- 15% AI & Magnificent 7 - Next Decade Winner(s) - Going Lower in Q2?

A co-analysis with James Foord from The Pragmatic Investor

Hi and welcome back for a Quant data driven analysis. [Full Disclaimer]

Q2 mid-term perspective on the Magnificent 7. Area of interest and buying zone. We’re not done yet with lower. Merged with a macro perspective from - The Pragmatic Investor check him out!

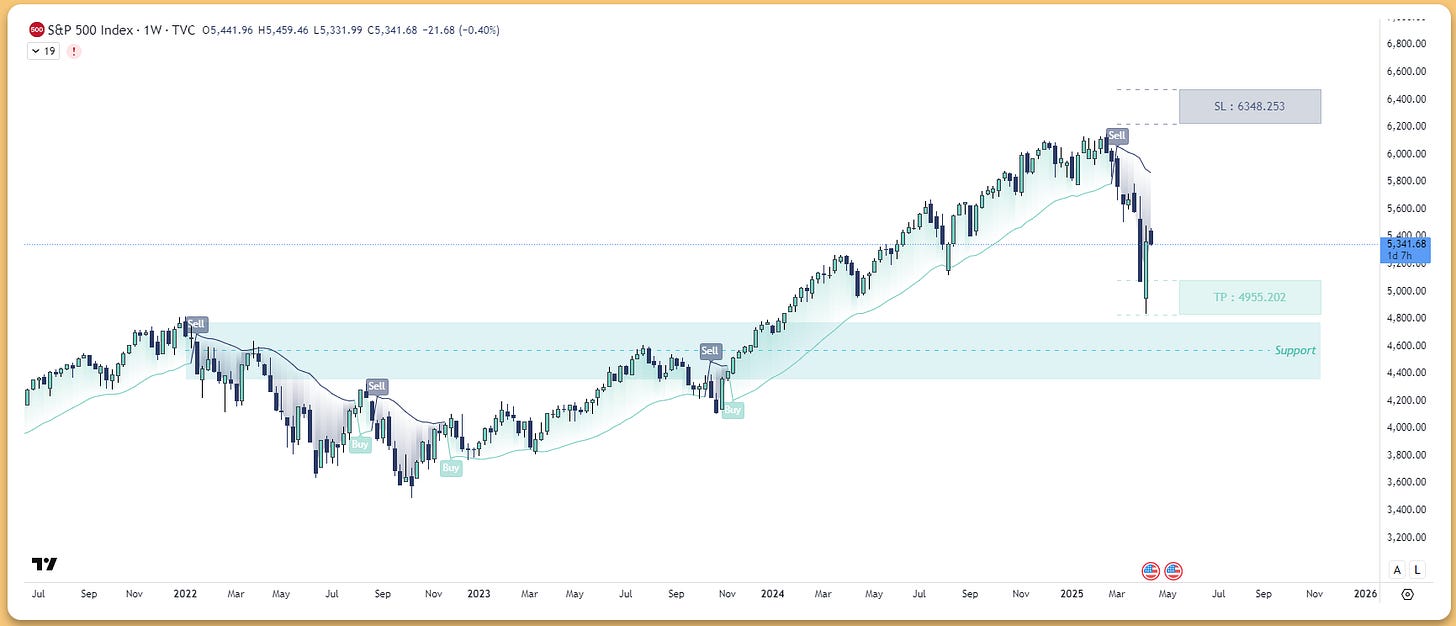

S&P 500 Painful Reckoning

We're now experiencing what I'm calling a "painful reckoning" for the S&P 500. After the historic 50%+ gain in 2024 — driven largely by rate cut fantasies and AI euphoria — Wall Street has been forced to dramatically slash forecasts. Just three months ago, Goldman Sachs had a 6,500 year-end target for the index. That's now been cut to 6,200, reflecting the harsh new reality we're facing.

The tariff situation has worsened significantly, with new rounds of protectionist measures creating supply chain chaos and inflationary pressures. Meanwhile, Q1 earnings are starting to roll in, and they're confirming my worst fears: corporate America cannot deliver the 11% EPS growth analysts were projecting. The early reporters are missing estimates by an average of 4.5%, with guidance being slashed across sectors.

Looking at the numbers, the S&P 500 closed recently at 5,346. This represents a significant drop from January's peak of 6,147, and my analysis suggests we'll see further downside, with the index likely trading in a range of 5,000-5,200 in Q2. This represents a severe correction from the January peak, and I wouldn't be surprised to see us test 4,835 (the 52-week low) before finding a durable bottom by year-end.

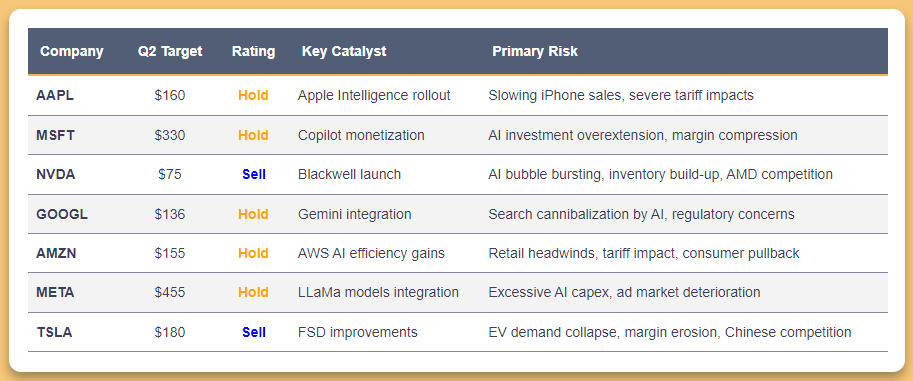

Stock-by-Stock Breakdown

The AI Super Cycle Is Here ()

Artificial Intelligence is not just another tech trend—it’s a new industrial revolution. From cloud infrastructure and foundational models to robotic automation and generative search, AI is reshaping the economy at every level. And at the center of this shift? The Magnificent 7—Apple, Microsoft, Nvidia, Google, Amazon, Meta, and Tesla. These are the most dominant companies in the market today, but how they adapt to AI will determine who dominates tomorrow.

Some are building the infrastructure, others are creating the platforms, and a few are betting big on physical AI and automation. The stakes couldn’t be higher. Trillions in market cap are up for grabs, and while the path is still being paved, a new tech hierarchy is starting to emerge.

AI is driving a three-layered transformation:

Infrastructure Layer – Chips (GPUs, TPUs), data centers, and networking gear

Platform Layer – Cloud services, foundational models, developer platforms

Application Layer – AI-enhanced software, automation tools, search, productivity, robotics

Every Mag 7 stock sits somewhere on this map—but not all positions are equally profitable.

Expect trillion-dollar shifts in market cap. But also expect high capital expenditures, margin compression, and competitive churn. Now let’s dig into each stock.

Microsoft MSFT 0.00%↑

Down from January peak of $468

Key Concerns:

Copilot adoption below expectations (30% of internal projections)

Azure growth slowing as cloud spending rationalized

$50B+ AI infrastructure investment showing questionable ROI

OpenAI partnership advantage eroding as competitors gain ground

Analyst View: Buy rating, target price $422

The Enterprise AI Juggernaut ()

AI Position: Platform + Application

Why It Wins:

Exclusive OpenAI partnership (ChatGPT, Copilot)

Azure dominates enterprise AI cloud workloads

Massive distribution via Microsoft 365 + Windows

Watch For:

Copilot monetization to ramp significantly

Gross margin compression from rising compute co

Microsoft is arguably the most prepared of the Magnificent 7 for the AI era. Its tight partnership with OpenAI has already paid off, embedding GPT models into everything from Microsoft 365 to Azure’s cloud offerings.

The result? Microsoft is becoming the default AI operating system for enterprise. Its Copilot product is rolling out across Word, Excel, and Teams, turning basic productivity software into intelligent tools.

Azure’s cloud infrastructure is gaining serious traction, and Microsoft’s early AI lead is quickly compounding. With every business in the world rushing to deploy generative AI, Microsoft is the vendor they’re turning to. Yes, higher compute costs may eat into margins, but with scale and entrenchment, Microsoft looks like the one to beat.

Apple AAPL 0.00%↑

Down from January peak of $260

Key Concerns:

iPhone sales plateauing globally with extending replacement cycles

Services growth decelerating to low double digits

"Apple Intelligence" development facing optimization challenges

Highly vulnerable to US-China trade tensions

Analyst View: Buy rating, target price $216

The Silent AI Killer ()

AI Position: Application Layer (still forming)

Why It Wins:

Massive installed base (2B devices)

Apple Silicon (on-device AI performance)

Upcoming generative AI integrations (iOS 18 “Apple Intelligence”)

Watch For:

AI services rollout at WWDC

Whether Siri finally gets a brain

Apple has been oddly quiet in the AI arms race—but don’t let that fool you. With over 2 billion devices in circulation and its own Apple Silicon powering the latest hardware, Apple is building something big under the surface. Rumors’ suggest the next iOS release will introduce “Apple Intelligence,” a privacy-focused take on generative AI that lives on-device rather than in the cloud.

While competitors chase flashy demos, Apple is laser-focused on seamless integration. If Siri finally gets a neural-network-powered brain, and if iPhones become true AI assistants, Apple could leapfrog into the lead. The company’s strength lies in user experience, and its ability to roll out AI at scale is unmatched.

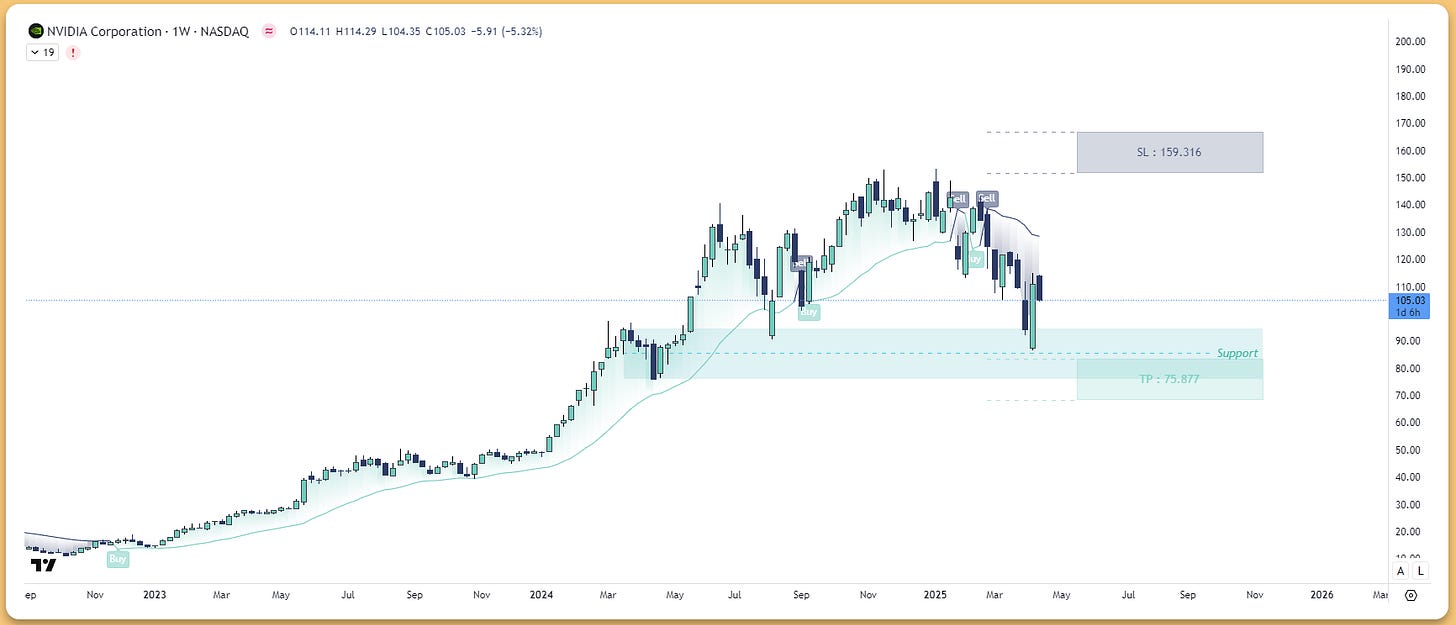

Nvidia NVDA 0.00%↑

Down from January peak of $153

Key Concerns:

GPU inventory build-up and slowing data center expansion

Blackwell architecture not generating expected orders

Forward P/E still above 30 despite selloff

Data center operators delaying further GPU procurement

AMD gaining ground with competitive MI300 chips

Analyst View: Buy rating, target price $110

The AI Arms Dealer ()

AI Position: Infrastructure Layer

Why It Wins:

80-90% market share in AI training chips

CUDA + software moat

New Blackwell chips + networking stack

Watch For:

Demand shifts toward inference

Rising competition from AMD, Google TPU, Amazon Trainium

Nvidia is the most obvious winner from the AI boom—and the market knows it. With nearly 90% market share in AI training chips and the all-important CUDA software stack, Nvidia is the hardware layer of the entire AI ecosystem. The latest Blackwell chips are already setting new benchmarks, and demand is off the charts.

But while Nvidia’s dominance is real, it’s also vulnerable. AMD, Google (with TPUs), and Amazon (with Trainium) are building alternatives. If inference demand takes over from training, or if hyperscalers build their own silicon, margins could compress. Still, for now, Nvidia is the single most important company in the AI supply chain.

Amazon AMZN 0.00%↑

Down from January peak of $243

Key Concerns:

AWS growth decelerated to mid-teens (down from 30%+)

Custom silicon not delivering promised cost advantages

Retail business facing consumer spending pullback

Tariffs potentially impacting retail margins by 150-200 basis points

Analyst View: Buy rating, target price $195

The AI Cloud and Logistics Machine ()

AI Position: Infrastructure + Application

Why It Wins:

AWS is #1 in cloud (and catching up in AI tooling)

Building own chips (Trainium, Inferentia)

AI + robotics = huge fulfillment cost savings

Watch For:

AWS margin expansion

AI advertising boost (via better targeting)

Amazon may not have the AI buzz of OpenAI or Nvidia, but it’s quietly becoming one of the biggest beneficiaries of AI. AWS still holds the top spot in cloud infrastructure, and it’s rapidly expanding its AI offerings with custom silicon like Trainium and Inferentia. But the real prize? Amazon’s logistics empire.

As the world’s largest fulfilment and delivery network, Amazon stands to save billions from robotics, automation, and generative AI-powered supply chains. The ad business is also booming, and improved targeting through AI will only accelerate that growth. Short-term noise from tariffs and retail headwinds shouldn’t distract from the long-term AI efficiency engine Amazon is building.

Meta META 0.00%↑

Down from January peak of $741

Key Concerns:

Core advertising business weakening amid economic pressure

$40B+ AI investment facing extended monetization timelines

LLaMa models facing increased competition

Vulnerable to extended economic slowdown affecting ad spending

Analyst View: Buy rating, target price $589

The Content and Attention Powerhouse ()

AI Position: Platform + Application

Why It Wins:

LLaMA 3 open models gaining traction

Dominant ad platform + real-time inference engine

AI-generated content + recommendation systems

Watch For:

Monetization of Meta AI (messaging assistant)

Capex intensity in data centers

Meta is AI-native, even if the market doesn’t give it full credit. Its ad platform already runs on some of the most advanced real-time inference engines in the world. Its open-source LLaMA models are gaining traction, and its push into AI-generated content is just beginning. Meta AI, its new assistant, is being rolled out across WhatsApp, Instagram, and Facebook, putting it in front of billions of users.

Of course, this comes with massive capex—the company is spending tens of billions on new data centers. But if you believe that the future of digital content is AI-generated and hyper-personalized, Meta might be the best-positioned company to win the next wave of the internet.

Google GOOGL 0.00%↑

Down from January peak of $207

Key Concerns:

Struggling to translate AI advantages into revenue growth

AI search risks cannibalizing core advertising business

Cloud division remains distant third to AWS and Azure

Unfocused AI deployment suggesting strategic uncertainty

Analyst View: Buy rating, target price $175

The Full-Stack Giant With Something to Prove ()

AI Position: Full Stack (Infra + Platform + Apps)

Why It Wins:

Owns key models (Gemini), TPUs, and search distribution

Android + Chrome integration

Deep AI research bench

Watch For:

Search cannibalization from AI answers

Ad revenue shifts

Google arguably has the most complete AI stack: it has its own models (Gemini), its own chips (TPUs), a dominant distribution channel (Search), and the world's largest data ecosystem. But integrating all of that without cannibalizing core ad revenue has proven tricky. Bard’s early stumbles and Gemini’s slow rollout have given Microsoft time to catch up.

Still, the potential is enormous. Google’s Android and Chrome ecosystems provide the perfect delivery vehicles for AI assistants, and its cloud business is starting to show signs of AI-driven growth. If Google can align its models, distribution, and monetization strategy, it could still reassert dominance.

Tesla TSLA 0.00%↑

Down from January peak of $489

Key Concerns:

Q1 deliveries showing 13% YoY decline

Price cuts failing to stimulate demand while eroding margins

Autonomous driving and robotaxi progress slower than promised

Increasingly resembling traditional automaker vs. tech company

Analyst View: Buy rating, target price $340

Betting Big on Physical AI ()

AI Position: Application Layer (Physical AI)

Why It Wins:

Full Self-Driving (FSD) neural net at scale

Dojo supercomputer

Robotaxis + Optimus humanoid bots

Watch For:

Regulatory approval for FSD

Delivery timeline for Optimus

Tesla is the wildcard of the Magnificent 7. While the others focus on software and cloud AI, Tesla is pushing the boundaries of physical AI—autonomous vehicles, robotics, and embedded intelligence. Its Full Self-Driving (FSD) software is gathering more data than any competitor, and Dojo, its custom AI supercomputer, is designed specifically to train vision-based models.

Then there’s Optimus, Tesla’s humanoid robot project. Whether it’s a moonshot or the beginning of something real is still unknown, but if Tesla succeeds, it won’t just be a car company. It’ll be a robotics and AI platform for the physical world. High risk, high reward.

Sentiment analysis

The Mag 7 are experiencing a brutal unwinding of their premium valuations. No longer viewed as infallible, these tech giants are being punished for massive AI investments that are proving slower to monetize than expected. When we last checked in, investors were questioning how much AI potential was already priced in. Now, with recession fears mounting and interest rates remaining stubbornly high, the market is forcing a severe repricing of growth assets across the board.

Who’s Winning the AI Race? ()

Based on the ideas laid out above, we’ve developed the AI Readiness Leaderboard.

The AI Readiness Leaderboard makes it abundantly clear—Microsoft and Nvidia are leading the charge when it comes to positioning themselves for long-term AI dominance. Microsoft sits at the top thanks to its strategic partnership with OpenAI, deep integration of AI into its productivity suite, and massive investment in cloud infrastructure through Azure. Nvidia follows closely, powering the hardware backbone of the AI revolution. These two companies are the “arms dealers” of AI—one makes the chips, the other sells the shovels. If AI is the new gold rush, these are the must-own stocks.

Meta, Amazon, and Google occupy the next tier. Each has massive AI ambitions, with Meta pushing the frontier in open-source LLMs, Amazon embedding AI across AWS and e-commerce, and Google sitting on a deep bench of AI research but struggling to commercialize it at scale. Apple and Tesla round out the bottom of the leaderboard—not because they lack innovation, but because their AI strategies are more niche and vertically integrated, less likely to drive multi-trillion-dollar platform-level disruption.

Breaking Down the AI Stack

When we look at the AI Layer Stack, a more nuanced picture emerges. Nvidia and Tesla are the only two companies playing in the hardware layer, which gives them critical control over the physical infrastructure powering AI.

Meanwhile, Microsoft, Google, and Amazon dominate the infrastructure and cloud layer, which is where the real platform-scale monetization will occur—think data, storage, and compute power.

The models and platforms layer is where companies like Meta, Google, and Microsoft battle it out to define the dominant language models and developer ecosystems. Finally, applications and UX—the most consumer-facing layer—is Apple’s strongest suit, followed by Amazon and Meta. This layer is where AI becomes tangible to users, and it’s crucial for long-term brand loyalty.

Together, these two charts show why Microsoft and Nvidia are in a league of their own, how Meta and Google are undervalued in this space, and why Apple’s lack of deep AI infrastructure could become a long-term liability unless it pivots hard. Investors looking to capitalize on AI’s full-stack potential should look not just at who’s using AI—but who’s building it from the ground up.

Final Thoughts

We could see the index test the 5,000 range by the end of Q2, with further downside to 4,500 or lower possible if recession indicators continue to flash red. The easy money has been made, and now it's time to play defense.

The smart approach for Q2: focus on capital preservation, reduce exposure to high-multiple tech stocks regardless of their AI positioning, and increase allocations to defensive sectors like consumer staples, utilities, and healthcare. Cash is no longer trash with T-bills yielding 5%+, and patience will be rewarded when truly attractive entry points emerge later this year.

The Next Trillion-Dollar Trades ()

The AI revolution is bigger than cloud, mobile, or social media. It’s going to redraw the map of global tech leadership. We’re not just betting on product rollouts—we’re betting on which companies become the operating systems of a new AI-powered economy.

Investing in the Magnificent 7 is still one of the best ways to play this shift—but how you allocate across them may define your next decade of returns. The AI race has begun—and the winners are already separating from the pack.

It’s clear now: not all of the Magnificent 7 are equally prepared for the AI future. Some are already cashing in. Others are scrambling to catch up. Here’s the long-term view:

Microsoft and Nvidia are the safest bets right now. Microsoft has the enterprise moat, and Nvidia powers the entire stack.

Meta, Amazon, and Google are right behind—strong positions, great cash flow, but with strategic execution risks.

Keep watching the signals, not the noise.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always do your own research and consider your financial situation before making investment decisions.

Remember what goes up must come down (eventually)

Stay safe and invest wisely and this is in no mean financial advice. [Full Disclaimer]Thank you for supporting this newsletter. It will keep improving.

Harry