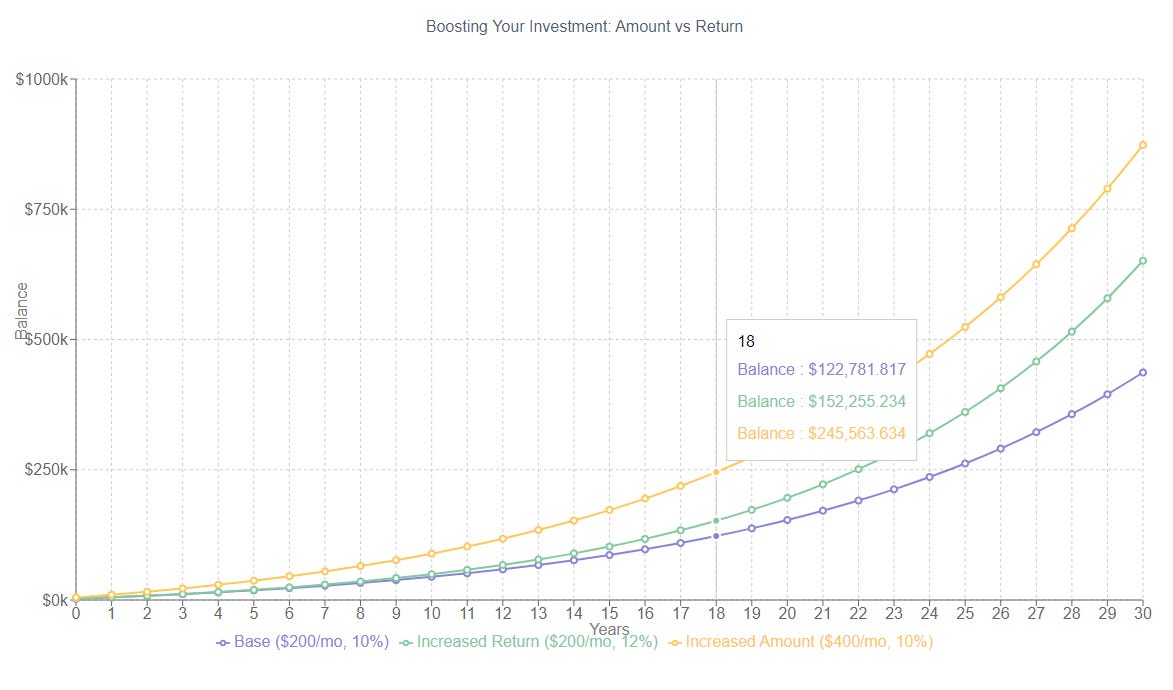

Second, focus on increasing your investment amount. Don't obsess over finding the perfect investment or squeezing out an extra 1-2% return. Instead, concentrate on growing what you can invest monthly. Here's why:

Investing $200 monthly for 30 years at 10% yields about $400,000. An extra 2% return? You'd have $600,000. Impressive, but consider this alternative: What if you doubled your monthly investment to $400? You'd reach $800,000. The key is increasing your earning potential through salary negotiations, partnering in investments, or starting a side business. Use the stock market to multiply your wealth, not as your primary wealth generator.

When it comes to supercharging your investments, conventional wisdom often points to chasing higher returns. But what if there's a more reliable strategy? Let's break it down:

The Scenarios:

📊 Base: $200/month at 10% return

📈 Increased Return: $200/month at 12% return

💰 Increased Amount: $400/month at 10% return

The Power of Increasing Your Investment

🚀 Base Scenario: $400,000 after 30 years

🚀 Increased Return: $600,000 after 30 years

🚀 Increased Amount: $800,000 after 30 years

Focus on What You Can Control: It's easier to increase your investment amount than to find consistently higher returns.

Small Increases, Big Impact: Doubling your monthly investment can potentially double your end result.

Strategies for Increasing Investment:

Negotiate for higher salaries

Partner in investments

Start a side business

Mindset Shift: Use the stock market to multiply your wealth, not as your primary wealth generator.

Consistency is Key: Regular, increased investments compound significantly over time.

Final thoughts

Remember, wealth-building paths vary. My approach? Excel in your job while consistently investing in the market. This builds good habits and lets compound interest work its magic. When you're ready to invest larger sums, you'll have experience and a head start. Never underestimate the power of increasing your investments and giving them time to grow. It's the combination that truly impacts your net worth.

By focusing on these strategies, you can accelerate your journey to financial freedom and beyond. Start today and watch your wealth grow exponentially.

Check your email and don't miss some interesting statistics in next week newsletter.

So until next time, good morning, good day or good evening, wherever you might be.

Remember what goes up must come down (eventually)

Stay safe and invest wisely and this is in no mean financial advice.Harry

Share this post