Cash Is Trash: Turn Inflation into Your Million-Dollar Opportunity

Why Holding Cash Loses Value and How the 60-20-10-10 Portfolio Can Build Your Wealth!

Hi fellow investors and welcome back for a guest newsletter. [Full Disclaimer]

Before we dive into the insights, let me introduce myself—I’m The Pragmatic Investor.

I believe in assessing the truth of theories and beliefs through their practical application. In other words, I focus on what works in the real world to help you achieve your financial goals.

My Substack is your guide on the journey to investing success, no matter your experience level. When you subscribe, you'll gain:

Weekly Market Insights: Understand the markets with my in-depth weekly newsletter, where I break down complex financial news into actionable insights.

A Resilient Portfolio Strategy: Learn how to build a diversified global portfolio designed to stand the test of time, navigating both bull and bear markets with confidence.

Actionable Trade Ideas: Elevate your investment returns with trade ideas that are grounded in thorough research and practical analysis.

Every week, I dive deep into stock reports and share my personal portfolios with subscribers—giving you a transparent look at how I apply these strategies myself.

If you’re ready to take control of your financial future and invest with confidence, I invite you to join me. Subscribe to my Substack today, and let's embark on this journey toward financial independence together.

TL;DR:

Investing can feel overwhelming, but it’s essential to understand that saving in cash guarantees losing value due to inflation. Historically, cash depreciates as economies rely on debt and monetary inflation. Owning productive assets like equities, gold, and alternative investments shields your wealth and benefits from inflationary trends.

The traditional 60-40 portfolio (60% stocks, 40% bonds) is less effective today due to low bond yields and increased correlation between stocks and bonds. A modern alternative is the 60-20-10-10 strategy: 60% equities, 20% gold/Bitcoin, 10% bonds, and 10% alternative assets. This approach balances growth, inflation protection, and diversification.

Historically, equities have delivered 7-10% annual returns With consistent investing, even small contributions can grow significantly over time. A disciplined strategy with a diversified portfolio can make you a millionaire within 30 years—no need for risky speculation. Time in the market truly beats timing the market.

Investing; The Odds Are In Your Favour

While being able to save/invest money is a privilege we should all be thankful for, it can also cause a certain amount of stress and anxiety.

There are so many things one can do with money, and it’s easy to be overwhelmed. In fact, this often leads to analysis paralysis, and that’s exactly what you don’t want to do regarding your savings.

The value of your savings, at least those you keep in cash, will depreciate yearly through inflation.

It’s easy to overlook a 1%-2% loss of value every year, but believe me, it adds up.

Over the last 100 years, the dollar has lost over 90% of its purchasing power. It’s not just that houses were cheaper when your grandparents bought one, it’s also the fact that the dollar is worth a lot less.

What’s key to understand here is that today’s economic system is inherently designed to punish those who hold dollars and reward investors.

Without getting into the weeds too much, let’s explain this.

The Debt Must Go On

Our economies today are fueled by debt. This applies to anything from households to corporations to the government.

The U.S. government runs a perpetual deficit. No one really expects this deficit to be paid down completely, it simply needs to be managed so that it is sustainable, but that’s not really happening right now.

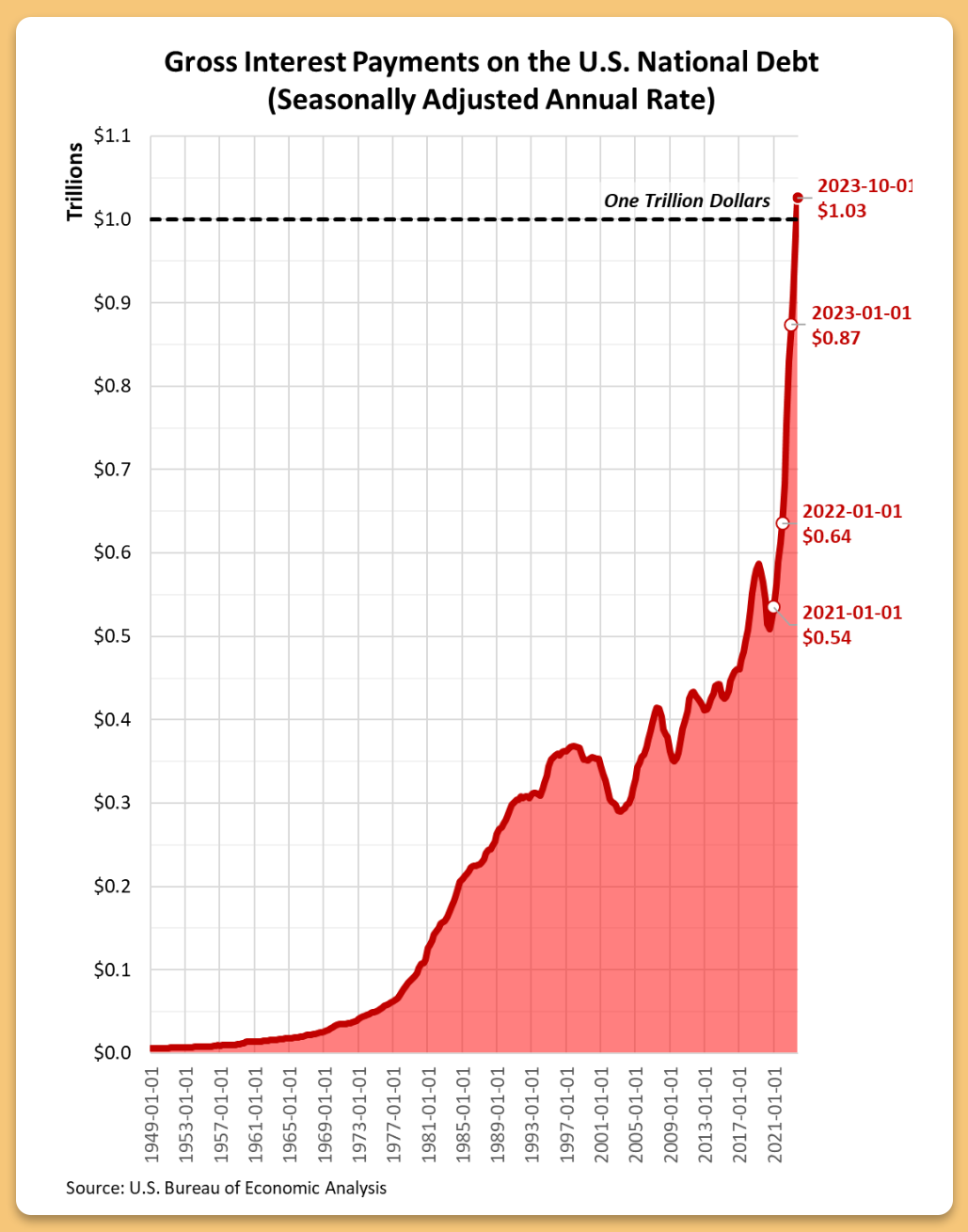

Interest on the national debt now exceeds $1 trillion, and it just keeps compounding.

In reality, though, there’s a 0% chance the US government will default since it also controls the supply of its own currency.

The fact that growing debt is a feature of our current economic system, means that so is monetary inflation.

This can be seen in the chart above, which shows the growth in M2. M2 is simply the amount of cash and deposits that are in the system. It’s a measure of money.

Notice how M2 steadily climbs every year. Pretty much the inverse of the first chart, which showed the purchasing power of the dollar.

And notice how the speed of inflation has been increasing, with a particularly large bump after COVID.

In other words, the US, and governments around the world, have been both lowering the cost of debt (artificially low interest rates) and more recently even monetizing the debt (Quantitative easing)

The higher the debt goes, the higher M2 goes too.

Cash Is Trash

All this is to say that, from the point of view of storing value, cash is trash. It’s going to lose value every year, and its rate of depreciation is only going to accelerate.

When faced with the choice of passing unpopular budget-cutting policies, or kicking the can down the road, and funding spending through monetization, the government will likely keep punishing currency holders.

It’s a tale that goes back millennia, with the Roman Emperor’s infamously mixing copper and less valuable metals into the existing supply of silver coins.

Back then, there wasn’t much the populace could do to protect themselves from this, but that’s definitely changed today.

You can get started with investing from your phone in a matter of minutes.

The Odds Are in Your Favour

If cash is trash, then what you want to do is own assets. This would include real assets, like gold, and also financial assets, like stocks and bonds.

The S&P 500, which offers exposure to the top 500 companies in the US, has delivered 7% annualized returns.

Investing is definitely not as risky as a lot of people think, especially when done right. I like to compare it to gambling, but where the odds are in your favour.

Sure, you can lose one year, but statistically, you’re bound to win in the long term, just the opposite of the casino, where you are statistically going to lose.

Firstly, because the companies in the S&P 500 represent productive assets that generate earnings and cash flow.

On top of that, while the dollar and currency holders suffer from monetary inflation, assets and stocks actually benefit. They act as a refuge and flows towards these assets increase with inflation.

When new money is put into circulation, it can either be spent (creating price inflation) or it can be saved. This usually takes the form of investing in an index like the S&P 500 and therefore creates asset price inflation.

It’s also not a coincidence that as monetary inflation has increased in the last few years, so have returns in the stock market.

The 60-40 Is Dead; Here’s What Comes Next

Perhaps one of the basic, and yet most powerful principles for long-term investing success, has been the 60-40 portfolio.

60% Stocks

40% Bonds

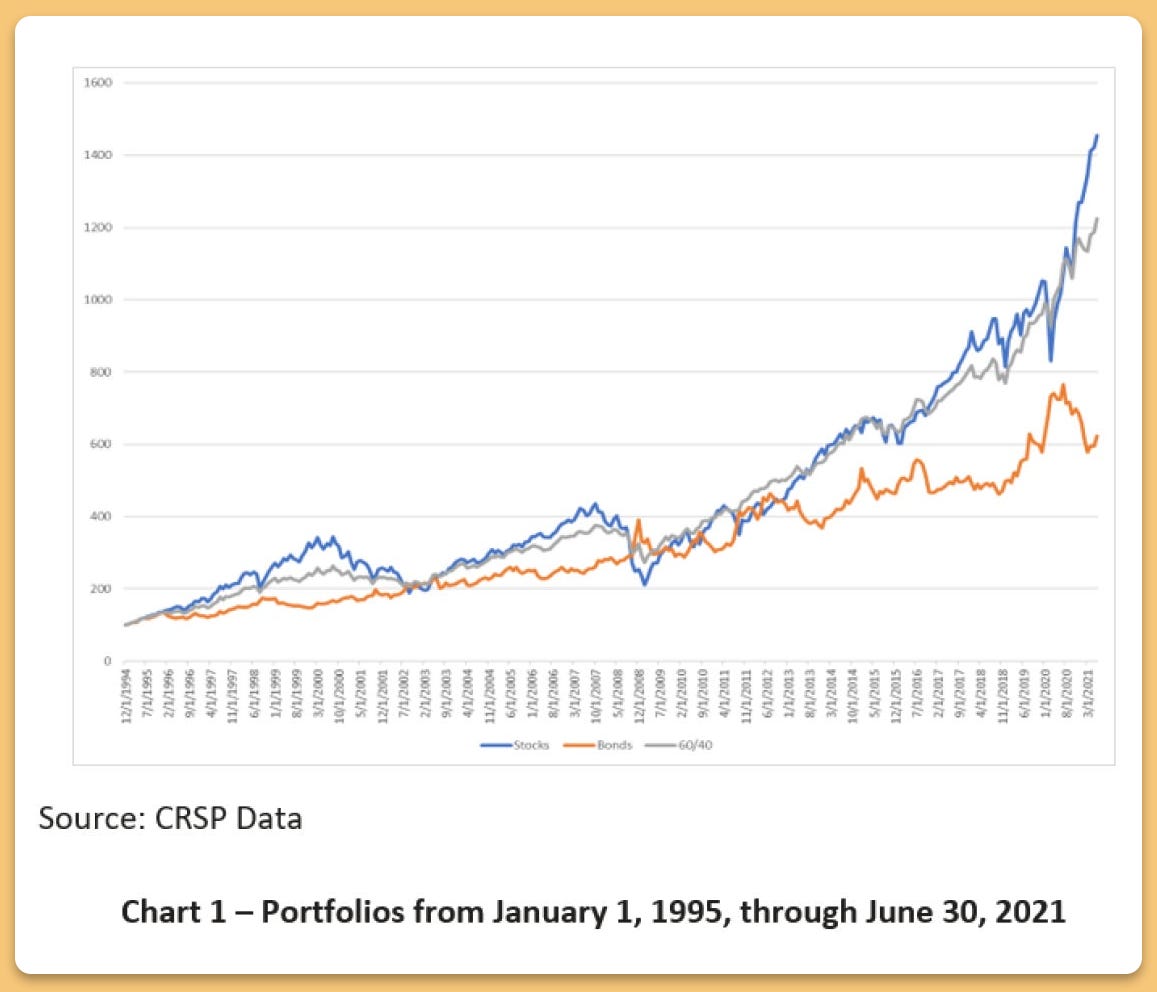

For decades, this portfolio has offered the best of both worlds. Solid returns while reducing the overall volatility of your investments.

We can see below the performance of the 60-40 over the last 30 years.

One of the advantages of the 60-40 is that stocks and bonds are generally negatively correlated. In times of recession and hardship, when stocks are down, bonds tend to perform okay.

However, its effectiveness has come into question in recent years due to several key factors.

Low Bond Yields

Decades of falling interest rates provided strong returns for bonds, but this environment has changed. Yields have risen from historic lows, leading to bond price declines. Moreover, the potential for future capital appreciation in bonds is limited when starting yields are already low.

Increased Correlation Between Assets

Historically, equities and bonds were negatively correlated, providing diversification benefits. However, in periods of high inflation or economic uncertainty, both asset classes have shown a tendency to decline simultaneously, reducing the portfolio's ability to hedge risks.

Inflationary Pressures

Rising inflation erodes fixed-income returns and challenges equity valuations. Bonds offer limited inflation protection, while equities may face pressure from central banks’ tightening policies, potentially impacting earnings growth.

More Complex Market Dynamics

Modern markets are influenced by globalisation, technology, and geopolitical events, creating volatility and uncertainty that the traditional 60-40 split struggles to navigate effectively.

Introducing the 60-20-10-10

For investors getting started today, the 60-40 portfolio may not be ideal. A lot has changed in the last 50 years.

That’s why, personally, I prefer to hold something closer to a 60-20-10-10 portfolio

60% Equities

20% Gold and Bitcoin

10% Bonds

10% Alternative Assets

60% Equities

Equities should still be the main focus of your portfolio. As mentioned above, the key here is to invest in productive assets. When done properly investing in equities can be quite safe and rewarding.

Remember, time in the market beats timing the market.

Your equity portfolio can be as simple as gaining exposure to an index fund, though more adventurous investors can see higher returns by picking their own stocks.

I personally like to divide my money equity exposure into two very distinct portfolios.

My “End Of The World” portfolio is made up of stocks I am comfortable holding indefinitely. It’s filled with stocks with strong balance sheets and companies that will be able to perform well during a recession-

I also have my “YOLO portfolio”, which is where I hold my more speculative investments. Relatively young, high-growth and exciting companies that have 10x potential.

Together these make for a very balanced overall equity exposure.

20% Gold And Bitcoin

These are your straight up monetary hedges. They will protect you from inflation, and offer a diversification from equities that nowadays bonds aren’t really giving.

As we can see gold holds a very strong correlation with the CPI, meaning it appreciates as inflation goes up. Gold is perhaps the oldest form of money. It was used for millennia due to its price stability, and that continues to be the case today.

And now, we also have Bitcoin, which I consider to be digital gold. This crypto asset is specifically designed to mimic the supply of gold in the may it is mined and it also has a limited supply.

I wrote extensively about Bitcoin here.

Since its inception, Bitcoin has been strongly linked to an increase in “Liquidity”, which is another way of describing monetary inflation. This is why crypto did very well after the COVID stimulus, and why Bitcoin has rallied since Trump won the election (the market expects higher deficits and lower rates from him)

10% Bonds

To keep things balanced, we’ll still include some bonds here. Rates are actually reasonably high right now, and this may not be the worst time to add. Overall, bonds can still add much needed balance to a modern portfolio, but their returns have been underwhelming.

10% Alternative Assets

Last, but certainly not least, the modern investor should also consider gaining exposure to Alternative assets.

Alternative assets are investments outside traditional categories like stocks and bonds. They include real estate, private equity, hedge funds, commodities (e.g., gold, oil), infrastructure, and collectibles (e.g., art, wine).

These assets often exhibit low correlation to traditional markets, making them valuable for diversification. They may also provide unique returns through income, capital appreciation, or inflation hedging. However, they can come with higher risks, lower liquidity, and complex valuation methods.

As markets evolve, alternative assets have gained popularity for their potential to enhance portfolio resilience, especially during periods of market volatility or economic uncertainty.

Alternative assets used to be limited to high net worth individuals and insiders, but they are becoming more accessible today thanks to the internet.

Simple Path To Your First Million

Let’s crunch some numbers.

S&P 500 has returned 12.84% annually in the last 10 years

Saylor recently predicted annualized Bitcoin returns of 29% over the next 20 years.

Alternative assets have historically returned 10%-20%

Gold has returned 4.57% in the last 10 years

Bonds (10- year Treasuries) have returned around 2.5%

I believe the 60-20-10-10 portfolio offers a good overall balance. Based on these historical returns, I think 10% annualized returns over the next 30 years is achievable.

Let’s say you have $10,000 to start investing

You add $500 every month

You achieve 10% annualized returns

Here’s where you’d stand in 30 years.

Easily a millionaire without really that much effort. The hardest part would be saving $500/month, but that can easily be done with some discipline.

10% may sound high, but bear in mind that, if my thesis holds, monetary inflation is going to pick up its pace in the coming decades as deficits balloon. There’s just no other way out.

The real risk is sitting in cash right now.

Final Thoughts

Investing doesn’t have to be daunting. Saving in cash feels safe but guarantees value loss due to inflation. Economies driven by debt and monetary inflation reward investors while penalising cash holders.

A diversified 60-20-10-10 portfolio—60% equities, 20% gold/Bitcoin, 10% bonds, and 10% alternative assets—offers growth, inflation protection, and resilience. Equities provide strong returns; gold and Bitcoin hedge against inflation.

Even modest, consistent investments grow significantly over time, leveraging the power of compounding.

With discipline and a long-term mindset, small savings can transform into substantial wealth. Time in the market always beats timing the market, putting the odds in your favour.

I try to help readers on their path to financial independence at the Pragmatic Investor, combining macro, fundamental and technical analysis.

Remember what goes up must come down (eventually)

Stay safe and invest wisely and this is in no mean financial advice. [Full Disclaimer]Thank you for supporting this newsletter. It will keep improving.

Harry