Hi and welcome back for a Quant data driven analysis. [Full Disclaimer]

What's a Mid-Term Bear-Market?

It’s Bulls trying to defend their positions because they were too stubborn to take partial at the top, trying to DCA (Dollar Cost Average) their losses.

It’s Bears who fully (for most) close at the top trying to push value lower with high leverage so they can buy at a discount what they fail to recognize as buy before the rally.

While traders desperate for more entering the battle field in the middle of chaos asking for FAFO to come knocking.

In both cases it’s nothing more than FOMO. (Fear Of Missing Out). While smart money (investors) will be sitting on their hands compounding profits, waiting for the carnage to end before scooping the weak hands’ losses triggering the next rally. A much needed correction in this hyper-over evaluated market ran by the new AI bubble.

It’s also the first signal to prepare for the next bear market. But this time it’s different! It will hurt peoples’ mind so badly some won’t recover. There’s still time but make no mistakes. Smart Money doesn’t buys tops, it buys bottoms.

Market Trends

The market's rotational behavior is getting vicious. Money isn't leaving—it's relocating. Tech darlings that dragged indices to all-time highs are bleeding while forgotten sectors like utilities, consumer staples, and even energy are quietly outperforming. This isn't random; it's deliberate. Smart money knows the tech-heavy FOMO rally was unsustainable.

The NASDAQ to Russell ratio tells the real story. Small caps are finding footing while mega-caps stumble. This rotation isn't just healthy—it's necessary. Markets need to breathe. When everything moves in one direction, the rubber band stretches until it snaps. We're witnessing the snap in slow motion.

The AI Hype Machine Running Out of Fuel

Let's talk about the elephant in the room: AI stocks. The market priced in 5 years of future growth in 6 months. Companies slapping "AI" in press releases saw 40% pops on no material changes to their business.

The numbers—semiconductor manufacturers trading at 45x earnings, cloud providers at 30x revenue. Historical mean? About half that. The narrative was "AI changes everything"—but markets always revert to fundamentals. How many AI models are actually generating meaningful revenue? How many companies have shown AI-driven margin expansion? Few. Very few.

The real transformation will happen—I'm not saying it won't—but markets overshot, as they always do. Now, we're seeing the rationalization phase, where companies must deliver on promises or face the consequences.

Macro Crosscurrents Are Building

The yield curve is performing gymnastics that most traders can't interpret. When the 2-10 spread widens this rapidly after an inversion, it's not immediately bullish—it's a regime change warning. Central banks are trapped between sticky inflation and slowing growth.

Employment numbers look strong on the surface—a classic late-cycle mirage. Dig deeper, and you'll find declining labor force participation, falling real wages, and stretched consumer balance sheets beyond reason. Credit card delinquencies hitting multi-year highs isn't a symptom of a healthy economy.

Global trade flows are also flashing warning signs. Shipping costs are rising while volumes decline. China's property market implosion isn't contained—it's just slow motion. Europe's manufacturing recession isn't "transitory." These aren't disconnected events; they're pieces of the same puzzle.

Never Fail.

Positioning for What's Coming

This isn't the time for heroes. Size down positions, raise cash levels to 20-30% and prepare your shopping list. Quality companies with cash flow-positive operations, low debt, and pricing power will weather what's coming. They'll also be the first to recover when the bottom forms.

Stop trying to catch falling knives. That "bargain" tech stock down more or less 20% from its highs could quickly drop another 30%. Remember: markets can stay irrational longer than you can stay solvent. The first leg down isn't the buying opportunity—it's usually the warning shot.

For those who insist on staying fully invested, rotate, don't exit. Value over growth, quality over speculation, cash flow over promises. Dividend aristocrats outperform in bear markets for a reason—they have proven business models that generate actual money.

The Road Ahead

Markets cycle; they always have. What we're seeing is the natural consequence of excessive optimism meeting economic reality. The Fed put isn't coming to save speculative positions this time, and the money printer isn't firing up at the first sign of market distress.

The coming months will separate the investors from the gamblers. Those who understand market cycles, manage risk, and maintain discipline will emerge stronger. Those who chase momentum, ignore fundamentals, and let emotions drive decisions will provide the liquidity for smart money's eventual buying spree.

I always say: Bull markets make people money, bear markets make people wealthy. The greatest fortunes in history weren't built buying tops—they were built patiently, accumulating quality assets when others panic-sold.

The time to prepare is now, not when the headlines scream crisis. By then, it'll be too late.

Stay liquid, stay patient, stay smart.

Let's dive in and make some smart moves! 💰🚀

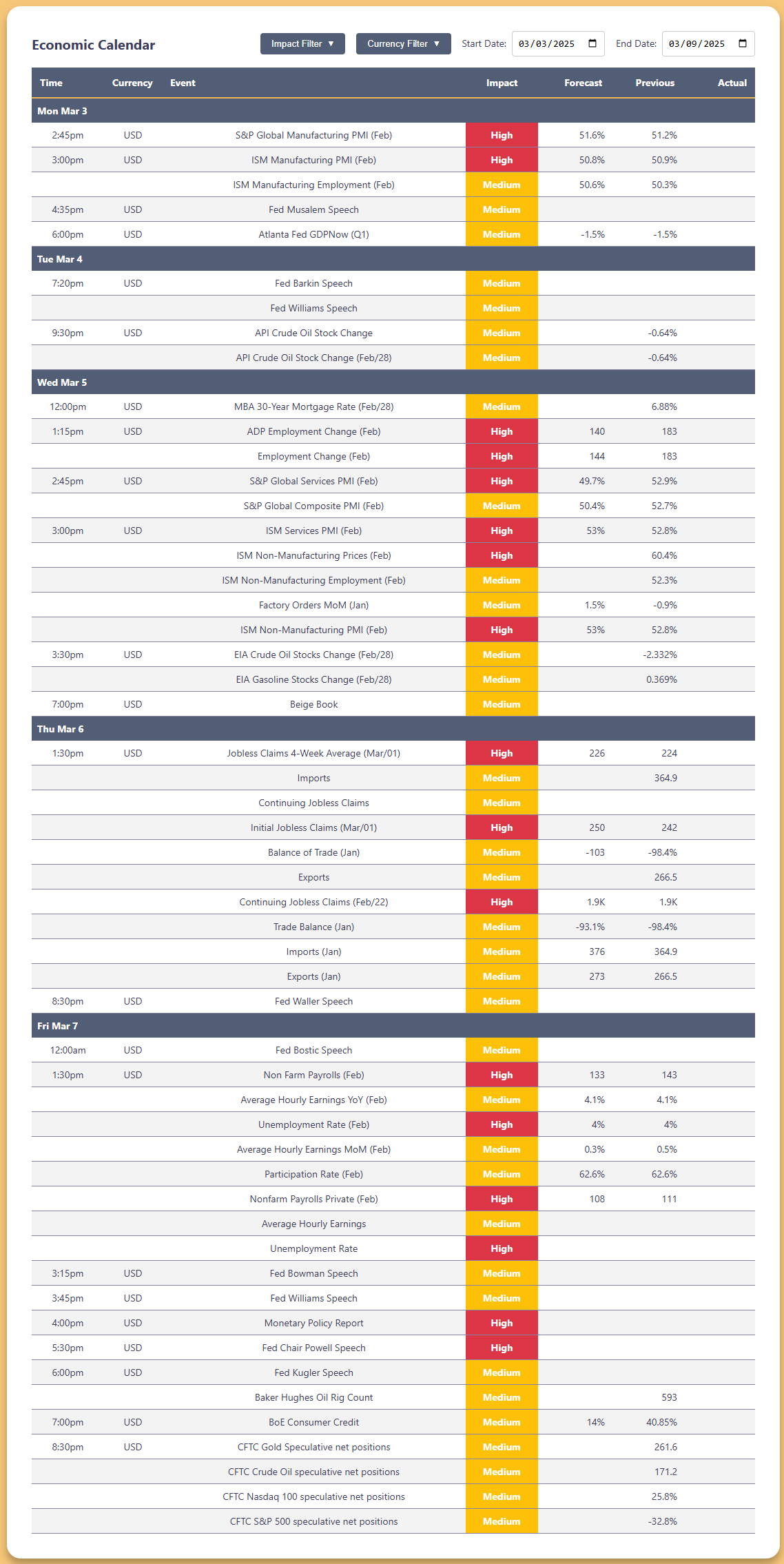

📅Week's Calendar March 03-03, 2025

High-Impact Events for the Week

Monday, March 3: Manufacturing Focus

S&P Global Manufacturing PMI: 51.6% forecast vs 51.2% prior

ISM Manufacturing PMI: 50.8% forecast vs 50.9% prior

Fed Muzaleem speech and Atlanta Fed GDPNow update expected

Atlanta Fed GDPNow (Q1): -1.5% forecast vs -1.5% prior

Tuesday, March 4: Fed Speeches & Oil Data

Fed Barkin and Williams speeches scheduled

API Crude Oil Stock Change: forecast pending vs -0.64% prior

Focus on monetary policy guidance from Fed officials

Wednesday, March 5: Employment & Services

ADP Employment Change: 140K forecast vs 183K prior

S&P Global Services PMI: 49.7% forecast vs 52.9% prior

ISM Services PMI: 53% forecast vs 52.8% prior

Factory Orders MoM: 1.5% forecast vs -0.9% prior

Thursday, March 6: Jobs & Trade Data

Initial Jobless Claims: 250K forecast vs 242K prior

Continuing Claims: 1.9M forecast vs 1.9M prior

Balance of Trade: -103B forecast vs -98.4B prior

Exports: forecast pending vs 266.5B prior

Imports: forecast pending vs 364.9B prior

Friday, March 7: Employment Report

Non-Farm Payrolls: 133K forecast vs 143K prior

Unemployment Rate: 4% forecast vs 4% prior

Average Hourly Earnings YoY: 4.1% forecast vs 4.1% prior

Multiple Fed speeches scheduled including Powell

Baker Hughes Oil Rig Count and CFTC data releases

Critical Economic Data and Market-Moving Events

Economic events to watch this week:

Short Term Update - Newest Additions

Movements and Shifts

Recent market activity shifts across various sectors:

Top Buy Signals

AVGO 0.00%↑ : Leading with +4.56% gain, 172.34 , 75 buys at $28.20M

NOW 0.00%↑ : Strong +4.23% rise, 162.45%, 72 buys at $27.20M

AMAT 0.00%↑ : Solid +3.98% increase, 154.67%, 68 buys at $25.60M

Notable Sell

KLAC 0.00%↑ : -2.65% decline, -73.12% position drop, 39 sales at $11.70M

ADI 0.00%↑ : -2.78% fall, -65.34% position decrease, 43 sales at $12.80M

LRCX 0.00%↑ : -2.87% dip, -67.89% position reduction, 44 sales at $13.30M

Strategic Movements

TXN 0.00%↑ : -2.34% decrease, -62.45% reduction, 41 sales at $12.30M

SNPS 0.00%↑ : -2.34% decline, -70.56% decrease, 39 sales at $11.70M

PANW 0.00%↑ : -2.67% drop, -66.23% reduction, 46 sales at $13.80M

Last Week Recap:

In-Short

Stock Market Performance

S&P 500 Rollercoaster: The S&P 500 notched new all-time highs on Tuesday and Wednesday but stumbled late in the week, dropping 4.5% from its February 19 peak. It briefly erased year-to-date gains, slipping below last year’s close, though it’s still up 15% from a year ago.

Tech Takes a Breather: The “Magnificent 7” stocks—once the engine of over 50% of the S&P 500’s gains over two years—slid into correction territory. Tech lagged the broader index in January 2025, a stark reversal from its dominance.

Europe Shines: European stocks are stealing the show, with a key European index up more than 12% year-to-date, dwarfing the S&P 500’s modest 4% gain. Transatlantic divergence is worth watching.

Economic Indicators

GDP Growth Softens: The Atlanta Fed’s GDPNow model slashed its Q1 2025 forecast to +2.3% from +2.9% on February 14. That’s a red flag for economic momentum.

Consumers Turn Gloomy: The University of Michigan Consumer Sentiment index cratered to 64.7—its lowest since November 2023—and is down 15.9% year-over-year. This is the steepest drop since late 2022.

Inflation Expectations Climb: One-year inflation expectations steadied at 4.3%, but five-year expectations hit 3.5%, the highest since late 2023. Sticky inflation could keep the Fed on edge.

Housing Hits a Wall: The NAHB Housing Market Index slid to 42 in February, a five-month low and well below the expected 48. Higher rates and costs are squeezing builders.

Manufacturing Turns Positive: The US ISM Manufacturing PMI rose to 50.90, marking expansion for the first time since March 2024. It’s a rare bright spot in the data.

Gold’s Wild Ride: Gold spiked to a record $2,964 per ounce before pulling back, after a 7.8% surge in January to $2,812.10. Investors are hedging hard.

🔐Premium Member only.🔐

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always do your own research and consider your financial situation before making investment decisions.