Market Performance Snapshot

As of September 10, 2024:

Current Price: $138.26 (up 0.08%)

Post-Market: $138.17 (down 0.07%)

AMD continues to show resilience in a competitive market, reflecting investor confidence in its diversified growth strategy and AI ambitions.

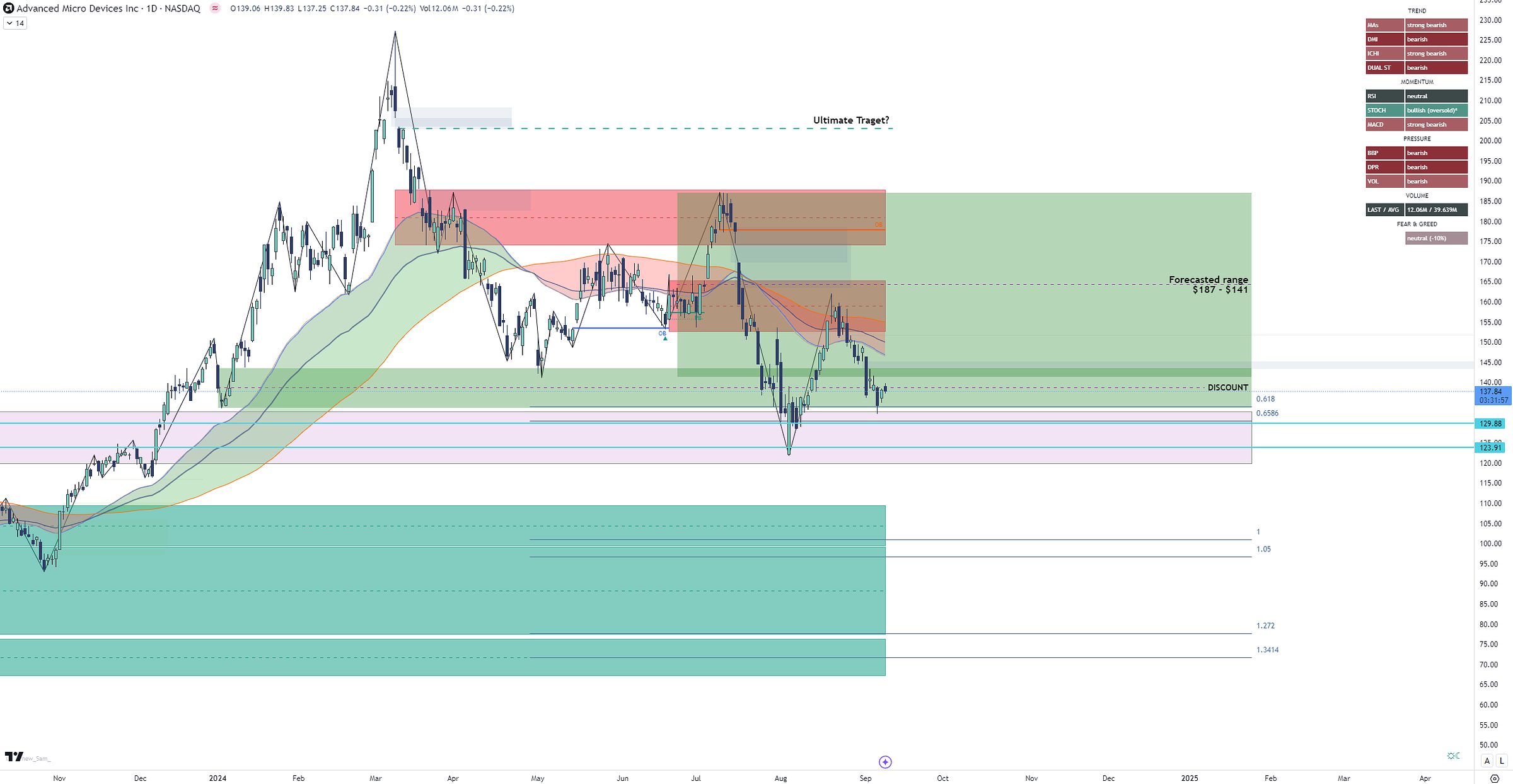

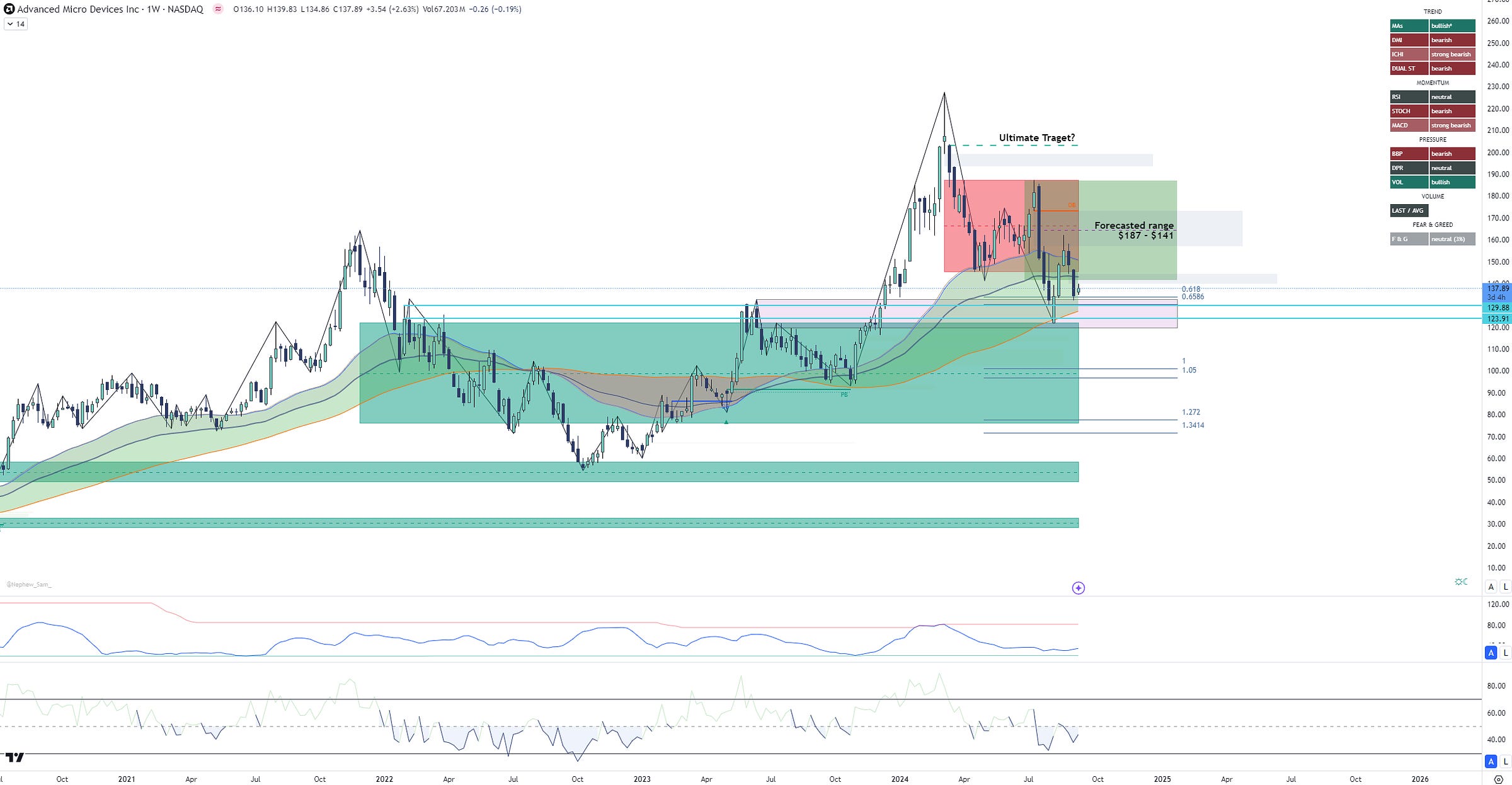

Technical Analysis Deep Dive

Overall Indicators

Recommendation: Sell

Oscillators: Neutral

Moving Averages: Sell

Key Metrics

RSI: 43.26 (Neutral)

MACD: -4.51 (Bearish)

Momentum: -34.10 (Bearish)

Bull Bear Power: -21.96 (Neutral)

Most moving averages signal 'Sell', with the 200-day SMA at 110.27 acting as a potential resistance level. The current price above this level suggests a possible overvaluation in the short term.

Fundamental Analysis: Q2 Fiscal 2024 Results

Revenue: $5.36 billion (4% YoY decline)

Data Center Revenue: $1.3 billion (11% YoY growth)

EPS: $0.58 (45% YoY decline)

These figures highlight AMD's challenges in the current market but also showcase growth in strategic segments like data centers.

Growth Drivers and Market Position

AI Chip Innovation: AMD's MI300 series aims to challenge NVIDIA's dominance in the AI accelerator market.

Data Center Expansion: Continued focus on high-performance computing and AI workloads.

EPYC Processor Adoption: Growing market share in the server CPU segment.

Gaming Segment Stability: Consistent performance in consumer graphics and gaming consoles.

Strategic Partnerships: Collaborations with major cloud providers and OEMs for AI and HPC solutions.

Challenges and Risk Factors

Intense Competition: NVIDIA's lead in AI chips and Intel's resurgence in CPUs pose significant challenges.

Market Volatility: Semiconductor industry's cyclical nature affects demand and pricing.

Supply Chain Constraints: Potential disruptions in global chip manufacturing and distribution.

R&D Investment Pressures: Keeping pace with AI innovation requires substantial ongoing investment.

Geopolitical Risks: Export controls and tech regulations could impact global operations.

Q4 2024 Forecast and Long-term Outlook

Q4 2024 Projections

Revenue: $6.1-6.7 billion

EPS: $0.93 (estimated)

Long-term Perspective

AI and data center segments expected to drive significant growth over the next 3-5 years.

Consumer market share likely to fluctuate with product cycles and competitive dynamics.

Continued investment in advanced process nodes crucial for maintaining technological edge.

Investment Considerations

For Long-term Investors

AMD represents a growth opportunity in AI and high-performance computing.

Valuation reflects high expectations, requiring careful monitoring of execution and market share gains.

Diversification across multiple segments provides some buffer against market volatility.

For Short-term Traders

Watch the $140 resistance level for potential breakout or reversal signals.

Earnings releases and product announcements can trigger significant price movements.

Key Factors to Monitor

AI Chip Market Share: Progress in challenging NVIDIA's dominance.

Data Center Revenue Growth: Indicator of AMD's success in high-margin segments.

Product Launch Reception: Market adoption of new CPU and GPU offerings.

Margin Trends: Ability to maintain or improve profitability amid competition.

Technological Advancements: Innovations in chip design and manufacturing processes.

Technical Indicators Breakdown

Moving Averages

EMA (10): 146.19 (Sell)

SMA (20): 146.42 (Sell)

SMA (50): 154.56 (Sell)

SMA (100): 131.82 (Buy)

SMA (200): 110.27 (Buy)

The divergence between short-term and long-term moving averages suggests a potential consolidation phase.

Oscillators

Relative Strength Index (14): 43.26 (Neutral)

Stochastic %K (14, 3, 3): 28.13 (Neutral)

Commodity Channel Index (20): -110.82 (Buy)

Average Directional Index (14): 17.71 (Neutral)

Momentum (10): -34.10 (Sell)

MACD Level (12, 26): -4.51 (Sell)

The mix of neutral and sell signals in oscillators indicates a cautious short-term outlook.

Pivot Points and Support/Resistance Levels

Classic Pivot Points

Resistance 3: 201.50

Resistance 2: 170.50

Resistance 1: 154.00

Pivot Point: 139.50

Support 1: 123.00

Support 2: 108.50

Support 3: 92.00

Fibonacci Pivot Points

Resistance 3: 175.74

Resistance 2: 164.09

Resistance 1: 156.75

Pivot Point: 139.50

Support 1: 132.16

Support 2: 124.82

Support 3: 113.17

These pivot points offer a framework for potential price movements and key levels to watch for trading decisions.

Market Sentiment and Analyst Perspectives

The market sentiment towards AMD remains cautiously optimistic, balancing its growth potential in AI and data centers against intense competition and market challenges.

Out of 53 analysts:

36 rate AMD as a "Buy"

15 maintain a "Hold" rating

2 suggest a "Sell"

This distribution reflects a generally positive outlook with some reservations about the company's ability to execute its ambitious growth plans.

Navigating AMD's Path in the Evolving Tech Landscape

AMD stands at a critical juncture in its journey to become a dominant force in the AI and high-performance computing markets. The company's strategic focus on AI chip development and data center expansion positions it well to capitalize on the ongoing digital transformation across industries.

For long-term investors, AMD represents a compelling, albeit risky, opportunity to invest in the future of computing. The company's diversified product portfolio and growing presence in high-margin segments provide a foundation for potential long-term growth. However, the high expectations built into its current valuation demand close scrutiny of its ability to execute and gain market share in competitive segments.

Short-term traders should remain alert to technical indicators and potential catalysts such as product launches, earnings reports, and shifts in the competitive landscape. The stock's volatility offers opportunities for significant gains but also carries substantial risk.

Ultimately, an investment in AMD is a bet on the company's ability to innovate and carve out a significant niche in the AI chip market while maintaining its strengths in traditional CPU and GPU segments. As the tech industry continues its rapid evolution, AMD's performance will serve as a key indicator of the shifting dynamics in the semiconductor sector and the broader AI revolution.

Remember what goes up must come down (eventually)

Stay safe and invest wisely and this is in no mean financial advice. [Full Disclaimer]Harry